Description

Philippines Furniture Industry

Furniture, encompassing movable objects facilitating various human activities such as sitting, reclining, or storing items, plays a vital role in enhancing the practicality and visual appeal of both indoor and outdoor spaces. Chairs, tables, beds, desks, and cabinets are among the common examples of furniture serving both functional and aesthetic purposes.

Crafted from diverse materials like wood, metal, plastic, and textiles, furniture has evolved from traditional handmade pieces to mass-produced standardized items with the advent of industrialization. It can be categorized based on its intended use: office furniture tailored for workspaces, outdoor furniture engineered for resilience against weather conditions, and residential furniture focused on comfort and style. The design and arrangement of furniture significantly influence the functionality and ambiance of a space.

Currently, furniture is available in a plethora of styles and designs, ranging from classical and ornate to modern and minimalist, across the Philippines. This wide range aims to cater to the diverse needs and preferences of individuals, highlighting the versatility and adaptability of furniture in meeting evolving lifestyle demands.

The market size of Philippines furniture industry reached US$ 780 million in 2023. The growth in market revenue can largely be attributed to the increase in the number of furniture manufacturers and retail outlets. Moreover, rising urbanization has led to increased demand for furniture in residential, hotel, office, and industrial sectors over the period. In addition, increasing customer awareness about online sales and e-commerce portals for furniture, along with the expansion of services offered by e-retailers such as Lorenz Furniture, has also had a significant impact on the Philippine furniture market in recent years.

The country’s growing middle-class population, coupled with an increasing GDP, has boosted demand for residential property. This surge in demand for housing structures has been the major driver behind the increased demand for furniture in the country. Home furniture therefore dominated the overall Philippines furniture market in 2023, followed by office, hotel and industrial sector.

The Philippines furniture market is largely dominated by the unorganized sector in terms of the number of manufacturers, with approximately 3,720 unorganized furniture companies operating in the country in 2016. This dominance can be attributed to the abundance of raw materials and the availability of cheap, skilled labor, which have fueled the market’s growth. Leveraging locally available resources allows these companies to produce furniture at a lower cost, enabling them to sell products at more competitive prices compared to established companies with multiple retail outlets in the Philippines.

In the Philippines, furniture sales have primarily been dominated by offline retail outlets, franchisee outlets, showrooms, and exclusive stores operated by manufacturers and major players in the industry. Despite the country having approximately 69.05 million internet users in 2023, online sales of furniture made only a minor contribution to overall market revenues. In 2023, brick-and-mortar stores continued to pose significant competition to online players in the Philippines furniture market. These physical retail outlets offered a diverse range of products at competitive prices, attracting a large portion of consumers. Consequently, online sales accounted for only a minor fraction, representing approximately 26.5% of the total sales revenue in the furniture market.

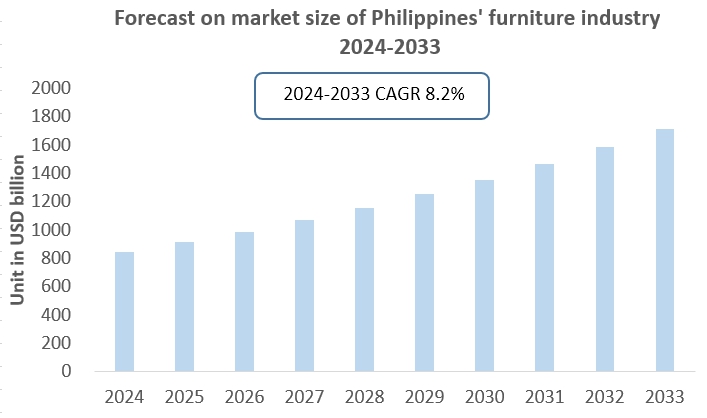

CRI predicts that the furniture industry of Philippines will grow rapidly during the forecast period (2024-2033). Rise in domestic as well export demand of furniture products is anticipated to result in market growth. Since tourism-based enterprises such as hotels, restaurants, museums and leisure service providers face growing needs to update their amenities; the demand for unique furniture items is expected to rise sharply. Apart from the robust hotel sector, construction of more condominiums and residential houses in the country is expected to drive the growth of the industry in the coming years. The property sector’s strong growth and families’ easier access to housing credit will also increase demand for household items and most importantly furniture products.

According to CRI, the furniture industry of Philippines is poised for significant growth, with expectations to reach a market value of US$ 1,715 million in 2033, with a compound annual growth rate of 8.2% from 2024 to 2033. Additionally, the export value of Philippine furniture is forecasted to reach US$ 3 billion in 2033, reflecting a growth rate of 5.5%.

Topics covered:

- Philippines Furniture Industry Overview

- The economic and policy environment of Philippines’s furniture industry

- Philippines Furniture Industry Market Size, 2024-2033

- Analysis of the main Philippines furniture production enterprises

- Key drivers and market opportunities for Philippines’s furniture industry

- What are the key drivers, challenges and opportunities for Philippines’s furniture industry during the forecast period 2024-2033?

- Which companies are the key players in the Philippines furniture industry market and what are their competitive advantages?

- What is the expected revenue of Philippines furniture industry market during the forecast period 2024-2033?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Philippines furniture industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the furniture industry in Philippines?

Table of Contents

1. Overview of Philippines

1.1 Geographical Situation

1.2 Demographic Structure of Philippines

1.3 The Economic Situation in Philippines

1.4 Minimum Wage in Philippines 2014-2023

1.5 Impact of COVID-19 on the Furniture Industry in Philippines

2. Overview of Philippines Furniture Industry

2.1 History of Philippines Furniture Industry Development

2.2 FDI in Philippines Furniture Industry

2.3 Social Environment of Philippines Furniture Industry

2.4 Policy Environment of Philippines Furniture Industry

3. Philippines Furniture Industry Supply and Demand Situation

3.1 Philippines Furniture Industry Supply Situation

3.2 Philippines Furniture Industry Demand Situation

4. Philippines Furniture Industry Import and Export Situation

4.1 Philippines Furniture Industry Import Situation

4.1.1 Import Volume and Import Value of Philippines Furniture Industry

4.1.2 Main Import Sources of Philippines Furniture

4.2 Philippines Furniture Industry Export Situation

4.2.1 Export Volume and Import Value of Philippines Furniture Industry

4.2.2 Main Export Destinations of Philippines Furniture

5. Cost Analysis of the Philippines Furniture Industry

5.1 Cost Analysis of Philippines Furniture Industry

5.1.1 Labor costs

5.1.2 Cost of raw materials

5.1.3 Other costs

5.2 Price Analysis of Philippines Furniture

6. Market Competition of Philippines Furniture Industry

6.1 Barriers to entry in the Philippines Furniture Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Philippines Furniture Industry

6.2.1 Bargaining Power of Upstream Suppliers

6.2.2 Consumer Bargaining Power

6.2.3 Competition in Philippines Furniture Industry

6.2.4 Threat of Potential Entrants

6.2.5 Threat of Substitutes

7. Analysis of Top 10 Furniture Brands in Philippines, 2023

7.1 IKEA

7.1.1 Corporate Profile of IKEA

7.1.2 Operations of IKEA in Philippines

7.2 West Elm

7.2.1 Corporate Profile of West Elm

7.2.2 Operations of West Elm in Philippines

7.3 Pottery Barn

7.3.1 Corporate Profile of Pottery Barn

7.3.2 Operations of Pottery Barn in Philippines

7.4 Ethan Allen

7.4.1 Corporate Profile of Ethan Allen

7.4.2 Operations of Ethan Allen in Philippines

7.5 Dimensione

7.5.1 Corporate Profile of Dimensione

7.5.2 Operations of Dimensione

7.6 Mandaue Foam

7.6.1 Corporate Profile of Mandaue Foam

7.6.2 Operations of Mandaue Foam in Philippines

7.7 Crate & Barrel Philippines

7.7.1 Corporate Profile of Crate & Barrel Philippines

7.7.2 Operations of Crate & Barrel Philippines

7.8 SM Home

7.8.1 Corporate Profile of SM Home

7.8.2 Operations of SM Home in Philippines

7.9 MOD Living Furnishing

7.9.1 Corporate Profile of MOD Living Furnishing

7.9.2 Operations of MOD Living Furnishing in Philippines

7.10 Trunc

7.10.1 Corporate Profile of Trunc

7.10.2 Operations of Trunc in Philippines

8. Philippines Furniture Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Philippines Furniture Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Philippines Furniture Industry, 2024-2033

8.3 Demand Forecast of Philippines Furniture Industry, 2024-2033

8.4 Import and Export Forecast of Philippines Furniture Industry, 2024-2033

LIST OF CHARTS

Chart Total population of Philippines 2008-2023

Chart GDP per capita in Philippines 2013-2023

Chart Furniture Industry Related Policies Issued by the Philippines Government 2018-2024

Chart Market size of furniture industry in Philippines

Chart 2019-2023 Philippines furniture industry imports

Chart 2019-2023 Philippines furniture industry import amount

Chart 2019-2023 Philippines furniture industry importers and import value

Chart 2019-2023 Export volume of Philippines’s furniture industry

Chart 2019-2023 Export value of Philippines’s furniture industry

Chart Exporting countries and export value of Philippines’s furniture industry in 2019-2023

Chart 2024-2033 Philippines furniture industry production forecast

Chart 2024-2033 Philippines Furniture Market Size Forecast

Chart 2024-2033 Philippines furniture industry import forecast

Chart 2024-2033 Export forecast for Philippines’s furniture industry

Related Reports

India Furniture Industry Research Report 2024-2033

Mexico Furniture Industry Research Report 2024-2033

Vietnam Furniture Industry Research Report 2024-2033

Global Camping Furniture Market – Global Industry Analysis, Size, Share, Growth, Trends, And Forecast, 2022-2029

Thailand Furniture Industry Research Report 2024-2033

Research Report on Southeast Asia Furniture Industry 2023-2032

Indonesia Furniture Industry Research Report 2024-2033

Hospital Furniture Market Forecast till 2027

Global and China Hospital Furniture Market Analysis and Forecast Report 2030

Global Foldable Furniture Market Analysis and Forecast 2031

Research Report on Vietnam Wooden Furniture Industry 2022-2031

Reviews

There are no reviews yet.