Description

Vietnam Pepper Industry

Vietnam is one of the most economically active countries in the world, with a GDP growth of 8.02% year-on-year and a GDP per capita of US$4,110 in 2022, up 10.6% year-on-year. Vietnam’s agriculture is more developed and is dominated by plantations, with rice, cashew nuts, coffee and pepper being the country’s main crops.

The dual value of pepper in flavoring and medicine makes it highly prized, and pepper powder is one of the most common and widely used spices in the world. According to CRI analysis, pepper is the most widely traded spice cash crop in the world in terms of monetary value.

Vietnam is the world’s largest producer and exporter of pepper, producing more than 40 percent of the world’s pepper and accounting for about 60 percent of the global pepper export market. More than 130,000 hectares of pepper are planted throughout Vietnam, with an annual production of up to 250,000 tons, and the Central Highlands and Southeast regions are the main pepper-producing areas of Vietnam.

About 95% of Vietnam’s pepper is exported. According to CRI’s analysis, the EU-Vietnam Free Trade Agreement, which takes effect in 2020, makes Vietnamese pepper exported to European countries enjoy zero tariff preferences, which is more advantageous compared to pepper-producing countries such as Indonesia, Malaysia and India. From January to November 2022, Vietnam exported 208,200 tons of pepper, with an export value of US$897 million, up 3.43% year-on-year.

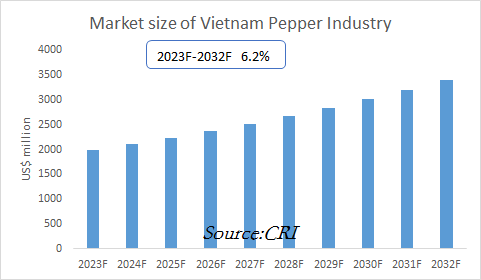

CRI expects the Vietnam pepper industry to maintain growth from 2023-2032 as the country actively develops potential markets and promotes export market diversification.

Topics covered:

- Vietnam Pepper Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Vietnam Pepper Industry?

- Which Companies are the Major Players in Vietnam Pepper Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Vietnam Pepper Industry

- What are the Key Drivers, Challenges, and Opportunities for Vietnam Pepper Industry during 2023-2032?

- What is the Expected Revenue of Vietnam Pepper Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Vietnam Pepper Industry Market?

- Which Segment of Vietnam Pepper Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Vietnam Pepper Industry?

Table of Contents

1 Overview of Vietnam

1.1 Geography

1.2 Demographic Structure

1.3 Economy

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on Vietnam’s Pepper Industry

2 Development Environment of Vietnam Pepper Industry

2.1 Brief History of Vietnam Pepper Industry Development

2.2 Types of Vietnam Pepper Industry

2.3 Policy Environment of Vietnam Pepper Industry

3 Supply and Demand of Vietnam Pepper Industry

3.1 Vietnam Pepper Industry Supply

3.2 Vietnam Pepper Industry Demand

4 Vietnam Pepper Industry Import and Export

4.1 Vietnam Pepper Industry Import Status

4.1.1 Vietnam Pepper Import Volume and Import Value

4.1.2 Main Import Sources of Vietnam Pepper

4.2 Vietnam Pepper Industry Export

4.2.1 Vietnam Pepper Export Volume and Export Value

4.2.2 Main Export Destinations of Vietnam Pepper

5 Vietnam Pepper Industry Market Competition

5.1 Barriers to Entry in Vietnam Pepper Industry

5.1.1 Brand Barriers

5.1.2 Quality Barriers

5.1.3 Capital Barriers

5.2 Vietnam Pepper Industry Competition Structure

5.2.1 Bargaining Power of Upstream Suppliers in the Pepper Industry

5.2.2 Bargaining Power of Consumers

5.2.3 Competitive Landscape of the Vietnam Pepper Industry

5.2.4 Potential Entrants in the Pepper Industry

5.2.5 Substitutes of Pepper

6 Analysis of Major Pepper Industry Players in Vietnam

6.1 Hanfimex

6.1.1 History of Hanfimex

6.1.2 Main Products of Hanfimex

6.1.3 Hanfimex’s Operation Model

6.2 K-agriculture

6.2.1 History of K-agriculture

6.2.2 Main Products of K-agriculture

6.2.3 K-agriculture’s Operation Model

6.3 Visimex

6.3.1 History of Visimex

6.3.2 Main Products of Visimex

6.3.3 Visimex’s Operation Model

6.4 Sybil Agri

6.4.1 History of Sybil Agri

6.4.2 Main Products of Sybil Agri

6.4.3 Sybil Agri’s Operation Model

6.5 Vietnamese Pepper

6.5.1 History of Vietnamese Pepper

6.5.2 Main Products of Vietnamese Pepper

6.5.3 Vietnamese Pepper’s Operation Model

6.6 Haprosimex JSC

6.7 Son Ha Spices

6.8 Agrotex Vietnam

6.9 Jayanti Herbs&Spice

6.10 Sunrise INS

7 Vietnam Pepper Industry Outlook 2023-2032

7.1 Vietnam Pepper Industry Development Factors Analysis

7.1.1 Drivers and Opportunities

7.1.2 Threats and Challenges

7.2 Vietnam Pepper Industry Supply Forecast

7.3 Vietnam Pepper Industry Demand Forecast

7.4 Vietnam Pepper Industry Import and Export Forecast

Reviews

There are no reviews yet.