Description

China’s chicken meat import

China is one of the largest broiler breeding countries in the world and the demand for chicken meat in the Chinese market is on the rise. Since there is limited room for growth in China’s local chicken meat production, China needs to import a large amount of chicken meat every year.

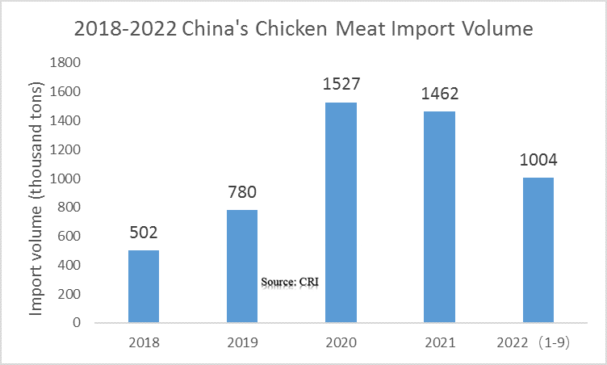

In 2021, China imported 1.5 million tons of chicken meat (including whole chickens, chicken cuts, wing of chicken, chicken claw, offal of chicken, the same below), down 4.2% year-on-year, with imports of US$3.5 billion, up 0.6% year-on-year. According to CRI analysis, in the first three quarters of 2022, China imported 1.004 million tons of chicken meat, down 6.1% year-on-year, with imports of US$3.1 billion, up 24.5% year-on-year.

In 2018-2021, the average price of China’s chicken meat imports is relatively stable, generally remaining in the price range of US$2.2-2.5 per kg. in 2022, the price of China’s chicken meat imports rises to US$3.0 per kg, up 32.7% year-on-year.

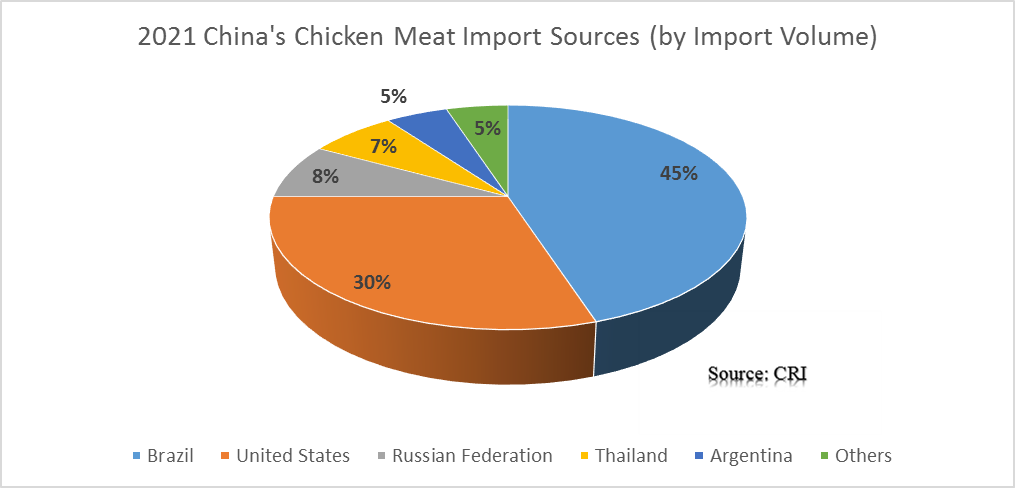

In 2021, China imported chicken meat from a total of 10 countries. According to CRI’s analysis, the main sources of China’s chicken meat imports by volume are Brazil, the United States, the Russian Federation, Thailand and Argentina, with chicken meat imports from these five countries accounting for more than 95% of total imports in that year. Among them, Brazil is China’s largest source of chicken meat imports. 2021, China imported 651,000 tons of chicken meat from Brazil, accounting for 44.5% of the total import volume and US$1.5 billion, accounting for 42.0% of the total import value.

CRI analyzes that China’s chicken meat imports are mainly frozen chicken meat. Among the various types of frozen chicken meat, frozen chicken claws, frozen chicken wings, frozen chicken pieces with bones and frozen chicken offal are the main types of imports. According to CRI’s analysis, frozen chicken claws are the largest type of chicken meat imported into China. 674,000 tons of frozen chicken claws were imported into China in 2021, accounting for 46.1% of the total import volume and US$1.9 billion, accounting for 55.1% of the total import value.

China is one of the world’s major chicken meat consumers, and chicken meat occupies an important position in the country’s diet and consumption structure. CRI forecasts that China’s chicken meat imports are expected to continue to rise from 2023-2032.

Topics covered:

- China’s Chicken Meat Import Status and Major Sources in 2018-2022?

- China’s chicken meat import market has witnessed significant growth over the past few years, with major sources including Brazil, the United States, and Thailand. In 2022, China’s chicken meat imports reached over 900,000 metric tons, with Brazil being the largest supplier followed by the United States and Thailand.

- What is the Impact of COVID-19 on China’s Chicken Meat Import?

- The COVID-19 pandemic has had a significant impact on China’s chicken meat import market, with disruptions in the supply chain and import restrictions. In 2020, China’s chicken meat imports decreased by approximately 20% due to the pandemic. However, the market has shown signs of recovery in recent years.

- Which Companies are the Major Players in China’s Chicken Meat Import Market and What are their Competitive Benchmarks?

- Major players in China’s chicken meat import market include JBS S.A., Tyson Foods Inc., BRF S.A., Cargill Inc., and Marfrig Global Foods S.A. These companies have significant market share and have adopted various strategies to increase their market share, such as acquisitions, partnerships, and product launches.

- Key Drivers and Market Opportunities in China’s Chicken Meat Import:

- The key drivers of China’s chicken meat import market include increasing demand for high-quality meat products, growing population and urbanization, and rising disposable incomes. Market opportunities include increasing demand for organic and natural chicken meat products, rising awareness of health benefits, and the expansion of online retail channels.

- What are the Key Drivers, Challenges, and Opportunities for China’s Chicken Meat Import during 2023-2032?

- The key drivers for China’s chicken meat import market during 2023-2032 include the growing population, increasing disposable income, and the demand for high-quality meat products. Challenges include strict import regulations, rising competition from domestic chicken meat producers, and the impact of diseases on chicken meat production. Opportunities include the adoption of new technologies to increase efficiency and production, the expansion of online retail channels, and the development of new markets.

- What is the Expected Revenue of China’s Chicken Meat Import during 2023-2032?

- The expected revenue of China’s chicken meat import market during 2023-2032 is expected to continue to grow, reaching over $10 billion by 2032. The market is expected to show steady growth, with increasing demand for high-quality meat products and the expansion of online retail channels.

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- The strategies adopted by key players in China’s chicken meat import market include mergers and acquisitions, partnerships, and product launches. Companies are also focusing on innovation to differentiate their products and gain a competitive advantage in the market.

- What are the Competitive Advantages of the Major Players in China’s Chicken Meat Import Market?

- Major players in China’s chicken meat import market have a competitive advantage in terms of their supply chain management, distribution networks, and production capabilities. Companies are also focusing on product innovation and branding to differentiate their products and gain a competitive edge in the market.

- Which Segment of China’s Chicken Meat Import is Expected to Dominate the Market in 2032?

- The processed chicken meat segment is expected to dominate the China’s chicken meat import market in 2032 due to the increasing demand for convenience foods and the expansion of the fast-food industry in China.

- What are the Major Adverse Factors Facing China’s Chicken Meat Import?

- The major adverse factors facing China’s chicken meat import market include the impact of diseases on chicken meat production, rising competition from domestic chicken meat producers, and strict import regulations.

Reviews

There are no reviews yet.