Description

Vietnam Motorcycle Industry

Motorcycle is a two-wheeled or three-wheeled vehicle driven by a gasoline engine and steered by the front wheel with a handlebar, which is light, flexible and fast. According to CRI’s analysis, Southeast Asia is the region with the highest per capita motorcycle ownership in the world, and Vietnam occupies a relatively high market share in the Southeast Asian motorcycle market.

Vietnam has a long and narrow terrain, with a high topography in the west and a low topography in the east. 75 percent of the territory is mountainous and highland. Moreover, Vietnam lacks good public transportation and the roads are in poor condition, which makes it more suitable for motorcycles as transportation. At the same time, Vietnam is a developing country with low per capita disposable income, so it cannot afford expensive cars and can only choose to buy motorcycles, which are more economical.

Vietnam has sufficient labor force and low production cost, which attracts global motorcycle manufacturers to shift their production capacity to Vietnam. According to CRI’s analysis, Honda has successively built motorcycle production bases in Vietnam’s Vinh Phuc and Ha Nam provinces with an annual output of 2.5 million units for domestic consumption and export demand. Suzuki has also established a number of motorcycle production plants in Dong Nai Province, Vietnam.

Vietnam is currently one of the top four countries in the world with the highest consumption of motorcycles, after India, China and Indonesia. Motorcycles are the main means of transportation for Vietnamese, accounting for more than 85% of the total motor vehicles in the country. According to CRI’s analysis, the CAGR of motorcycle sales in Vietnam from 2018-2022 is -5.4%, and in 2020, hit by the epidemic, Vietnam’s motorcycle sales decreased significantly by 16.66% year-on-year.

the CAGR of motorcycle production in Vietnam from 2018-2022 is -2.0%, and Vietnam’s motorcycle production decreases year-on-year from 2018-2021. Especially in 2019, production decreases by 9.53% year-on-year, with production of only 3.26 million units. in 2022, Vietnam’s motorcycle market picks up, with production increasing by 11.64% year-on-year to about 3.323 million units, but still not as much as the motorcycle production of 3.603 million units in 2018.

Vietnam has the fourth largest two-wheeler market in the world, behind India, China and Indonesia. After a sharp decline in motorcycle sales in Vietnam in 2020 due to the impact of Covid-19, the market has rebounded in the past two years, achieving a strong recovery.

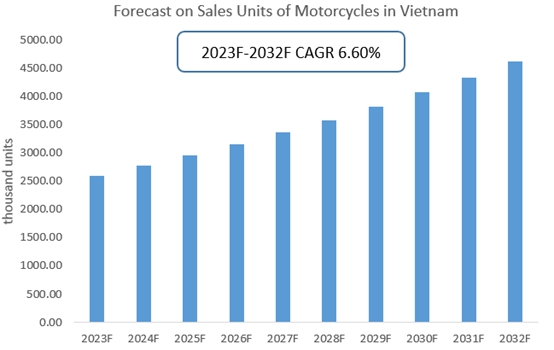

According to CRI’s forecast, in the future, as the impact of the Covid-19 epidemic fades, the economy gradually recovers, and the rapid popularity of electric motorcycles, Vietnam’s motorcycle market will still have some room for future growth. CRI estimates that Vietnam’s motorcycle sales could reach 3.28 million units by 2027, with a CAGR of 6.6% from 2023-2027.

According to CRI, the sales units of motorcycles will reach US$ 4621.51 thousand in 2032 and the CAGR in 2023 to 2032 is 6.6%.

Topics covered:

- Vietnam Motorcycle Industry Overview

- The economic and policy environment of Vietnam’s motorcycle industry

- What is the impact of COVID-19 on the Vietnamese motorcycle industry?

- Vietnam motorcycle industry market size, 2023-2032

- Analysis of major Vietnamese motorcycle industry manufacturers

- Key Drivers and Market Opportunities in Vietnam’s Motorcycle Industry

- What are the key drivers, challenges and opportunities for the Vietnamese motorcycle industry during the forecast period 2023-2032?

- Which companies are the key players in the Vietnamese motorcycle industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam motorcycle industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam motorcycle industry market is expected to dominate the market in 2032?

- What are the main negative factors facing the Vietnamese motorcycle industry?

Table of Contents

1 Overview of Vietnam

1.1 Geographical situation

1.2 Demographic structure of Vietnam

1.3 The economic situation in Vietnam

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on the Vietnamese motorcycle industry

2 Vietnam Motorcycle Industry Overview

2.1 History of motorcycle development in Vietnam

2.2 FDI in Vietnam’s motorcycle industry

2.3 Policy environment of Vietnam’s motorcycle industry

3 Vietnam motorcycle industry supply and demand situation

3.1 Vietnam motorcycle industry supply situation

3.2 Vietnam motorcycle industry demand situation

4 Vietnam motorcycle industry import and export status

4.1.1 Vietnam motorcycle imports and import value

4.1.2 Vietnam’s main sources of motorcycle imports

4.2 Vietnam motorcycle industry export status

4.2.1 Vietnam motorcycle export volume and export value

4.2.2 Vietnam’s main export destinations for motorcycles

5 Vietnam motorcycle industry cost analysis

6 Vietnam motorcycle industry market competition

6.1 Barriers to entry in Vietnam’s motorcycle industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Vietnam Motorcycle Industry Competition Structure

6.2.1 Bargaining power of motorcycle suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Vietnam’s motorcycle industry

6.2.4 Potential entrants in the motorcycle industry

6.2.5 Alternatives to motorcycles

7 Analysis of major motorcycle companies in Vietnam

7.1 Honda

7.1.1 Honda Company Profile

7.1.2 Honda Motorcycle Production and Sales

7.2 Yamaha Motor

7.2.1 Yamaha Motor Corporate Profile

7.2.2 Yamaha Motor Motorcycle Production and Sales

7.3 Pega

7.3.1 Pega Enterprise Profile

7.3.2 Pega Motorcycle Production and Sales

7.4 Vinfast

7.4.1 Vinfast Corporate Profile

7.4.2 Vinfast Motorcycle Production and Sales

7.5 Yadea

7.5.1 Yadea Corporate Profile

7.5.2 Yadea Motorcycle Production and Sales

7.6 Sym

7.6.1 Sym Enterprise Profile

7.6.2 Sym Motorcycle Production and Sales

7.7 Dibao

7.7.1 Dibao Corporate Profile

7.7.2 Dibao Motorcycle Production and Sales

7.8 suzuki

7.8.1 suzuki Corporate Profile

7.8.2 Production and Sales of suzuki Motorcycles

7.9 anbico

7.9.1 anbico Corporate Profile

7.9.2 anbico motorcycle production and sales

7.10 Piaggio

7.10.1 Piaggio Corporate Profile

7.10.2 Piaggio Motorcycle Production and Sales

8 Vietnam Motorcycle Industry Outlook 2023-2032

8.1 Vietnam motorcycle industry development factors analysis

8.1.1 Drivers and Development Opportunities for Vietnam Motorcycle Industry

8.1.2 Threats and challenges to Vietnam’s motorcycle industry

8.2 Vietnam Motorcycle Industry Supply Forecast

8.3 Vietnam Motorcycle Market Demand Forecast

8.4 Vietnam Motorcycle Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.