Description

Thailand Cement Industry

The cement industry in Thailand is a vital sector contributing significantly to the country’s economic growth and infrastructure development. Known for its robust manufacturing capabilities and strategic geographical location, Thailand has emerged as one of the key players in the global cement market.

Thailand Cement market currently, in 2023, has witnessed an HHI of 9071, Which has decreased substantially as compared to the HHI of 9670 in 2017. The market is moving towards Highly concentrated. Herfindahl index measures the competitiveness of exporting countries. The range lies from 0 to 10000, where a lower index number represents a larger number of players or exporting countries in the market while a large index number means fewer numbers of players or countries exporting in the market. Thailand’s cement industry is characterized by a diverse range of manufacturers, including both domestic players and multinational corporations. Major companies such as Siam Cement Group (SCG), Siam City Cement (SCCC), and TPI Polene dominate the market, alongside several smaller players.

One of the key drivers of Thailand’s cement industry is the booming construction sector, fueled by rapid urbanization, industrialization, and government infrastructure projects. The country’s expanding population, coupled with increasing investments in residential, commercial, and public infrastructure projects, has created a sustained demand for cement.

Thailand’s cement industry is known for its adherence to international quality standards and adoption of advanced manufacturing technologies. Many cement plants in the country are equipped with state-of-the-art facilities, ensuring high efficiency, productivity, and environmental sustainability.

Moreover, Thailand’s cement industry has been proactive in implementing sustainable practices, including alternative fuel usage, waste heat recovery, and carbon emissions reduction initiatives. This commitment to sustainability aligns with global trends towards greener and more environmentally responsible manufacturing processes.

In recent years, Thailand’s cement industry has also focused on expanding its presence in international markets, leveraging its competitive advantages in terms of cost-efficiency, product quality, and logistics infrastructure. Export opportunities to neighboring countries in Southeast Asia and beyond have further fueled the growth of the industry.

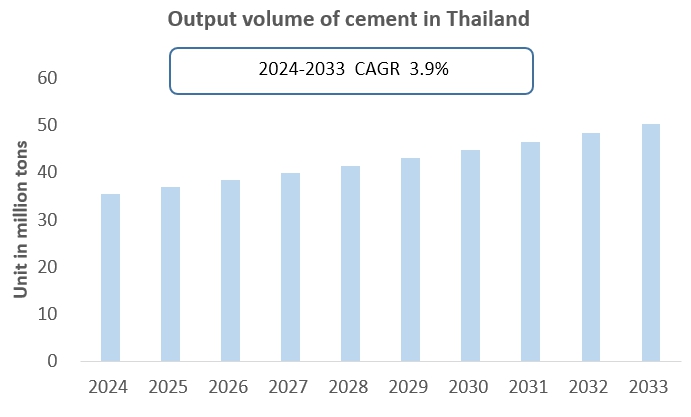

In 2023, Thailand’s cement production will be about 35.42 million tons, down from 2022. CRI expects Thailand cement production to reach about 37.01 million tons in 2024. In 2033 Thailand cement production will reach 52.22 million tons, a CAGR of about 3.9% from 2024 to 2033. Drivers of growth in the Thai cement industry in the coming years include rising demand for cement in the Thai domestic market and rising exports of Thai cement.

However, like any other industry, Thailand’s cement sector also faces challenges, including fluctuating raw material costs, regulatory compliance, and competition from imports. Nevertheless, with its strong fundamentals, technological advancements, and strategic vision, the Thai cement industry continues to thrive, playing a crucial role in driving the country’s economic progress and infrastructure development.

Topics covered:

- Thailand Cement Industry Overview

- Economic environment and policy environment of cements in Thailand

- Thailand cement market size from 2019 to 2023

- Analysis of major Thailand cement manufacturers

- Key Drivers and Market Opportunities of Thailand’s Cement Industry

- What are the key drivers, challenges and opportunities for the Thailand cement industry during the forecast period 2024-2033?

- What is the expected revenue of the Thailand Cement market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Thailand Cement Market is expected to dominate the market in 2033?

- Thailand Cement Market Forecast from 2024 to 2033

- What are the main headwinds facing Thailand’s cement industry?

Table of Contents

1 Overview of Thailand

1.1 Geographical conditions

1.2 Thailand’s demographic structure

1.3 Thailand’s economy

1.4 Thailand minimum wage from 2014 to 2024

1.5 Impact of COVID -19 on Thailand’s Cement Industry

2. Development Environment of Thailand Cement Industry

2.1 Economic Environment

2.1.1 Thailand’s GDP

2.1.2 Minimum Wage in Thailand, 2014-2023

2.2 FDI in Thailand Cement Industry

2.3 Policy Environment of Thailand Cement Industry

2.3.1 Preferential Policies on Foreign Investment of Cement Industry in Thailand

2.3.2 Policies Related to Imports and Exports of Cement Industry in Thailand

3. Analysis on Market Status of Thailand Cement Industry

3.1 Supply of Thailand Cement Industry

3.1.1 Production Volume of Thailand Cement Industry

3.1.2 Production volume of Thailand Cement products by types

3.2 Demand of Thailand Cement Industry

3.2.1 Domestic Sales Volume of Cement

3.2.2 Market size of Cement

3.2.3 Demand structure and key clients of cement industry in Thailand

4. Analysis on Import and Export of Cement in Thailand

4.1 Thailand Cement Industry Import Situation

4.1.1 Import Volume and Import Value of Thailand Cement Industry

4.1.2 Main Import Sources of Thailand Cement

4.2 Thailand Cement Industry Export Situation

4.2.1 Export Volume and Export Value of Thailand Cement Industry

4.2.2 Main Export Destinations of Thailand Cement

5. Cost and Price Analysis of the Thailand Cement Industry

5.1 Cost

5.1.1 Raw Material Cost

5.1.2 Energy Cost

5.1.3 Human Resources Cost

5.2 Price trend of cement in Thailand 2020-2024

6. Market Competition Analysis of Thailand’s Cement Industry

6.1 Barriers to entry in Thailand’s cement industry

6.1.1 Brand barriers

6.1.2 Quality barriers

6.1.3 Capital barriers

6.2 Competitive Structure of Thailand’s Cement Industry

6.2.1 Bargaining power of cement suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Thailand’s Cement Industry

6.2.4 Potential Entrants to the Cement Industry

6.2.5 Alternatives to chemical cements

7. Top 5 Cement Manufacturers in Thailand

7.1 Siam Cement Group (SCG)

7.1.1 Corporate Profile of Siam Cement Group (SCG)

7.1.2 Operations of Siam Cement Group (SCG) in Thailand

7.2 TPI Polene Public Company Limited

7.2.1 Corporate Profile of TPI Polene Public Company Limited

7.2.2 Operations of TPI Polene Public Company Limited in Thailand

7.3 Siam City Cement Public Company Limited (SCCC)

7.3.1 Corporate Profile of Siam City Cement Public Company Limited (SCCC)

7.3.2 Operations of Siam City Cement Public Company Limited (SCCC) in Thailand

7.4 Cementhai SCT

7.4.1 Corporate Profile of Cementhai SCT

7.4.2 Operations of Cementhai SCT in Thailand

7.5 Asia Cement Public Company Limited

7.5.1 Corporate Profile of Asia Cement Public Company Limited

7.5.2 Operations of Asia Cement Public Company Limited in Thailand

8. Thailand Cement Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Thailand Cement Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Thailand Cement Industry, 2024-2033

8.3 Demand Forecast of Thailand Cement Industry, 2024-2033

8.4 Import and Export Forecast of Thailand Cement Industry, 2024-2033

LIST OF CHARTS

Chart Thailand’s total population from 2013 to 2023

Chart Thailand’s GDP per capita from 2013 to 2023

Char Policies related to the cement industry issued by the Thailand government from 2018 to 2024

Chart Foreign investment policy in Thailand’s cement industry

Chart 2014-2024 Thailand minimum wage

Chart 2019-2023 Thailand’s total cement production

Chart 2019-2023 Thailand’s nitrogen, phosphorus and potassium cement production

Chart 2019-2023 Thailand’s domestic consumption of chemical cements

Chart 2019-2023 Thailand cement imports

Chart 2019-2023 Thailand cement import amount

Chart 2019-2023 Thailand’s cement importing countries and import amounts

Chart 2019-2023 Thailand cement export volume

Chart 2019-2023 Thailand cement export value

Chart 2019-2023 Thailand’s main export destinations of cements

Chart 2024-2033 Thailand’s cement production forecast

Chart 2024-2033 Thailand domestic cement market size forecast

Chart 2024-2033 Thailand’s cement import forecast

Chart 2024-2033 Thailand’s cement export forecast

Reviews

There are no reviews yet.