Description

Southeast Asia Denture Industry

A denture, also known as a dental prosthesis, is an auxiliary device that replaces teeth and is generally used to replace teeth that cannot be used properly due to accidents, natural loss or loss of teeth due to aging.

According to CRI’s analysis, Southeast Asia has a large population and a large elderly population, with a total of more than 45 million people aged 65 and older, and the number is expected to grow to 132 million by 2050. Tooth loss is common among the elderly due to problems such as periodontal disease and dental caries that are not treated in a timely manner, or diseases such as osteoporosis that cause damage to the tooth structure. In Singapore, for example, surveys show that about 30% of Singaporeans over the age of 60 have lost all their teeth loosely and need to wear dentures.

The price of dentures in Southeast Asia is high, according to CRI analysis, the average price of full dentures made of Alec in Indonesia is about US$800, which is about one-fifth of Indonesia’s per capita income in 2021. However, with the economic development of Southeast Asia and the expansion of the middle class, more and more people will be able to afford the cost of dentures, so the future development of the denture industry in Southeast Asia is promising.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

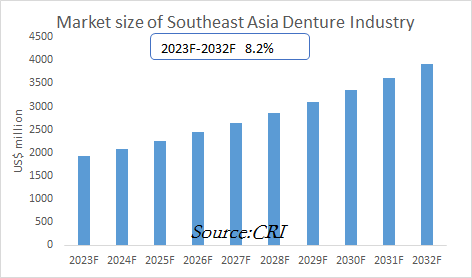

CRI expects the Southeast Asian denture industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Denture Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Denture Industry?

- Which Companies are the Major Players in Southeast Asia Denture Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Denture Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Denture Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Denture Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Denture Industry Market?

- Which Segment of Southeast Asia Denture Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Denture Industry?

Table of Contents

1 Singapore Denture Industry Analysis

1.1 Singapore Denture Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Denture Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.3 Analysis of Major Denture Manufacturing and Trading Companies in Singapore

2 Thailand Denture Industry Analysis

2.1 Thailand Denture Industry Development Environment

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Denture Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.3 Analysis of Major Denture Manufacturing and Trading Companies in Thailand

3 Analysis of the Philippine Denture Industry

3.1 Philippine Denture Industry Development Environment

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Denture Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.3 Analysis of Major Denture Manufacturing and Trading Companies in the Philippines

4 Malaysia Denture Industry Analysis

4.1 Malaysia Denture Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Denture Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.3 Analysis of Major Denture Manufacturing and Trading Companies in Malaysia

5 Indonesia Denture Industry Analysis

5.1 Indonesia Denture Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Denture Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.3 Analysis of Major Denture Manufacturers and Traders in Indonesia

6 Vietnam Denture Industry Analysis

6.1 Vietnam Denture Industry Development Environment

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Vietnam Minimum Wage

6.2 Vietnam Denture Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.3 Analysis of Major Denture Manufacturing and Trading Companies in Vietnam

7 Analysis of the Denture Industry in Myanmar

7.1 Development Environment of the Denture Industry in Myanmar

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Denture Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.3 Analysis of Major Denture Manufacturing and Trading Companies in Myanmar

8 Brunei Denture Industry Analysis

8.1 Brunei Denture Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Denture Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.3 Analysis of Major Denture Manufacturing and Trading Companies in Brunei

9 Analysis of the Denture Industry in Laos

9.1 Development Environment of the Denture Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Operation of the Denture Industry in Laos 2023-2032

9.2.1 Supply

9.2.2 Demand

9.3 Analysis of Major Denture Manufacturing and Trading Companies in Laos

10 Cambodia Denture Industry Analysis

10.1 Development Environment of Cambodia Denture Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Denture Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.3 Analysis of Major Denture Manufacturing and Trading Companies in Cambodia

11 Southeast Asia Denture Industry Outlook 2023-2032

11.1 Southeast Asia Denture Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Denture Industry Supply Analysis 2023-2032

11.3 Southeast Asia Denture Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Denture Industry

Reviews

There are no reviews yet.