Description

Mexico Cement Industry

NAFTA’s co-sponsors consist of the United States, Mexico and Canada. After many rounds of dialog and intensive negotiations, the agreement finally came into force in 1994. NAFTA was designed to eliminate trade tariffs between the member countries. The tariff barriers between the three countries have now indeed been completely eliminated.

Since NAFTA came into effect in 1994, the volume of trade between the U.S., Mexico, and Canada has realized phenomenal growth.

From a manufacturing perspective, the impact of NAFTA on the Mexican economy has been generally positive. After the agreement was signed, many foreign manufacturing companies entered in force, opening new manufacturing plants near the Mexican border. According to CRI’s market research, a large number of factories are relocating or planning to relocate from China to the U.S.-Mexico border in recent years. For the cement industry in Mexico, there are good opportunities for growth in the coming years.

The construction of industrial properties such as factories and warehouses, as well as the construction of infrastructure such as roads, will contribute to the rising demand for cement in the Mexican market.

Mexico cement industry stands as a cornerstone of the nation’s infrastructure development, playing a vital role in fueling construction projects across the country. Characterized by a mix of domestic and international players, the industry boasts a rich history rooted in both traditional craftsmanship and modern technological advancements.

In Mexico, the cement industry remains highly concentrated, with six key companies holding sway over the national market. These companies, namely Cemex, Grupo Cementos Chihuahua, Cemento Moctezuma, Holcim-Apasco, Cruz Azul, and Cementos Fortaleza, collectively wield significant influence. Their combined production capacity amounts to approximately 55 million tons per year, distributed across 35 cement plants strategically positioned throughout the country.

The cement market is currently navigating a landscape of both potential and volatility, largely driven by the infrastructural demands of fast-developing economies despite global economic uncertainties. With about two-thirds of global cement consumption attributed to the construction sector, the market’s stability is closely linked to overall economic activity. However, this consistent expansion also exposes the industry to cyclical risks and fluctuations in raw material costs.

Despite these challenges, several factors contribute to the vitality of the cement market. Urbanization, infrastructure development, and the growing need for housing are significant drivers of growth, especially in regions like Asia-Pacific, Africa, and South America. However, environmental concerns and stricter regulatory measures may pose limitations on future expansion efforts.

Furthermore, the significance of the cement industry transcends mere production statistics; it serves as a cornerstone of Mexico’s economic advancement and societal advancement. As Mexico continues its journey of urbanization and modernization, the demand for cement remains steadfastly high, underpinning a myriad of infrastructure endeavors vital for progress, including factory buildings, residential complexes, commercial edifices, highways, and bridges.

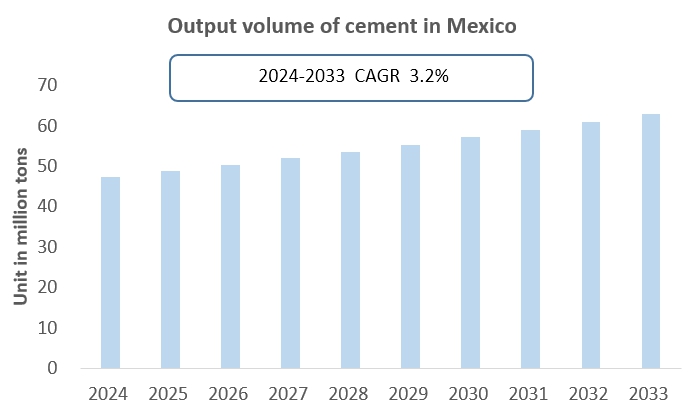

According to CRI’s forecast, Mexico cement production will rise from 47.3 million tons in 2024 to 62.8 million tons in 2033, a CAGR of 3.2% from 2024 to 2033.

According to CRI, the growth of the Mexican cement industry is driven by the rising population of Mexico, which contributes to the rising demand for housing and infrastructure, as well as the large number of foreign companies investing in Mexico, which contributes to the rising demand for industrial real estate such as factories and warehouses.

Topics covered:

- Mexico Cement Industry Overview

- Economic environment and policy environment of cements in Mexico

- Mexico cement market size from 2019 to 2023

- Analysis of major Mexico cement manufacturers

- Key Drivers and Market Opportunities of Mexico’s Cement Industry

- What are the key drivers, challenges and opportunities for the Mexico cement industry during the forecast period 2024-2033?

- What is the expected revenue of the Mexico Cement market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Mexico Cement Market is expected to dominate the market in 2033?

- Mexico Cement Market Forecast from 2024 to 2033

- What are the main headwinds facing Mexico’s cement industry?

Table of Contents

1 Overview of Mexico

1.1 Geographical conditions

1.2 Mexico’s demographic structure

1.3 Mexico’s economy

1.4 Mexico minimum wage from 2014 to 2024

1.5 Impact of COVID -19 on Mexico’s Cement Industry

2. Development Environment of Mexico Cement Industry

2.1 Economic Environment

2.1.1 Mexico’s GDP

2.1.2 Minimum Wage in Mexico, 2014-2023

2.2 FDI in Mexico Cement Industry

2.3 Policy Environment of Mexico Cement Industry

2.3.1 Preferential Policies on Foreign Investment of Cement Industry in Mexico

2.3.2 Policies Related to Imports and Exports of Cement Industry in Mexico

3. Analysis on Market Status of Mexico Cement Industry

3.1 Supply of Mexico Cement Industry

3.1.1 Production Volume of Mexico Cement Industry

3.1.2 Production volume of Mexico Cement products by types

3.2 Demand of Mexico Cement Industry

3.2.1 Domestic Sales Volume of Cement

3.2.2 Market size of Cement

3.2.3 Demand structure and key clients of cement industry in Mexico

4. Analysis on Import and Export of Cement in Mexico

4.1 Mexico Cement Industry Import Situation

4.1.1 Import Volume and Import Value of Mexico Cement Industry

4.1.2 Main Import Sources of Mexico Cement

4.2 Mexico Cement Industry Export Situation

4.2.1 Export Volume and Export Value of Mexico Cement Industry

4.2.2 Main Export Destinations of Mexico Cement

5. Cost and Price Analysis of the Mexico Cement Industry

5.1 Cost

5.1.1 Raw Material Cost

5.1.2 Energy Cost

5.1.3 Human Resources Cost

5.2 Price trend of cement in Mexico 2020-2024

6. Market Competition Analysis of Mexico’s Cement Industry

6.1 Barriers to entry in Mexico’s cement industry

6.1.1 Brand barriers

6.1.2 Quality barriers

6.1.3 Capital barriers

6.2 Competitive Structure of Mexico’s Cement Industry

6.2.1 Bargaining power of cement suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Mexico’s Cement Industry

6.2.4 Potential Entrants to the Cement Industry

6.2.5 Alternatives to chemical cements

7. Top Cement Manufacturers in Mexico

7.1 Cemex

7.1.1 Corporate Profile of Cemex

7.1.2 Operations of Cemex in Mexico

7.2 GCC SAB de

7.2.1 Corporate Profile of GCC SAB de

7.2.2 Operations of GCC SAB de in Mexico

7.3 Cemento y Concreto Moctezuma

7.3.1 Corporate Profile of Cemento y Concreto Moctezuma

7.3.2 Operations of Cemento y Concreto Moctezuma in Mexico

7.4 Holcim-Apasco

7.4.1 Corporate Profile of Holcim-Apasco

7.4.2 Operations of Holcim-Apasco in Mexico

7.5 Cementos y Concretos Nacionales

7.5.1 Corporate Profile of Cementos y Concretos Nacionales

7.5.2 Operations of Cementos y Concretos Nacionales in Mexico

7.6 Cementos Fortaleza

7.6.1 Corporate Profile of Cementos Fortaleza

7.6.2 Operations of Cementos Fortaleza in Mexico

8. Mexico Cement Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Mexico Cement Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Mexico Cement Industry, 2024-2033

8.3 Demand Forecast of Mexico Cement Industry, 2024-2033

8.4 Import and Export Forecast of Mexico Cement Industry, 2024-2033

LIST OF CHARTS

Chart Mexico’s total population from 2013 to 2023

Chart Mexico’s GDP per capita from 2013 to 2023

Char Policies related to the fertilizer industry issued by the Mexico government from 2018 to 2024

Chart Foreign investment policy in Mexico’s fertilizer industry

Chart 2014-2024 Mexico minimum wage

Chart 2019-2023 Mexico’s total fertilizer production

Chart 2019-2023 Mexico’s nitrogen, phosphorus and potassium fertilizer production

Chart 2019-2023 Mexico’s domestic consumption of chemical fertilizers

Chart 2019-2023 Mexico fertilizer imports

Chart 2019-2023 Mexico fertilizer import amount

Chart 2019-2023 Mexico’s fertilizer importing countries and import amounts

Chart 2019-2023 Mexico fertilizer export volume

Chart 2019-2023 Mexico fertilizer export value

Chart 2019-2023 Mexico’s main export destinations of fertilizers

Chart 2024-2033 Mexico’s fertilizer production forecast

Chart 2024-2033 Mexico domestic fertilizer market size forecast

Chart 2024-2033 Mexico’s fertilizer import forecast

Chart 2024-2033 Mexico’s fertilizer export forecast

Reviews

There are no reviews yet.