Description

Malaysia Cement Industry

Malaysia’s GDP per capita is over US$ 10,000, ranking third in Southeast Asia. Malaysia’s manufacturing and construction industries are leading in Southeast Asia. The cement industry is also one of the important industries in Malaysia.

The demand for cement in Malaysia remains strong, largely driven by ongoing major infrastructure projects. These projects are key pillars supporting the medium-to-long-term growth of the cement industry, indicating a potential increase in construction activities across Peninsular Malaysia.

Several factors contribute to the buoyancy of Malaysia’s cement industry. Low inventory levels, along with a focus on emerging sectors like solar panels and electric vehicles, coupled with the anticipated recovery in China’s manufacturing and property sectors, are expected to fuel future demand growth.

Recent trends indicate a robust performance in the cement market, with bulk cement prices experiencing a notable 24.7% year-on-year increase in August 2023. This surge contrasts with the three-year average price reported between 2019 and 2021, signaling the industry’s strength and resilience.

Despite the promising outlook, the cement industry faces various challenges. Rising operational costs, driven by factors such as escalating raw material prices, soaring coal costs, and increased shipping expenses, pose significant challenges to businesses operating in the sector. Additionally, the appreciation of the US dollar against the ringgit further tightens profit margins.

The surge in coal prices is identified as a major contributor to the rise in cement prices, with forecasts indicating a continuation of this trend due to strong demand in ASEAN nations. The withdrawal of electricity subsidies for industrial customers exacerbates the situation, further increasing the cost of production.

Supply chain disruptions and regional disparities also complicate matters for the cement industry. Businesses importing cement or raw materials face challenges in maintaining sustainable profit margins, particularly in regions like Sarawak, where a shortage of cement, combined with escalating shipping costs and currency strength, leads to significantly higher prices compared to other parts of Malaysia.

Moreover, balancing supply and demand poses a significant challenge, particularly in regions experiencing rapid infrastructure development. Sarawak, for example, faces a surge in cement demand due to major infrastructure projects, necessitating local producers to ensure an adequate supply to meet escalating requirements.

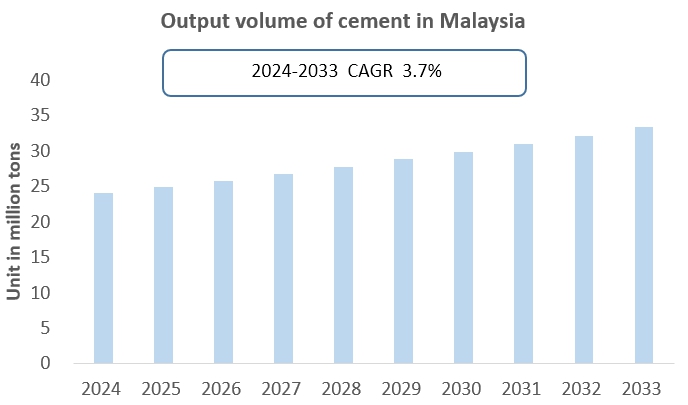

In conclusion, while Malaysia’s cement industry benefits from strong demand driven by infrastructure projects and emerging sectors, various challenges such as rising operational costs, supply chain disruptions, and regional disparities must be addressed to sustain growth and stability in the market. According to CRI, Malaysia cement production is projected to increase from 24.05 million metric tonnes in 2024 to 33.35 million metric tonnes by 2033, exhibiting a compound annual growth rate (CAGR) of 3.7%.

Topics covered:

- Malaysia Cement Industry Overview

- Economic environment and policy environment of cements in Malaysia

- Malaysian cement market size from 2019 to 2023

- Analysis of major Malaysian cement manufacturers

- Key Drivers and Market Opportunities of Malaysia’s Cement Industry

- What are the key drivers, challenges and opportunities for the Malaysian cement industry during the forecast period 2024-2033?

- What is the expected revenue of the Malaysia Cement market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysian Cement Market is expected to dominate the market in 2033?

- Malaysia Cement Market Forecast from 2024 to 2033

- What are the main headwinds facing Malaysia’s cement industry?

Table of Contents

1 Overview of Malaysia

1.1 Geographical conditions

1.2 Malaysia’s demographic structure

1.3 Malaysia’s economy

1.4 Malaysian minimum wage from 2014 to 2024

1.5 Impact of COVID -19 on Malaysia’s Cement Industry

2. Development Environment of Malaysia Cement Industry

2.1 Economic Environment

2.1.1 Malaysia’s GDP

2.1.2 Minimum Wage in Malaysia, 2014-2023

2.2 FDI in Malaysia Cement Industry

2.3 Policy Environment of Malaysia Cement Industry

2.3.1 Preferential Policies on Foreign Investment of Cement Industry in Malaysia

2.3.2 Policies Related to Imports and Exports of Cement Industry in Malaysia

3. Analysis on Market Status of Malaysia Cement Industry

3.1 Supply of Malaysia Cement Industry

3.1.1 Production Volume of Malaysia Cement Industry

3.1.2 Production volume of Malaysia Cement products by types

3.2 Demand of Malaysia Cement Industry

3.2.1 Domestic Sales Volume of Cement

3.2.2 Market size of Cement

3.2.3 Demand structure and key clients of cement industry in Malaysia

4. Analysis on Import and Export of Cement in Malaysia

4.1 Malaysia Cement Industry Import Situation

4.1.1 Import Volume and Import Value of Malaysia Cement Industry

4.1.2 Main Import Sources of Malaysia Cement

4.2 Malaysia Cement Industry Export Situation

4.2.1 Export Volume and Export Value of Malaysia Cement Industry

4.2.2 Main Export Destinations of Malaysia Cement

5. Cost and Price Analysis of the Malaysia Cement Industry

5.1 Cost

5.1.1 Raw Material Cost

5.1.2 Energy Cost

5.1.3 Human Resources Cost

5.2 Price trend of cement in Malaysia 2020-2024

6. Market Competition Analysis of Malaysia’s Cement Industry

6.1 Barriers to entry in Malaysia’s cement industry

6.1.1 Brand barriers

6.1.2 Quality barriers

6.1.3 Capital barriers

6.2 Competitive Structure of Malaysia’s Cement Industry

6.2.1 Bargaining power of cement suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Malaysia’s Cement Industry

6.2.4 Potential Entrants to the Cement Industry

6.2.5 Alternatives to chemical cements

7. Top 5 Cement Manufacturers in Malaysia

7.1 YTL Cement Berhad

7.1.1 Corporate Profile of YTL Cement Berhad

7.1.2 Operations of YTL Cement Berhad in Malaysia

7.2 Lafarge Rawang Plant

7.2.1 Corporate Profile of Lafarge Rawang Plant

7.2.2 Operations of Lafarge Rawang Plant in Malaysia

7.3 Hume Cement Sdn. Bhd.

7.3.1 Corporate Profile of Hume Cement Sdn. Bhd.

7.3.2 Operations of Hume Cement Sdn. Bhd. in Malaysia

7.4 Tasek Corporation Berhad (TCB)

7.4.1 Corporate Profile of Tasek Corporation Berhad (TCB)

7.4.2 Operations of Tasek Corporation Berhad (TCB) in Malaysia

7.5 Cement Industries of Malaysia Berhad (CIMA)

7.5.1 Corporate Profile of Cement Industries of Malaysia Berhad (CIMA)

7.5.2 Operations of Cement Industries of Malaysia Berhad (CIMA) in Malaysia

8. Malaysia Cement Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Malaysia Cement Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Malaysia Cement Industry, 2024-2033

8.3 Demand Forecast of Malaysia Cement Industry, 2024-2033

8.4 Import and Export Forecast of Malaysia Cement Industry, 2024-2033

LIST OF CHARTS

Chart Malaysia’s total population from 2013 to 2023

Chart Malaysia’s GDP per capita from 2013 to 2023

Char Policies related to the fertilizer industry issued by the Malaysian government from 2018 to 2024

Chart Foreign investment policy in Malaysia’s fertilizer industry

Chart 2014-2024 Malaysian minimum wage

Chart 2019-2023 Malaysia’s total fertilizer production

Chart 2019-2023 Malaysia’s nitrogen, phosphorus and potassium fertilizer production

Chart 2019-2023 Malaysia’s domestic consumption of chemical fertilizers

Chart 2019-2023 Malaysian fertilizer imports

Chart 2019-2023 Malaysian fertilizer import amount

Chart 2019-2023 Malaysia’s fertilizer importing countries and import amounts

Chart 2019-2023 Malaysian fertilizer export volume

Chart 2019-2023 Malaysian fertilizer export value

Chart 2019-2023 Malaysia’s main export destinations of fertilizers

Chart 2024-2033 Malaysia’s fertilizer production forecast

Chart 2024-2033 Malaysian domestic fertilizer market size forecast

Chart 2024-2033 Malaysia’s fertilizer import forecast

Chart 2024-2033 Malaysia’s fertilizer export forecast

Reviews

There are no reviews yet.