Description

Vietnam Auto Parts Industry

According to the analysis by CRI based on the data released by the Southern Automobile Manufacturers Association (VAMA), the total vehicle sales of VAMA member units in 2022 will be 404,600 units, an increase of 33% compared to 2021.

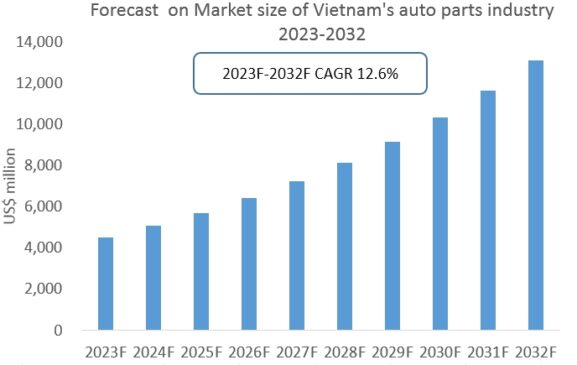

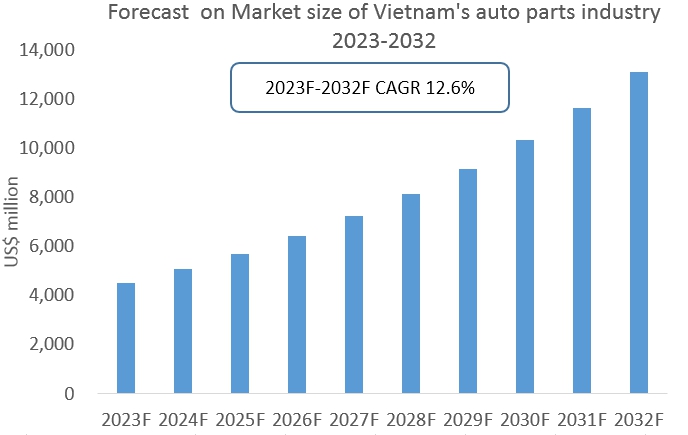

According to CRI’s forecast, Vietnam’s auto market could reach an annual sales scale of 700,000 to 800,000 units by 2025 and over 1 million units by 2030. The expanding scale of Vietnam’s auto market has driven the development of auto parts industry.

In addition, to ensure the supply source of spare parts and improve the localization rate of vehicles, some large domestic enterprises in Vietnam have taken the initiative to increase their investment in auto auxiliary industry. Many overseas manufacturers have also moved their auto parts business to Vietnam.

BYD plans to build an auto parts factory in Vietnam, the scale of investment will be more than 250 million U.S. dollars, is expected to start factory construction before mid-2023, the Vietnamese factory will export parts to the assembly plant built in Thailand.

Overall, according to CRI’s analysis, Vietnam’s auto parts industry has maintained a trade surplus in international trade in recent years, with exports greater than imports, and the trade surplus has generally maintained a relatively stable trend of change, with a CAGR of 3.18% from 2018-2022. In 2022, Vietnam’s auto parts industry’s trade surplus is $160 million, down 9.92% year-on-year.

The impact of Covid-19, Vietnam’s auto production shrinks significantly in 2020, and according to CRI’s analysis, Vietnam’s auto production is only 249,000 units in 2020, down 31.55% y-o-y. The CAGR of Vietnam’s auto production from 2018-2022 is 14.04%. in 2022, as the impact of Covid-19 gradually dissipates and the domestic and global market’s economic recovery, Vietnam’s automotive production also rises significantly, with annual production of about 440,000 units in 2022, up 46.65% year-on-year. The rising automobile production in Vietnam has driven up the demand for auto parts.

In terms of passenger car ownership, according to CRI’s analysis, Vietnam will have 29 cars per 1,000 people in 2022, up 9.74% y-o-y. The CAGR of passenger car ownership in Vietnam is 12.18% from 2018-2022, with 19 cars per 1,000 people in 2018 and 29 cars by 2022. The rising passenger car ownership in Vietnam is driving up the demand for automotive parts.

According to the analysis of CRI, by the end of 2020, the total number of enterprises of wholesale, retail and repair of motor vehicles and motorcycles in Vietnam was 639 and the total number of automobile manufacturing enterprises was 14,404. Vietnam’s automobile industry is relatively fragmented and most of the enterprises in the industry are small and medium-sized enterprises with small capital scale.

74 enterprises in the wholesale, retail and repair of motor vehicles and motorcycles with capital scale over VND500 billion, accounting for only 0.51% of the total. There are 83 automobile manufacturing enterprises with capital scale over VND500 billion, accounting for only 12.99% of the total.

Topics covered:

- Vietnam auto parts industry overview

- The economic and policy environment of Vietnam’s auto parts industry

- What is the impact of COVID-19 on the Vietnamese auto parts industry?

- Vietnam Auto Parts Industry Market Size 2018-2022

- Analysis of major Vietnamese auto parts industry manufacturers

- Key Drivers and Market Opportunities in Vietnam’s Auto Parts Industry

- What are the key drivers, challenges and opportunities for the automotive components industry in Vietnam during the forecast period 2023-2032?

- Which companies are the key players in the Vietnam auto parts industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam automotive parts industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam automotive components industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the auto parts industry in Vietnam?

Related reports:

- Research Report on Vietnam Automotive Tire Industry 2022-2031

- Research Report on Vietnam Automobile Industry 2022-2031

Table of Contents

1 Overview of Vietnam

1.1 Geographical situation

1.2 Demographic structure of Vietnam

1.3 The economic situation in Vietnam

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on the electric vehicle industry in Vietnam

2 2021-2023 Vietnam auto parts industry development environment

2.1 Economic environment and the development of the automotive industry

2.1.1 Vietnam Economy

2.1.2 Overview of Vietnam’s automotive industry

2.1.3 Analysis of car ownership in Vietnam

2.2 Policy Environment

2.2.1 Policy Overview

2.2.2 Key Policy Analysis

2.2.3 Policy Trends

3 2021-2023 Vietnam auto parts industry operation

3.1 Industry Scale

3.1.1 Number of enterprises

3.1.2 Foreign investment in Vietnam’s auto parts industry

3.2 Vietnam auto parts industry supply analysis

3.2.1 Production capacity

3.2.2 Production

3.3 Overall requirements

3.3.1 Consumption

3.3.2 Market Size

3.4 Vietnam auto parts market segment analysis

3.4.1 Analysis of the demand for auto parts in the vehicle manufacturing industry

3.4.2 Analysis of the demand for auto parts in the automotive aftermarket

4 2021-2023 Vietnam auto parts industry market competition situation

4.1 Barriers to entry

4.1.1 Policy Barriers

4.1.2 Financial barriers

4.1.3 Technical barriers

4.1.4 Customer Barriers

4.2 Industry Competition Structure

4.2.1 Upstream suppliers

4.2.2 Downstream users

4.2.3 Competition among existing companies in the industry

4.2.4 New entrants

4.2.5 Alternatives

5 2021-2023 Vietnam auto parts industry import and export analysis

5.1 Import

5.1.1 Import Overview

5.1.2 Main import sources

5.1.3 Import trends

5.2 Export

5.2.1 Export Overview

5.2.2 Main export destinations

5.2.3 Export Trends

6 Vietnam auto parts industry chain, 2021-2023

6.1 Introduction to the industry chain

6.2 Upstream of the industry chain

6.2.1 Steel industry

6.2.2 Rubber Industry

6.2.3 Non-ferrous raw materials

6.2.4 Impact of upstream industry on auto parts industry

6.3 Downstream industries

6.3.1 Automotive industry

6.3.2 Automotive after-sales service industry

6.3.3 Impact of downstream industry on auto parts industry

7 2021-2023 Vietnam auto parts industry sub-regional analysis

7.1 Regional distribution of automotive parts industry

7.2 Vinh Phuc City

7.2.1 Vinh Phuc City Auto Parts Industry Size

7.2.2 Vinh Phuc City Auto Parts Industry Operation

7.3 Hai Phong City

7.3.1 Hai Phong City Auto Parts Industry Size

7.3.2 Hai Phong City Auto Parts Industry Operation

7.4 Ninh Binh City

7.4.1 Ninh Binh City Auto Parts Industry Size

7.4.2 Ninh Binh City Auto Parts Industry Operation

7.5 Quang Nam City

7.5.1 Quang Nam City Auto Parts Industry Size

7.5.2 Quang Nam City Auto Parts Industry Operation Status

7.5.3 THACO CHU LAI industrial park

7.6 Dong Nai City

7.6.1 Dong Nai City Auto Parts Industry Size

7.6.2 Dong Nai City Auto Parts Industry Operation

7.7 Binh Duong City 7.7.1 Binh Duong City Auto Parts Industry Size

7.7.2 Binh Duong City Auto Parts Industry Operation

7.8 Quang Ninh City

7.8.1 Viet Hung Industrial Park

7.8.2 Dong Mai Industrial Park

8 2021-2023 Vietnam auto parts industry key company analysis

8.1 VinFast

8.1.1 Company Profile

8.1.2 Analysis of operating conditions

8.2 Truong Hai Auto Corporation

8.2.1 Company Profile

8.2.2 Analysis of operating conditions

8.3 Hoa Phat Group

8.3.1 Company Profile

8.3.2 Analysis of operating conditions

8.4 Thanh Cong Group

8.4.1 Company Profile

8.4.2 Analysis of operating conditions

8.5 Huyndai Thanh Cong and Huyndai Motor

8.5.1 Company Profile

8.5.2 Analysis of operating conditions

8.6 Toyota Motor Vietnam Co., Ltd (TMV)

8.6.1 Company Profile

8.6.2 Analysis of operating conditions

8.7 Honda Vietnam

8.7.1 Company Profile

8.7.2 Analysis of operating conditions

9 Vietnam Auto Parts Industry Outlook 2023-2032

9.1 Development Influencing Factors

9.1.1 Driving forces and market opportunities

9.1.2 Threats and Challenges

9.2 Supply Forecast

9.2.1 Production capacity forecast

9.2.2 Production Forecast

9.3 Demand Forecasting

9.3.1 Overall market size forecast

9.3.2 Vietnam vehicle manufacturing industry demand for automotive parts analysis

9.3.3 Analysis of demand for auto parts in Vietnam’s automotive aftermarket

9.4 Development and Investment Recommendations

9.4.1 Exploring Investment Opportunities

9.4.2 Development suggestions

Reviews

There are no reviews yet.