Description

Vietnam Bus Industry

Commercial buses are an important means of transportation for carrying large numbers of passengers and their belongings, and are a type of commercial vehicle that operates within and between cities. With its large population and vast area, Vietnam has a high demand for commercial buses in metropolitan areas or in rural areas with poor infrastructure.

Vietnam has a well-developed tourism industry that attracts millions of tourists every year to visit the country. Bus travel is a popular and affordable way to see Vietnam, and with buses connecting most of the major towns and cities, it is very convenient for tourists and the demand for road passenger transportation is growing. With the economic development of the region, increased investment in infrastructure development, and the gradual improvement of highway conditions, Vietnam’s bus industry has great potential for future development.

In 2022, Vietnam received only 3.6 million tourists, about 18% of the 19 million tourists before the Covid-19 pandemic. As the economy recovers and tourism gradually recovers, CRI expects Vietnam’s visitor arrivals to grow rapidly in 2023.

From 2018 to 2022, Vietnam’s bus sales volume shows a general trend of first decline and then increase, with a CAGR of -22.19% from 2018 to 2022, and a 70.05% year-on-year decrease in sales in 2020, which is the largest five-year decline in the past.In 2022, Vietnam’s bus sales volume for the whole year was 3,830 units, an increase of 87.75% year-on-year.

In December 2021, Vietnam’s first electric bus was officially put into service in the city of Hanoi, which will invest about VND21 trillion ($887.27 million at the current exchange rate) over the next few years in replacing all gasoline- and diesel-powered buses with electric alternatives, according to an analysis by CRI. Vietnam’s vinbus, a manufacturer of electric buses, said the number of buses replaced by electric buses in Hanoi will reach 225 by 2025, accounting for 21.3 percent of the total.

Under the Government Action Plan for Green Energy Transition and Reduction of Carbon and Methane Emissions, the Vietnamese government aims to have 100 percent of new public transit buses powered by electricity or green energy from 2025; at least half of all vehicles and all new cabs will be powered by electricity or green energy from 2030; and 100 percent of all buses and cabs will be powered by electricity or green energy by 2050.

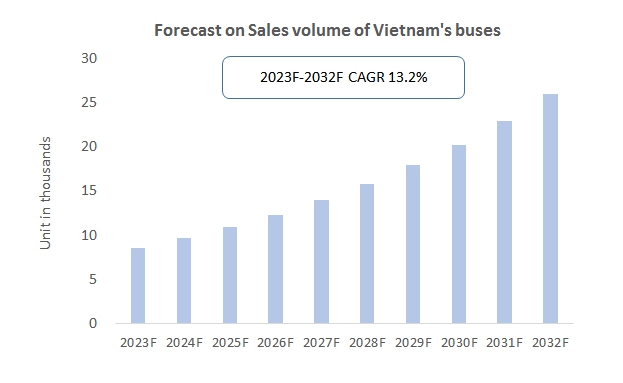

With the recovery of Vietnam’s tourism industry, the continued growth of the passenger transportation sector, and the gradual replacement of fuel buses by electric buses, CRI expects Vietnam’s bus sales to reach 25,900 units by 2032, growing at a compound annual growth rate (CAGR) of 13.2% over the 2023-2032 period.

CRI suggests that for foreign-funded bus brands, they can initially enter the Vietnamese market through whole-vehicle export, or CKD, and if they get better results in the Vietnamese market, they can consider setting up their own factories in Vietnam, or looking for local partners to set up joint-venture factories in Vietnam.

Topics covered:

- Overview of the bus industry in Vietnam

- Economic and policy environment of the bus industry in Vietnam

- What is the impact of COVID-19 on the bus industry in Vietnam?

- Vietnam Bus Industry Market Size, 2023-2032

- Analysis of Major Vietnamese Bus Industry Manufacturers

- Key Drivers and Market Opportunities in Vietnam Bus Industry

- What are the key drivers, challenges and opportunities for the bus industry in Vietnam during the forecast period 2023-2032?

- Which are the key players in the Vietnam Bus Industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam Bus Industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam Bus Industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the bus industry in Vietnam?

Table of Contents

1. Overview of Vietnam

1.1 Geographical Situation

1.2 Demographic Structure of Vietnam

1.3 Economic Situation in Vietnam

1.4 Minimum Wage in Vietnam, 2013-2022

1.5 Impact of COVID-19 on the Bus Industry in Vietnam

2. Overview of the Bus Industry in Vietnam

2.1 History of Bus Development in Vietnam

2.2 FDI in Vietnam’s Bus Industry

2.3 Policy Environment of Vietnam’s Bus Industry

3. Supply and Demand Situation of the Bus Industry in Vietnam

3.1 Supply Situation of the Bus Industry in Vietnam

3.2 Demand Situation in Vietnam’s Bus Industry

3.2.1 Total Passenger Traffic

3.2.2 Number of Visitors

3.2.3 Public Transportation Needs

4. Import and Export Situation of Vietnam’s Bus Industry

4.1 Imports into the Vietnamese Bus Industry

4.2 Vietnam’s Bus Industry Exports

5. Revenue and Cost Analysis of Vietnam Bus Industry

5.1 Revenue Analysis of Vietnam Bus Industry

5.1.1 Total Revenue of the Bus Industry in Vietnam

5.1.2 Bus Fares in Vietnam

5.2 Cost Analysis of Vietnam Bus Industry

6. Market Competition in Vietnam Bus Industry

6.1 Entry Barriers for Vietnam Bus Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of the Bus Industry in Vietnam

6.2.1 Bargaining Power of Suppliers of Passenger Cars

6.2.2 Consumer Bargaining Power

6.2.3 Competition in the Vietnamese Bus Industry

6.2.4 Potential Entrants in the Bus Industry

6.2.5 Alternatives to Buses

7. Analysis of Major Bus Companies in Vietnam

7.1 Hoang Long Bus

7.1.1 Hoang Long Bus Company Profile

7.1.2 Hoang Long Bus Operations

7.2 Sinh Cafe Bus

7.2.1 Sinh Cafe Bus Corporate Profile

7.2.2 Sinh Cafe Bus Operations

7.3 Phuong Trang FUTA Bus

7.3.1 Phuong Trang FUTA Bus Company Profile

7.3.2 Phuong Trang FUTA Bus Operation Status

7.4 Mai Linh Bus

7.4.1 Mai Linh Bus Company Profile

7.4.2 Mai Linh Bus Operations

7.5 VinBus

7.5.1 VinBus Corporate Profile

7.5.2 VinBus Operation Status

8. Vietnam Bus Industry Outlook, 2023-2032

8.1 Analysis of Factors for the Development of the Bus Industry in Vietnam

8.1.1 Driving Forces and Development Opportunities for the Bus Industry in Vietnam

8.1.2 Threats and Challenges Facing Vietnam’s Bus Industry

8.2 Vietnam Bus Industry Supply Forecast

8.3 Vietnam Bus Market Demand Forecasts

8.4 Import and Export Forecast for Vietnam Bus Industry

8.5 Vietnam Bus Industry Revenue Forecast

Reviews

There are no reviews yet.