Description

Thailand Rice Industry

In Thailand, seasonal rainfall occurs in the form of the southwest monsoon, which usually begins its heaviest rainfall pattern in June and continues through September. The germination and growth of Thai rice is largely dependent on these seasonal rains. Seasonal rains favor early planting and enhance rice yields.

In 2022, Thailand exported 7.69 million tons of rice, exceeding the Ministry of Commerce’s target of 7.5 million tons. Exports rose 25.77 percent from 6.12 million tons in 2021, while the value in Thai baht terms increased 28.48 percent to 138.45 billion baht ($4.02 billion). 2022 saw Thailand become the world’s second-largest rice exporter after India, which exported 21.9 million tons.

Iraq is the largest importer of Thai rice, buying 1.6 million tons last year, up 458 percent from a year earlier. South Africa came in second, importing 775,000 tons (down 2.26 percent), followed by China at 750,000 tons (up 18.8 percent), the United States at 650,000 tons (up 13.2 percent) and Benin at 321,000 tons (down 15.3 percent). According to CRI’s analysis, in 2022, Thailand’s total rice production of nearly 18.86 million tons meets demand for domestic consumption, processing, use in poultry and livestock feed, and export.

In terms of price, the average price of Thai rice exports increased by 2.16 percent year-on-year to $521.88 per ton in 2022. The price of broken 5% white rice remained high on the world market, rising to US$523 per ton on January 18 from US$465 per ton in mid-December.

The baht weakens again in 2023. The outlook for the Thai baht is critical for the country’s rice exports this year. If the baht continues to weaken, Thai rice exports will be competitive in the world market.

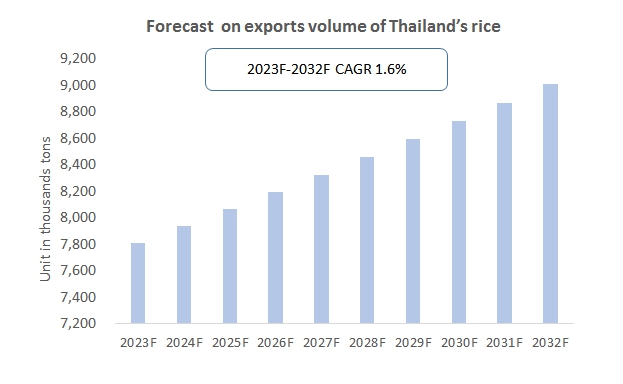

A weaker baht, rising domestic consumption stocks in India and Vietnam, and growing demand from the Middle East are key factors helping to drive Thai rice exports. CRI expects the exports volume of Thailand’s rice to reach 9.01 million tons in 2032, growing at a compound annual growth rate (CAGR) of 1.6 percent over the 2023-2032 period.

Topics covered:

- Overview of the Thai rice industry

- Economic and policy environment of the Thai rice industry

- What is the impact of COVID-19 on the Thai rice industry?

- Market Size of Thai Rice Industry, 2023-2032

- Analysis of major Thai rice industry players

- Key Drivers and Market Opportunities in Thailand Rice Industry

- What are the key drivers, challenges and opportunities for the Thai Rice industry during the forecast period 2023-2032?

- Which are the key players in the Thailand Rice Industry market and what are their competitive advantages?

- What is the expected revenue of Thailand Rice Industry market during the forecast period 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Thailand Rice Industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the Thai rice industry?

Table of Contents

1. Thailand Overview

1.1 Geographical Situation

1.2 Thailand’s Demographic Structure

1.3 Thailand’s Economy

1.4 Minimum Wage in Thailand, 2011-2022

1.5 Impact of COVID-19 on the Thai Rice Industry

2. Thailand Rice Industry Development Environment

2.1 Brief History of Rice Development in Thailand

2.2 Types of Thai Rice

2.3 Policy Environment of Thai Rice Industry

3. Supply and Demand Situation of Thailand Rice Industry

3.1 Supply Situation of Thailand Rice Industry

3.2 Demand Situation in the Thai Rice Industry

4. Import and Export Status of Thailand’s Rice Industry

4.1 Import Status of the Thai Rice Industry

4.1.1 Thailand Rice Import Volume and Value

4.1.2 Main Import Sources of Thai Rice

4.2 Export Status of Thailand’s Rice Industry

4.2.1 Volume and Value of Thailand’s Rice Exports

4.2.2 Main Export Destinations of Thai Rice

5. Market Competition in Thailand Rice Industry

5.1 Entry Barriers for Thai Rice Industry

5.1.1 Brand Barriers

5.1.2 Quality Barriers

5.1.3 Capital Barriers

5.2 Competitive Structure of the Thai Rice Industry

5.2.1 Bargaining Power of Rice Suppliers

5.2.2 Consumer Bargaining Power

5.2.3 Competition in the Thai Rice Industry

5.2.4 Potential Entrants in the Rice Industry

5.2.5 Alternatives to Rice

6. Analysis of Major Rice Exporters in Thailand

6.1 Group of Asia Golden Rice Co., Ltd.

6.1.1 History of Group of Asia Golden Rice Co., Ltd.

6.1.2 Main Products of Group of Asia Golden Rice Co., Ltd.

6.1.3 Operational Mode of Group of Asia Golden Rice Co., Ltd.

… (Continuing for other companies)

7. Thailand Rice Industry Outlook, 2023-2032

7.1 Analysis of Factors for Development of Thailand Rice Industry

7.1.1 Drivers and Development Opportunities for Thailand Rice Industry

7.1.2 Threats and Challenges Facing the Thai Rice Industry

7.2 Thailand Rice Industry Supply Forecast

7.3 Demand Forecast for Thailand Rice Market

7.4 Thailand Rice Import and Export Forecast

Reviews

There are no reviews yet.