Description

Vietnam Fertilizer Industry

Agriculture plays an important role in Vietnam’s economy. The agricultural population accounts for more than 50% of Vietnam’s total population, and arable land and forestland account for 60% of Vietnam’s total land area. According to CRI’s analysis, Vietnam’s annual fertilizer exports have exceeded 3 million tons in recent years, while fertilizer imports have also exceeded 1 million tons.

According to CRI’s analysis, Vietnam’s fertilizer market concentration is low, with local companies accounting for about 70% of the market share. Based on the overall revenue of the Vietnam fertilizer market in 2023, the top five companies together account for approximately 30% of the market. Major fertilizer manufacturers in the Vietnamese market are adopting various strategies, such as expanding production capacity and finding more distributors, to increase their market share.

The main types of chemical fertilizers exported by Vietnam are ammonium sulfate, diamine phosphate, nitrogen, phosphorus and potassium, etc. Cambodia, India, Indonesia, South Korea, Malaysia, the Philippines and other countries are the main export markets for Vietnamese fertilizers. At the same time, Vietnam imports more than 4 million tons of fertilizers every year, of which ammonium sulfate imports the largest amount. According to CRI’s analysis, China is currently Vietnam’s largest fertilizer supplier, accounting for nearly 45% of Vietnam’s total fertilizer imports. In addition, Russia, Israel, Laos, Canada and other countries are also the main import sources of fertilizers in Vietnam.

According to CRI’s analysis, although COVID -19 has had a certain impact on Vietnam’s economy, Vietnam’s fertilizer industry still showed a growth trend during the epidemic, and its fertilizer output increased by 5.2% and 3.5% respectively in 2020-2021. In addition, although the supply chain and logistics were disrupted during the epidemic, the export and import volume of fertilizers still showed an overall upward trend. Vietnam’s fertilizer imports will reach 4.116 million tons in 2023, a year-on-year increase of 21.3%.

But in 2023, due to oversupply in the global fertilizer industry, fertilizer prices have fallen, and fewer foreign orders have led to a decline in Vietnam’s fertilizer exports. However, as a net importer of fertilizers, Vietnam has experienced lower fertilizer prices in the process. China has also benefited. In 2023, Vietnam’s fertilizer import volume increased by 21.3% year-on-year, but the import value dropped by 12.8% year-on-year.

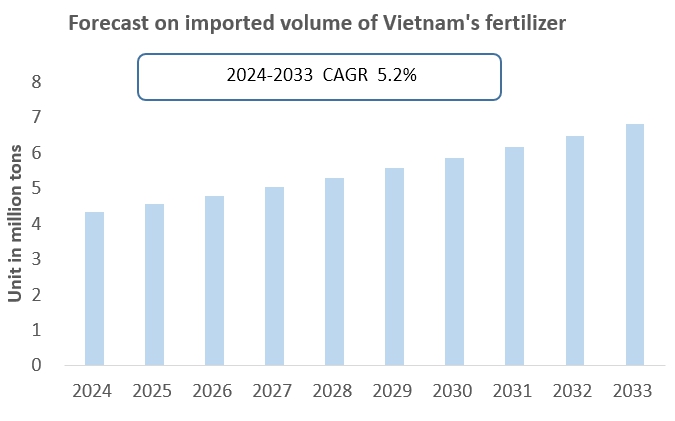

CRI predicts that with the development of Vietnam’s agriculture and planting industry, Vietnam’s chemical fertilizer imports will gradually increase in the next few years. CRI predicts that Vietnam’s fertilizer imports will reach 6.83 million tons by 2033, with a compound annual growth rate (CAGR) of 5.2% from 2024 to 2033.

Topics covered:

- Overview of Vietnam’s Fertilizer Industry

- Economic environment and policy environment for fertilizers in Vietnam

- Vietnam fertilizer market size from 2019 to 2023

- Analysis of major Vietnamese fertilizer manufacturers

- Main driving forces and market opportunities of Vietnam’s fertilizer industry

- What are the main drivers, challenges and opportunities for Vietnam’s fertilizer industry during the forecast period 2024-2033?

- What is the expected revenue of Vietnam Fertilizer market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam Fertilizer Market is expected to dominate the market in 2033?

- Vietnam Fertilizer Market Forecast from 2024 to 2033

- What are the main negative factors facing Vietnam’s fertilizer industry?

Table of Contents

1 Vietnam Overview

1.1 Geographical conditions

1.2 Vietnam’s demographic structure

1.3 Vietnam’s economy

1.4 Vietnam’s minimum wage standards from 2014 to 2024

1.5 Impact of COVID -19 on Vietnam’s Fertilizer Industry

2 Development environment of Vietnam’s fertilizer industry

2.1 Economic environment

2.1.1 Development status of agriculture and planting industry in Vietnam

2.1.2 Analysis of chemical fertilizer usage in Vietnam market

2.2 Technical environment

2.2.1 Main types of chemical fertilizers used in Vietnam

2.2.2 Technical level of Vietnam’s fertilizer manufacturing industry

2.3 Policy environment of Vietnam’s fertilizer industry

2.3.1 Main government policies for Vietnam’s fertilizer industry

2.3.2 Foreign investment policies in Vietnam’s fertilizer industry

2.4 Analysis of operating costs of Vietnam’s fertilizer industry

2.4.1 Human resource costs

2.4.2 Electricity price

2.4.3 Factory rent

2.4.4 Other costs

3 Supply and demand status of Vietnam’s fertilizer industry

3.1 Supply situation of Vietnam’s fertilizer industry

3.1.1 Vietnam’s total fertilizer production

3.1.2 Production of different types of fertilizers

3.2 Demand situation of Vietnam’s fertilizer industry

3.2.1 Analysis of Vietnam’s Fertilizer Consumption

3.2.2 Analysis of Vietnam market demand for different types of chemical fertilizers

3.2.3 Comprehensive forecast of Vietnam’s fertilizer market

3.3 Vietnam Fertilizer Market Price Analysis

4 Import and export status of Vietnam’s fertilizer industry from 2019 to 2023

4.1 Import status of Vietnam’s fertilizer industry

4.1.1 Vietnam’s chemical fertilizer import volume and import value

4.1.2 Main import sources of chemical fertilizers in Vietnam

4.2 Export status of Vietnam’s fertilizer industry

4.2.1 Vietnam’s fertilizer export volume and export value

4.2.2 Main export destinations of Vietnam’s chemical fertilizers

5 Market Competition Analysis of Vietnam’s Fertilizer Industry

5.1 Barriers to entry in Vietnam’s fertilizer industry

5.1.1 Brand barriers

5.1.2 Quality barriers

5.1.3 Capital barriers

5.2 Competition structure of Vietnam’s fertilizer industry

5.2.1 Bargaining power of fertilizer suppliers

5.2.2 Consumer bargaining power

5.2.3 Competition in Vietnam’s Fertilizer Industry

5.2.4 Potential Entrants to the Fertilizer Industry

5.2.5 Alternatives to chemical fertilizers

6 Analysis of major fertilizer brands in Vietnam

6.1 Binh Dien Fertilizer JSC ( BFC )

6.1.1 The development history of Binh Dien Fertilizer JSC ( BFC )

6.1.2 Binh Dien Fertilizer JSC ( BFC )’s main products

6.1.3 Binh Dien Fertilizer JSC ( BFC ) ’s operating model

6.2 Southern Fertilizer JSC

6.2.1 Development History of Southern Fertilizer JSC

6.2.2 Main Products of Southern Fertilizer JSC

6.2.3 Southern Fertilizer JSC ’s operating model

6.3 PetroVietnam Fertilizer and Chemical Corp.

6.3.1 Development History of PetroVietnam Fertilizer and Chemical Corp.

6.3.2 PetroVietnam Fertilizer and Chemical Corp.’s main products

6.3.3 PetroVietnam Fertilizer and Chemical Corp.’s operating model

6.4 Ninh Binh Phosphate Fertilizer JSC

6.4.1 The development history of Ninh Binh Phosphate Fertilizer JSC

6.4.2 Main products of Ninh Binh Phosphate Fertilizer JSC

6.4.3 Ninh Binh Phosphate Fertilizer JSC ’s operating model

6.5 Habac Nitrogenous Fertilizer & Chemicals Company Limited

6.5.1 Development History of Habac Nitrogenous Fertilizer & Chemicals Company Limited

6.5.2 Main products of Habac Nitrogenous Fertilizer & Chemicals Company Limited

6.5.3 Habac Nitrogenous Fertilizer & Chemicals Company Limited’s operating model

6.6 Lam Thao Fertilizers and Chemicals JSC

6.7 Que Lam Group

6.8 Agricultural Products and Materials JSC ( APROMACO )

6.9 Song Gianh Corporation

6.10 Thien Sinh JSC

6.11 DAP Dinh Vu Fertilizers

6.12 DUC Giang Chemicals

7 Outlook for Vietnam’s Fertilizer Industry from 2024 to 2033

7.1 Analysis of development factors of Vietnam’s fertilizer industry

7.1.1 Driving forces and development opportunities of Vietnam’s fertilizer industry

7.1.2 Threats and challenges faced by Vietnam’s fertilizer industry

7.2 Vietnam Fertilizer Industry Supply Forecast

7.3 Vietnam Fertilizer Market Demand Forecast

7.4 Vietnam Fertilizer Import and Export Forecast

LIST OF CHARTS

Chart Vietnam’s total population from 2013 to 2023

Chart Vietnam’s GDP per capita from 2013 to 2023

Chart 2014-2024 Vietnam’s minimum wage

Chart Policies related to the fertilizer industry issued by the Vietnam government from 2018 to 2024

Chart Vietnam’s policies for foreign investment in the fertilizer industry

Chart Vietnam’s total fertilizer production from 2019 to 2023

Chart 2019-2023 Vietnam’s nitrogen, phosphorus and potassium fertilizer production

Chart 2019-2023 Vietnam’s domestic consumption of chemical fertilizers

Char Vietnam’s chemical fertilizer imports from 2019 to 2023

Chart 2019-2023 Vietnam’s fertilizer import amount

Chart 2019-2023 Vietnam’s fertilizer importing countries and import amounts

Chart 2019-2023 Vietnam’s fertilizer export volume

Chart 2019-2023 Vietnam’s fertilizer export value

Chart Vietnam’s main export destinations of fertilizers from 2019 to 2023

Chart 2024-2033 Vietnam fertilizer production forecast

Chart 2024-2033 Vietnam domestic fertilizer market size forecast

Chart 2024-2033 Vietnam fertilizer import forecast

Chart 2024-2033 Vietnam fertilizer export forecast

Reviews

There are no reviews yet.