Description

Vietnam Construction Industry

Construction refers to the installation, maintenance and repair of buildings and other fixed structures, as well as the construction of roads and services that form an essential part of the structure and are required for its operation. Construction includes the process of constructing buildings, infrastructure and industrial facilities and related operations from start to finish. According to CRI’s analysis, the Vietnam construction market can be divided by industry into commercial construction, residential construction, industrial construction, infrastructure (transportation) construction, and energy and utilities construction.

According to CRI’s analysis, with the development of Vietnam’s economy, the infrastructure construction and real estate sectors continue to grow, contributing to the growth of the construction industry.

Vietnam’s construction industry output will grow by an average of 8.3% during 2018-2022 (with the largest increase of 12.9% in 2019). Vietnam’s construction sector is the best performing sector in Asia Pacific. Despite losing momentum due to COVID-19, it continues to grow strongly in 2020, with construction output increasing by 6.8% year-on-year amid a 6.4% year-on-year increase in construction raw material prices. According to CRI’s analysis, in 2022, Vietnam’s construction output will be VND549 trillion (about $234.15 billion at current exchange rates), up 8.5% year-on-year.

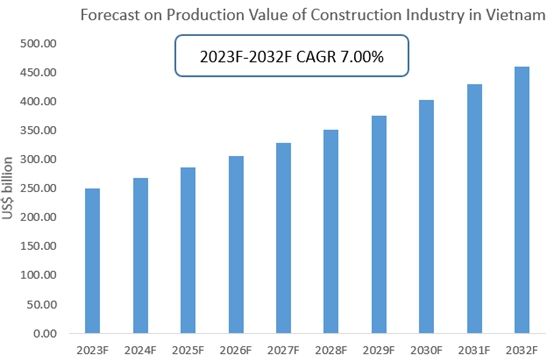

According to CRI, the production value of construction industry will reach US$ 460.61 billion in 2032 and the CAGR in 2023 to 2032 is 7.0%.

According to CRI, the construction industry in Vietnam is forecast to continue to grow from 2023-2032. Relatively cheap labor and land costs have attracted a large number of foreign investors to shift their production capacity to Vietnam, foreign trade has expanded, and the development of industrial real estate, commercial real estate and infrastructure sectors has boosted the construction industry. On the other hand, as Vietnam’s economy grows, the real estate sector is also growing rapidly, contributing to the development of the construction industry.

Topics covered:

- Vietnam Construction Industry Overview

- The economic and policy environment of the construction industry in Vietnam

- What is the impact of COVID-19 on the Vietnamese construction industry?

- Vietnam construction industry market size, 2023-2032

- Analysis of major Vietnamese construction industry manufacturers

- Key Drivers and Market Opportunities in Vietnam’s Construction Industry

- What are the key drivers, challenges and opportunities for the construction industry in Vietnam during the forecast period 2023-2032?

- Which companies are the key players in the Vietnamese construction industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam construction industry market during the forecast period of 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam construction industry market is expected to dominate the market in 2032?

- What are the main negative factors facing the construction industry in Vietnam?

Table of Contents

1 Overview of Vietnam

1.1 Geographical situation

1.2 Demographic structure of Vietnam

1.3 The economic situation in Vietnam

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on the construction industry in Vietnam

2 Overview of Vietnam’s construction industry

2.1 History of Vietnamese architecture development

2.2 FDI in Vietnam’s construction sector

2.3 Policy environment of Vietnam’s construction industry

3 Vietnam construction industry supply and demand situation

3.1 Vietnam construction industry supply situation

3.2 Vietnam construction industry demand situation

4 Vietnam construction industry import and export status

4.1.1 Vietnam’s construction imports and import volume

4.1.2 Main import sources of Vietnamese construction

4.2 Vietnam’s construction industry export status

4.2.1 Vietnam’s construction export volume and export value

4.2.2 Vietnam’s main export destinations for construction

5 Cost analysis of the construction industry in Vietnam

6 Vietnam Construction Industry Market Competition

6.1 Barriers to entry in Vietnam’s construction industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive structure of Vietnam’s construction industry

6.2.1 Bargaining power of construction suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Vietnam’s construction industry

6.2.4 Potential entrants in the construction industry

6.2.5 Alternatives to construction

7 Analysis of major construction companies in Vietnam

7.1 Song Da Corp JSC

7.1.1 Song Da Corp JSC Corporate Profile

7.1.2 Song Da Corp JSC Enterprise Revenue Status

7.2 Truong Xuan Investment And Construction JSC

7.2.1 Truong Xuan Investment And Construction JSC Corporate Profile

7.2.2 Hitachi Enterprise Revenue Status

7.3 COFICO

7.3.1 COFICO Corporate Profile

7.3.2 COFICO Corporate Revenue Status

7.4 Hoa Binh Construction Group JSC

7.4.1 Hoa Binh Construction Group JSC Corporate Profile

7.4.2 Hoa Binh Construction Group JSC Corporate Revenues

7.5 Coteccons Construction JSC

7.5.1 Coteccons Construction JSC Corporate Profile

7.5.2 Coteccons Construction JSC Enterprise Revenue Status

7.6 Coteccons

7.6.1 Coteccons Corporate Profile

7.6.2 Coteccons Corporate Revenue Status

7.7 Vinaconex

7.7.1 Vinaconex Corporate Profile

7.7.2 Vinaconex Corporate Revenue Status

7.8 Civil Engineering Construction Corporation No. 4 Ltd

7.8.1 Corporate Profile of Civil Engineering Construction Corporation No. 4 Ltd

7.8.2 Civil Engineering Construction Corporation No. 4 Ltd Corporate Revenue Status

7.9 Civil Engineering Construction Corporation No. 6

7.9.1 Civil Engineering Construction Corporation No. 6 Company Profile

7.9.2 Civil Engineering Construction Corporation No. 6 Corporate Revenue Status

7.10 Hyundai Engineering & Construction Co.

7.10.1 Hyundai Engineering & Construction Co. Ltd Corporate Profile

7.10.2 Hyundai Engineering & Construction Co. Ltd Corporate Revenue Status

8 Vietnam Construction Industry Outlook 2023-2032

8.1 Analysis of development factors in Vietnam’s construction industry

8.1.1 Drivers and Development Opportunities in Vietnam’s Construction Industry

8.1.2 Threats and challenges to the Vietnamese construction industry

8.2 Vietnam Construction Industry Supply Forecast

8.3 Vietnam Construction Market Demand Forecast

8.4 Vietnam construction industry import and export forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.