Description

Thailand Light Truck Industry

Pickup trucks have had a significant impact on Thailand’s automotive industry and economy due to their sustainability, versatility, and low cost. in 2022, pickup trucks accounted for 45.7% of all vehicle sales in Thailand, with 388,296 pickup trucks sold. The Thai pickup truck market is dominated by two models – the Isuzu D-Max and the Toyota Hilux (banned in the US).

Together, these two models accounted for 83% of the market, with the Isuzu D-Max topping the list for the third consecutive year. With sales of 175,425 units in 2022, the D-Max model is the market leader with a 45.56% market share, while the Toyota Hilux is in second place with sales of 148,101 units in the same year and a 37.77% market share.

Many manufacturers (Ford, Isuzu, Mazda, Mitsubishi) have chosen to locate their global pickup truck manufacturing base in Thailand, building pickup trucks that are typically exported to Europe, Japan, and much of the rest of the world. These one-ton trucks are not exported to North America, where larger trucks are preferred.Thailand surpassed the U.S. as the world’s largest manufacturer of one-ton pickup trucks in 2005, and Thailand’s automotive industry is already a global hub for one-ton pickup truck exports. Thailand’s exports of one-ton pickup trucks account for about 40 percent of its total production.

Daihatsu Hijet, Toyota Pixis Van and Suzuki Every will collaborate on the launch of a new electric vehicle in the form of a minivan, a zero-emission commercial van based on the DNGA platform with a 660cc gasoline engine. Expected to debut as a concept vehicle at a special event during the Japan Automobile Manufacturers Association’s 2023 G7 Hiroshima Summit, the electric minivan is said to have a range of 200 kilometers (124 miles).

In 2019, Foton Motor Group and the Chengtai Group, signed a joint venture agreement. The two sides will jointly establish a joint venture company in Thailand, which will set up a sales company and a manufacturing company, respectively, and give full play to the advantages of the two sides in commercial vehicle technology and market operation capabilities, and strive to become the third largest commercial vehicle Thai car brand in Thailand.

As an international commercial vehicle enterprise leading China’s commercial vehicle industry for 14 consecutive years, Foton’s business scope covers a full range of commercial vehicles such as medium and heavy trucks, light trucks, vans, pickup trucks, buses, passenger cars. Buses, construction machinery vehicles, etc.

The joint venture will utilize Foton’s strengths in commercial vehicles, new energy vehicle products and manufacturing technology, Telematics technology and ZD Group’s strategic customer relationships, banking resources and social influence to operate Foton’s heavy trucks, medium trucks, light truck trucks trucks, buses and new energy vehicles.

Despite the volatility in the economy triggered by the Covid-19 outbreak, which posed challenges to parcel shipment volumes, especially from the e-commerce channel, the courier business in Thailand has continued to grow.The local courier market is worth 50 billion baht in 2021, which is about half of the overall logistics segment. According to CRI’s analysis, from 2017-2021, the Thai market’s express parcel volume showed a changing trend of year-on-year growth, with a five-year CAGR of 47.24%.

In 2017, Thailand handled only 320 million express parcels in the whole year, and by 2021, the volume of express parcels handled in the country has grown rapidly to 1.5 billion parcels, an increase of 32.74% year-on-year, which is more than quadruple the five-year increase, and the development has been very rapidly.

From 2019-2022, according to CRI analysis, Light Commercial Vehicle sales volume in Thailand shows a trend of decrease and then increase, with a CAGR of -2.08% from 2019-2022. Due to the impact of Covid-19, in 2020, the annual sales volume of Light Commercial Vehicles in Thailand decreases by 16.75% to 449,000 units, and in 2021, the annual sales volume of Light Commercial Vehicles in Thailand decreases by 2.74% to 436,000 units.

With the gradual liberalization of the embargo measures, the economy started to recover, and the market and supply chain gradually recovered, in 2022, Thailand’s light commercial vehicle market started to rebound, with an increase of 15.96% in the annual sales of light commercial vehicles, and the annual sales of light commercial vehicles amounted to 506,000 units, respectively.

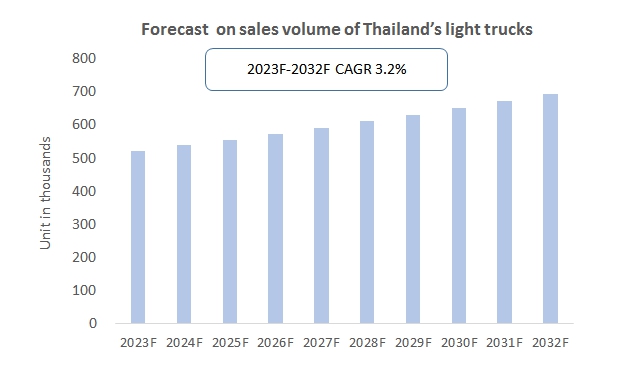

With the growing e-commerce logistics market in Thailand, the continued rise in disposable income of the population, and the replacement of traditional fuel trucks by electric light trucks, CRI expects the light truck market in Thailand to continue to grow in the future, with sales volume reaching 693,000 units in 2032, and a compounded annual growth rate (CAGR) of 3.2% over the 2023-2032 period.

Topics covered:

- Overview of the Light Truck Industry in Thailand

- Economic and Policy Environment of Light Truck Industry in Thailand

- What is the impact of COVID-19 on the light truck industry in Thailand?

- Thailand Light Truck Industry Market Size, 2023-2032

- Analysis of Major Thai Light Truck Industry Players

- Key Drivers and Market Opportunities in Thailand’s Light Truck Industry

- What are the key drivers, challenges and opportunities for the Light Truck industry in Thailand during the forecast period 2023-2032?

- Which are the key players in Thailand Light Truck Industry market and what are their competitive advantages?

- What is the expected revenue of Thailand Light Truck Industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Thailand Light Truck Industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the Light Trucks industry in Thailand?

Related reports:

- Malaysia Light Truck Industry Research Report 2023-2032

- Indonesia Light Truck Industry Research Report 2023-2032

- Philippines Light Truck Industry Research Report 2023-2032

- Vietnam Light Truck Industry Research Report 2023-2032

Table of Contents

1. Thailand Overview

1.1 Geographical Situation

1.2 Thailand’s Demographic Structure

1.3 Thailand’s Economic Situation

1.4 Minimum Wage in Thailand, 2013-2022

1.5 Impact of COVID-19 on the Light Truck Industry in Thailand

2. Thailand Light Truck Industry Operation 2018-2022

2.1 Status of Light Truck Production in Thailand (Pickups, Vans, Minivans, etc.)

2.2 Sales of Light Trucks in Thailand

2.3 Thailand’s Import and Export of Light Trucks

2.4 Development of Electric Light Trucks in Thailand

3. Thailand’s Light Truck Policy Environment:

3.1 Driver’s License Requirements (Are They Different from Passenger Cars)

3.2 Licensing Fees

4. Market Competition in Thailand’s Light Truck Industry

4.1 Entry Barriers for Thailand’s Light Truck Industry

4.1.1 Brand Barriers

4.1.2 Quality Barriers

4.1.3 Capital Barriers

4.2 Competitive Structure of the Light Truck Industry in Thailand

4.2.1 Bargaining Power of Light Truck Suppliers

4.2.2 Consumer Bargaining Power

4.2.3 Competition in Thailand’s Light Truck Industry

4.2.4 Potential Entrants in the Light Truck Industry

4.2.5 Alternatives to Light Trucks

5. Thailand Major Light Truck Manufacturers Analysis

5.1 Daihatsu

5.1.1 Daihatsu Corporate Profile

5.1.2 Daihatsu’s Operations

5.2 Ford

5.2.1 Overview of Ford Enterprises

5.2.2 Ford Operations

5.3 Isuzu

5.3.1 Isuzu Company Profile

5.3.2 Isuzu’s Operations

5.4 Mazda

5.4.1 Mazda Corporate Profile

5.4.2 Mazda Operations

5.5 Mitsubishi

5.5.1 Mitsubishi Corporate Profile

5.5.2 Mitsubishi Operations

5.6 Chevrolet

5.6.1 Chevrolet Corporate Profile

5.6.2 Chevrolet Operations

5.7 Foton

5.7.1 Foton Corporate Profile

5.7.2 Foton Operations

5.8 Nissan

5.8.1 Nissan Corporate Profile

5.8.2 Nissan Operations

5.9 Toyota

5.9.1 Overview of Toyota Enterprises

5.9.2 Toyota Operations

6. Thailand Light Truck Industry Outlook, 2023-2032

6.1 Analysis of Factors Contributing to the Development of the Light Truck Industry in Thailand

6.1.1 Drivers and Development Opportunities for the Light Truck Industry in Thailand

6.1.2 Threats and Challenges Facing the Light Truck Industry in Thailand

6.2 Supply Forecast for Thailand Light Truck Industry

6.3 Demand Forecast for Thailand Light Truck Market

6.4 Import and Export Forecasts for Thailand’s Light Truck Industry

6.5 Thailand Light Truck Industry Revenue Forecasts

Reviews

There are no reviews yet.