Analysis on China’s Electronic Cigarette Market in 2018

In 2017, the global sales value of electronic cigarettes reached USD 12,054 million, increasing by 18.50% YOY; the global sales value of heat-not-burn electronic cigarettes reached USD 5,003 million, increasing by 135.60%. The U.S. and the U.K., the largest markets of electronic cigarettes, took up market shares of 39.28% and 14.40% respectively in 2017. The U.S. has been the world’s largest market of electronic cigarettes in recent years, with sales value reaching USD 4,734 million and electronic cigarette consumers accounting for nearly 30% of the national smokers in 2017. According to Research Report on China’s Electronic Cigarette Industry, 2018-2022

China is the world’s largest consumer and producer of tobacco. The annual tobacco consumption in China is equivalent to the total tobacco consumption in the countries ranked second to 29th. Every year, Chinese smokers contribute 44% of the global cigarette consumption. According to the State Tobacco Monopoly Administration, China National Tobacco Corporation achieved pre-tax profits of CNY 1,114.51 billion in 2017, CNY 1,079.50 billion in 2016 and CNY 1,143.60 billion in 2015. According to Research Report on China’s Electronic Cigarette Industry, 2018-2022

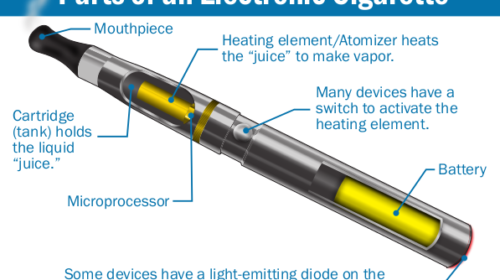

In 2017, the sales value of electronic cigarettes exceeded CNY 25 billion. Moreover, China’s electronic cigarette market is unregulated. Most electronic cigarettes are not subject to product standards, quality supervision and safety evaluation. For example, the atomizer is the largest profit source for electronic cigarette startups. Its production costs are between CNY 30 and CNY 50 while its price is above CNY 300. According to Research Report on China’s Electronic Cigarette Industry, 2018-2022

According to CRI, traditional cigarettes can generate profits 10 times or even 50 times the costs. As electronic cigarettes have various molds and cartridges, the profits on electronic cigarettes could only be higher. The profits on electronic cigarettes mainly come from cartridges. Traditional electronic brands have developed fixed cartridge customers while emerging brands have no advantages in this aspect. In addition, some traditional cigarette companies are also trying to sell electronic cigarettes. However, they emphasize portability rather than healthiness or no habituation when promoting electronic cigarettes. According to Research Report on China’s Electronic Cigarette Industry, 2018-2022

As a large producer of electronic cigarettes, China is second to none in the production of smoking sets, cartridges and e-juice. Statistics show that about 90% vapes and vape accessories in the world are made in China. In the U.S., three of the five bestselling brands of low-power electronic cigarettes and all the five bestselling brands of advanced personal vaporizers are attributed to Chinese companies. Besides, the global sales values of electronic cigarettes and heat-not-burn electronic cigarettes are still growing rapidly. According to Research Report on China’s Electronic Cigarette Industry, 2018-2022