Description

Southeast Asia Fast Food Industry

With the economic development of Southeast Asia, the pace of life of residents has accelerated and the concept of food has gradually changed. Modern fast food, as a mass catering to meet people’s basic daily needs, is flourishing in Southeast Asia with its quick, convenient and delicious features.

The development of the fast food industry in Southeast Asia varies greatly from country to country. For example, the fast food industry in Singapore has been relatively mature and has gradually emerged in Singapore since the 1970s. McDonald’s is one of the major fast food brands in Singapore, with more than 100 stores, and KFC has about seventy stores. In Vietnam, the fast food industry developed later, and only in 2010 did western fast food chains such as KFC and Pizza Hut try to enter the Vietnamese market. At present, brands such as Lotte Lee, Happy Bee, Yum Brands and Quan Ngon 138 dominate the fast food industry in Vietnam, and the fast food industry is highly competitive.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

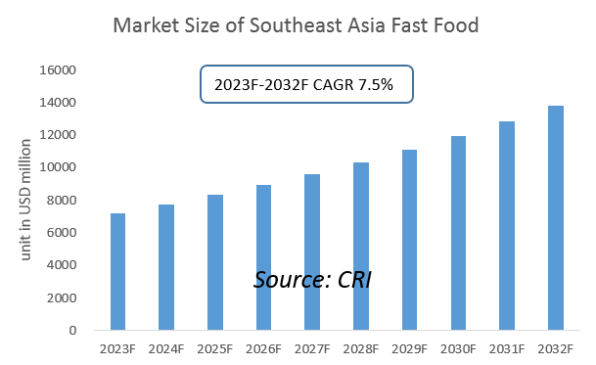

With the rapid expansion of the middle class in Southeast Asian countries in recent years, the population’s standard of living has improved, and the overall spending power has increased, CRI expects the fast food industry in Southeast Asia to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Fast Food Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Fast Food Industry?

- Which Companies are the Major Players in Southeast Asia Fast Food Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Fast Food Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Fast Food Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Fast Food Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Fast Food Industry Market?

- Which Segment of Southeast Asia Fast Food Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Fast Food Industry?

Table of Contents

1 Singapore Fast Food Industry Analysis

1.1 Singapore Fast Food Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Fast Food Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.3 Analysis of Major Fast Food Brands in Singapore

2 Analysis of the Fast Food Industry in Thailand

2.1 Development Environment of Fast Food Industry in Thailand

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Fast Food Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.3 Analysis of Major Fast Food Brands in Thailand

3 Analysis of the Fast Food Industry in the Philippines

3.1 Development Environment of the Fast Food Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Fast Food Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.3 Analysis of Major Fast Food Brands in the Philippines

4 Malaysia Fast Food Industry Analysis

4.1 Malaysia Fast Food Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Fast Food Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.3 Analysis of Major Fast Food Brands in Malaysia

5 Indonesia Fast Food Industry Analysis

5.1 Indonesia Fast Food Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Indonesia Minimum Wage

5.2 Indonesia Fast Food Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.3 Analysis of Major Fast Food Brands in Indonesia

6 Vietnam Fast Food Industry Analysis

6.1 Vietnam Fast Food Industry Development Environment

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Fast Food Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.3 Analysis of Major Fast Food Brands in Vietnam

7 Myanmar Fast Food Industry Analysis

7.1 Development Environment of Fast Food Industry in Myanmar

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Fast Food Industry Operation 2023-2032

7.2.1 Supply

7.2.2 Demand

7.3 Analysis of Major Fast Food Brands in Myanmar

8 Brunei Fast Food Industry Analysis

8.1 Brunei Fast Food Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Fast Food Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.3 Brunei Major Fast Food Brands Analysis

9 Analysis of the Fast Food Industry in Laos

9.1 Laos Fast Food Industry Development Environment

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Fast Food Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.3 Analysis of Major Fast Food Brands in Laos

10 Cambodia Fast Food Industry Analysis

10.1 Cambodia Fast Food Industry Development Environment

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Fast Food Industry Operation 2023-2032

10.2.1 Supply

10.2.2 Demand

10.3 Analysis of Major Fast Food Brands in Cambodia

11 Southeast Asia Fast Food Industry Outlook 2023-2032

11.1 Analysis of Factors Affecting the Development of Fast Food Industry in Southeast Asia

11.1.1 Favorable Factors

11.1.2 Disadvantageous Factors

11.2 Southeast Asia Fast Food Industry Supply Analysis, 2023-2032

11.3 Southeast Asia Fast Food Industry Demand Analysis 2023-2032

11.3 Southeast Asia Fast Food Industry Import and Export Status Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Fast Food Industry

Reviews

There are no reviews yet.