Description

Vietnam Construction Machinery Industry

The machinery and equipment used to complete various construction projects are collectively called construction machinery. Construction machinery is divided into several categories such as excavation machinery, earth-moving machinery, construction cranes, industrial vehicles, compaction machinery and concrete machinery.

With the development of Vietnam’s economy, investment in infrastructure construction, plant and commercial real estate, housing and mining is growing, making Vietnam’s construction machinery market has also seen rapid growth. Machinery, equipment, tools and spare parts are currently Vietnam’s third largest export products (after cell phones and computers). According to CRI’s analysis, during 2018-2022, Vietnam’s construction machinery and equipment exports continue to grow with an average growth rate of 29.35%/year (the largest increase of 48.58% in 2020).

In 2022, Vietnam’s total machinery and equipment exports are expected to be $45.8 billion, up 19.45% from 2021. This is the highest turnover in the past 10 years and nearly 15 times higher than in 2010. In particular, the export share of the item still belongs mainly to FDI enterprises.

Among them, exports of machinery and equipment from FDI enterprises are estimated at US$42.58 billion, up 19.74% from the same period in 2021; the share is nearly 93% (higher than the share of 92.75% in 2021).

Vietnam mainly exports machinery and equipment to the U.S. market, according to CRI’s analysis, the turnover is expected to exceed $20 billion in 2022, up 12.5% from 2021, accounting for more than 44% of the country’s total machinery and equipment exports. The next markets are: the European Union accounted for 12.37%; China accounted for 7.95%; ASEAN accounted for 7.11%; South Korea accounted for 6.09%; Japan accounted for 6.03%.

Vietnam’s imports of machinery, equipment, tools and spare parts grow by an average of 7.73% during 2018-2022 (with the largest increase of 74.11% in 2020). According to CRI’s analysis, in 2022, Vietnam’s machinery and equipment imports are expected to be $45.4 billion, a slight decrease of 1.73%. Among them, FDI enterprises accounted for nearly 70% of machinery and equipment imports, amounting to $31.7 billion, up 2.6% from 2021.

China, the largest market for supplying machinery and equipment to Vietnam, is expected to have a turnover of $24.6 billion in 2022, down 1.3% from 2021; accounting for more than 54% of the country’s total imports of machinery and equipment and spare parts. Despite the decline, Vietnam remains highly dependent on imports of machinery and equipment from China overall. This is followed by: South Korea with 13.92%; Japan with 9.38%; ASEAN with 6.47%; EU27 with 6.05%; Taiwan with 3.09%; the United States with 2.06%; and India with 1.19%.

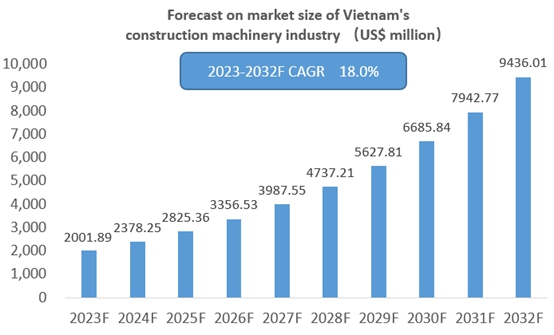

CRI expects the construction machinery market in Vietnam to maintain growth in 2023-2032. On the one hand, the low operating cost of Vietnam attracts global construction machinery enterprises to transfer their production capacity to Vietnam and build factories in Vietnam. In addition, there are many companies will export construction machinery products to Vietnam.

According to CRI, the market size of construction machinery industry will reach US$ 9436.01 million in 2032 and the CAGR in 2023 to 2032 is 18%.

Topics covered:

- Vietnam Construction Machinery Industry Overview

- The economic environment and policy environment of the construction machinery industry in Vietnam

- What is the impact of COVID-19 on the construction machinery industry in Vietnam?

- Vietnam Construction Machinery Industry Market Size, 2023-2032

- Analysis of the main Vietnamese construction machinery industry manufacturers

- Key drivers and market opportunities for the Vietnamese construction machinery industry

- What are the key drivers, challenges and opportunities for the construction machinery industry in Vietnam during the forecast period 2023-2032?

- Which companies are the major players in the Vietnamese construction machinery industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam Construction Machinery Industry market during the forecast period of 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam construction machinery industry market is expected to dominate the market in 2032?

- What are the main unfavorable factors facing the construction machinery industry in Vietnam?

Table of Contents

1 Overview of Vietnam

1.1 Geographical situation

1.2 Demographic structure of Vietnam

1.3 The economic situation in Vietnam

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on the construction machinery industry in Vietnam

2 Vietnam construction machinery industry profile

2.1 History of construction machinery development in Vietnam

2.2 FDI in Vietnam’s construction machinery industry

2.3 Policy environment of Vietnam’s construction machinery industry

3 Vietnam construction machinery industry supply and demand situation

3.1 Vietnam construction machinery industry supply situation

3.2 Vietnam construction machinery industry demand situation

4 Vietnam construction machinery industry import and export status

4.1.1 Vietnam construction machinery imports and imports

4.1.2 Vietnam’s main sources of imports of construction machinery

4.2 Vietnam construction machinery industry export status

4.2.1 Vietnam construction machinery export volume and export value

4.2.2 Vietnam’s main export destinations for construction machinery

5 Vietnam construction machinery industry market competition

5.1 Barriers to entry in Vietnam’s construction machinery industry

5.1.1 Brand Barrier

5.1.2 Quality Barriers

5.1.3 Capital Barriers

5.2 Vietnam construction machinery industry competitive structure

5.2.1 Bargaining power of construction machinery suppliers

5.2.2 Consumer bargaining power

5.2.3 Competition in Vietnam’s construction machinery industry

5.2.4 Potential entrants in the construction machinery industry

5.2.5 Alternatives to construction machinery

6 Vietnam’s major construction machinery brand enterprise analysis

6.1 Komatsu

6.1.1 Komatsu Corporate Profile

6.1.2 Production and Sales of Komatsu Construction Machinery and Equipment

6.2 Hitachi

6.2.1 Hitachi Enterprise Profile

6.2.2 Hitachi engineering machinery and equipment production and sales

6.3 Caterpillar

6.3.1 Caterpillar Corporate Profile

6.3.2 Caterpillar Production and Sales of Construction Machinery and Equipment

6.4 Hyundai

6.4.1 Hyundai Corporate Profile

6.4.2 Production and sales of engineering machinery and equipment

6.5 Doosan

6.5.1 Doosan Corporate Profile

6.5.2 Doosan Engineering Machinery and Equipment Production and Sales

6.6 ShanDong Huaxin Machinery (China)

6.6.1 ShanDong Huaxin Machinery (China) Company Profile

6.6.2 ShanDong Huaxin Machinery (China) Production and Sales of Construction Machinery and Equipment

6.7 CLAAS KGaA GmbH (Germany)

6.7.1 Corporate Profile of CLAAS KGaA GmbH (Germany)

6.7.2 CLAAS KGaA GmbH (Germany) Production and Sales of Construction Machinery and Equipment

6.8 Tong Yang Buhler (Switzerland)

6.8.1 Company Profile of Tong Yang Buhler (Switzerland)

6.8.2 Tong Yang Buhler (Switzerland) Production and Sales of Construction Machinery and Equipment

6.9 Moolsan (South Korea)

6.9.1 Moolsan (South Korea) Corporate Profile

6.9.2 Moolsan (South Korea) Production and Sales of Construction Machinery and Equipment

6.10 CNH Industrial (USA-Italy)

6.10.1 CNH Industrial (USA-Italy) Corporate Profile

6.10.2 CNH Industrial (USA-Italy) Production and Sales of Construction Machinery and Equipment

7 Vietnam Construction Machinery Industry Outlook 2023-2032

7.1 Vietnam construction machinery industry development factors analysis

7.1.1 Drivers and Development Opportunities for Vietnam Construction Machinery Industry

7.1.2 Threats and challenges to the construction machinery industry in Vietnam

7.2 Vietnam Construction Machinery Industry Supply Forecast

7.3 Vietnam Construction Machinery Market Demand Forecast

7.4 Vietnam Construction Machinery Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.