Description

Philippines Automobile Industry

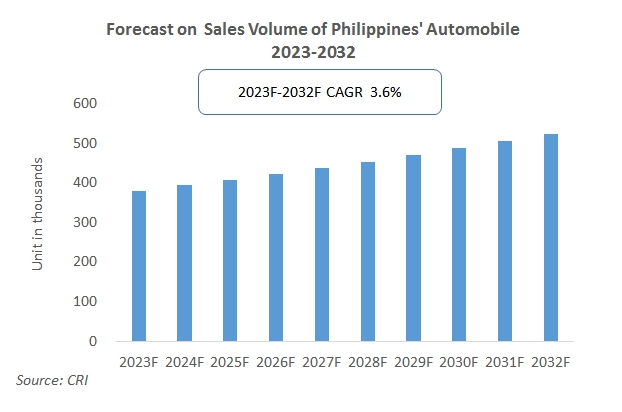

Sales volume of the Philippine automobile industry increased by 31.3% in 2022, with a total of 352,696 vehicles sold. According to CRI, light commercial vehicles and Asian utility vehicles (AUVs) have the highest growth rates. It is expected that total vehicle sales will increase to 400,000 units by the end of 2023. In 2018, the industry produced 79,763 units.

In 2017, the export value of parts and components was US$3.6 billion, and the import value was US$6.6 billion. New car sales increased slightly by 3.7% in 2019, with sales of 416,637 units. According to CRI, passenger cars accounted for 31% of total vehicle sales in 2019. Commercial vehicles account for the remaining 69%. Demand for commercial vehicles has increased with the launch of the government’s $180 billion “Build, Build, Build” infrastructure initiative.

According to CRI, total motor vehicle sales in the country jumped to 352,596 units in 2022 from 268,488 units in 2021, exceeding the full-year sales forecast of 336,000 units. Currently, Japanese brands hold nearly 80% of the market share, followed by Korean brands due to local manufacturing, brand recognition and parts availability. Chinese brands are slowly gaining market share through economical options.

For the entire Philippine automobile market, it is currently in the initial development stage and needs strong support from many foreign brands. Toyota Motor Philippines contributed the majority of sales at 174,106 units, a 34.3% increase from 2021’s 129,667 units. Toyota Philippines currently holds 49.38% of the total market.

Mitsubishi Motors Philippines was the second largest contributor, selling 53,211 vehicles, up 41.7% from 37,548 units in 2021. Rounding out the top three was Ford Motor Company Philippines with 24,710 vehicles sold, a 23.5% increase from 2021’s 20,005 vehicles sold. Motors also account for 7.01% of the local market share. Nissan Philippines ranked fourth with sales of 21,222 units and Suzuki Philippines ranked fifth with sales of 19,942 units.

Now, due to environmental pollution and waste of resources, electric vehicles are being developed all over the world, and countries around the world will usher in the EV era. According to CRI, there were 11,950 electric vehicles registered with the agency between 2010 and 2019. In this period, cars, sport utility vehicles (SUV), and utility vehicles, made up only 7.5% of registrations, around 896 units.

This is very low compared to sales in countries like Thailand, which reached almost 800,000 units in 2020. Creating an EV ecosystem in the Philippines is also challenging, and consumer uptake cannot increase in the current market environment.

Topics covered:

- Philippines Automobile Industry Overview

- The economic and policy environment of Philippines’ automobile industry

- What is the impact of COVID-19 on the Philippines’ automobile industry?

- Philippines Automobile Industry Market Size, 2023-2032

- Analysis of the main Philippines’ automobile production enterprises

- Key drivers and market opportunities for Philippines’ automobile industry

- What are the key drivers, challenges and opportunities for Philippines’ automobile industry during the forecast period 2023-2032?

- Which companies are the key players in the Philippines automobile industry market and what are their competitive advantages?

- What is the expected revenue of Philippines automobile industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Philippines automobile industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the automobile industry in Philippines?

Table of Contents

1 OVERVIEW OF PHILIPPINES

1.1 Geographical situation

1.2 Demographic structure of Philippines

1.3 Economic situation in Philippines

1.4 Minimum Wage in Philippines 2013-2023

1.5 Impact of COVID-19 on the Philippines Automobile Industry

2 PHILIPPINES AUTOMOBILE INDUSTRY OVERVIEW 2018-2023

2.1 History of Automobile Development in Philippines

2.2 FDI in Philippines’ automobile industry

2.3 Policy Environment of Philippines’ Automobile Industry

3 PHILIPPINES AUTOMOBILE INDUSTRY SUPPLY AND DEMAND STATUS

3.1 Philippines Automobile Industry Supply Status

3.1.1 Automobile

3.1.2 By types

3.1.3 EV

3.2 Sales volume of Philippines’ automobile

3.2.1 Automobile

3.2.2 By types

3.2.3 EV

4 PHILIPPINES AUTOMOBILE INDUSTRY IMPORT AND EXPORT STATUS

4.2 Import Status of Philippines’ Automobile Industry

4.1.1 Philippines Automobile Import Volume and Import Value

4.1.2 Major Import Sources of Automobiles in Philippines

4.2 Export Status of Philippines’ Automobile Industry

4.2.1 Philippines Automobile Export Volume and Export Value

4.2.2 Main Export Destinations of Philippines Automobiles

5 COST AND PRICE ANALYSIS OF THE PHILIPPINES AUTOMOBILE INDUSTRY

5.1 Cost

5.1.1 Raw Materials

5.1.2 Labor Costs

5.1.3 Manufacturing Overhead

5.2 Price of automobile

6 PHILIPPINES AUTOMOBILE INDUSTRY MARKET COMPETITION

6.1 Barriers to entry in Philippines’ automobile industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Philippines’ Automobile Industry

6.2.1 Bargaining Power of Automobile Suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Philippines Automobile Industry

6.2.4 Potential Entrants in the Automobile Industry

6.2.5 Alternatives to Automobiles

7 ANALYSIS OF MAJOR AUTOMOBILE Brands IN PHILIPPINES

7.1 TOYOTA

7.1.1 TOYOTA Corporate Profile

7.1.2 TOYOTA Corporate Automobile Sales

7.2 MITSUBISHI

7.2.1 MITSUBISHI Corporate Profile

7.2.2 MITSUBISHI Corporate Automobile Sales

7.3 Ford.

7.3.1 Corporate Profile of Ford.

7.3.2 Ford., Ltd. Corporate Automobile Sales

7.4Nissan

7.4.1 Corporate Profile of Nissan

7.4.2Nissan Corporate Automobile Sales

7.5 Suzuki

7.5.1 Suzuki Corporate Profile

7.5.2 Suzuki Corporate Automobile Sales

7.6 Isuzu

7.6.1 Isuzu Corporate Profile

7.6.2 Isuzu Corporate Automobile Sales

7.7 Honda Motor

7.7.1 Honda Motor a Corporate Profile

7.7.2 Honda Motor Corporate Automobile Sales

7.8 Kia Motor Corporation

7.8.1 Kia Motor Corporation Corporate Profile

7.8.2 Kia Motor Corporation Corporate Automobile Sales

7.9 Geely Motor Corporation

7.9.1 Geely Motor Corporation Corporate Profile

7.9.2 Geely Motor Corporation Corporate Automobile Sales

7.10 Foton Motor (SGMW Motors)

7.10.1 Foton Motor (SGMW Motors) Corporate Profile

7.10.2 Foton Motor (SGMW Motors) Corporate Automobile Sales

8 PHILIPPINES AUTOMOBILE INDUSTRY OUTLOOK 2023-2032

8.1 Philippines Automobile Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Philippines’ Automobile Industry

8.1.2 Threats and Challenges to Philippines’ Automobile Industry

8.2 Philippines Automobile Industry Supply Forecast

8.3 Philippines Automobile Market Demand Forecast

8.4 Philippines Automobile Industry Import and Export Forecast

LIST OF CHARTS

Chart Total Population of Philippines 2008-2022

Chart GDP per capita in Philippines 2013-2022

Chart Automobile Industry Related Policies Issued by Government in Philippines 2018-2023

Chart 2018-2022 Automobile Production in Philippines

Chart 2018-2022 Domestic Consumption of Automobiles in Philippines

Chart 2018-2022 Philippines Automobile Import Volume

Chart 2018-2022 Philippines Automobile Import Value

Chart 2018-2022 Philippines Automobile Importing Countries and Import Value

Chart 2018-2022 Philippines Automobile Export Volume

Chart 2018-2022 Philippines Automobile Export Value

Chart 2018-2022 Philippines Automobile Export Countries and Export Value

Chart 2023-2032 Philippines Automobile Production Forecast

Chart Philippines Automobile Market Size Forecast 2023-2032

Chart 2023-2032 Philippines Automobile Import Forecast

Chart 2023-2032 Philippines Automobile Export Forecast

Reviews

There are no reviews yet.