Description

Mexico Automobile Industry

Mexico’s automobile industry holds a significant position globally, making substantial contributions to manufacturing and exports. The country’s strategic location, coupled with government incentives like tax breaks and favorable trade agreements, has attracted considerable foreign investment. According to CRI, major players in the industry, including General Motors, Ford, Toyota, Volkswagen, and Nissan, have established a robust presence, solidifying Mexico’s status as a leading automobile producer.

One of Mexico’s notable advantages lies in its cost competitiveness, driven by lower labor costs and manufacturing expenses. Additionally, participation in trade agreements, particularly the United States-Mexico-Canada Agreement (USMCA), provides favorable conditions for both domestic and international automakers. The presence of a skilled and trainable workforce further enhances the efficiency and quality of manufacturing processes.

However, challenges exist within the industry. According to CRI, dependence on international supply chains, particularly from regions like Asia, introduces vulnerabilities during global disruptions. Environmental concerns related to emissions and sustainability practices also accompany the industry’s rapid growth. Furthermore, the sector’s sensitivity to global economic conditions makes it susceptible to economic downturns and fluctuations in consumer demand.

The advent of the electric vehicle (EV) era marks a transformative period in the automotive industry, and Mexico is poised to navigate this shift with both challenges and opportunities. According to CRI, the advantages of electric vehicles bring about significant changes that have noteworthy implications for Mexico’s automotive landscape.

Electric vehicles offer a compelling array of advantages, foremost among them being environmental sustainability. With zero tailpipe emissions, EVs contribute to reducing air pollution and mitigating the automotive industry’s environmental impact. This aligns with global efforts to combat climate change and positions electric vehicles as a crucial component of sustainable transportation solutions.

Moreover, electric vehicles contribute to energy efficiency and resource conservation. Unlike traditional internal combustion engine vehicles, EVs generally have fewer moving parts, resulting in reduced maintenance requirements. The simplicity of electric drivetrains often leads to increased reliability and longevity, translating to lower overall ownership costs for consumers.

The rise of electric vehicles also presents an opportunity for Mexico’s automotive industry to evolve and diversify. According to CRI, as global demand for electric vehicles increases, Mexican manufacturers can position themselves as key players in the production of EV components, such as batteries and electric drivetrains. This shift towards electric mobility aligns with the country’s ongoing efforts to attract foreign investment in the renewable energy and technology sectors.

However, embracing the electric vehicle era requires strategic planning and adaptation. The traditional automotive supply chain, deeply rooted in internal combustion engines, needs to undergo a transformation to accommodate the production of electric vehicles and their components. This shift presents both a challenge and an opportunity for Mexican manufacturers to invest in research, development, and training to remain competitive in the evolving market.

Topics covered:

- Mexico Automobile Industry Overview

- The economic and policy environment of Mexico’ automobile industry

- What is the impact of COVID-19 on the Mexico’ automobile industry?

- Mexico Automobile Industry Market Size, 2023-2032

- Analysis of the main Mexico’ automobile production enterprises

- Key drivers and market opportunities for Mexico’ automobile industry

- What are the key drivers, challenges and opportunities for Mexico’ automobile industry during the forecast period 2023-2032?

- Which companies are the key players in the Mexico automobile industry market and what are their competitive advantages?

- What is the expected revenue of Mexico automobile industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Mexico automobile industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the automobile industry in Mexico?

Table of Contents

1 OVERVIEW OF MEXICO

1.1 Geographical situation

1.2 Demographic structure of Mexico

1.3 Economic situation in Mexico

1.4 Minimum Wage in Mexico 2013-2023

1.5 Impact of COVID-19 on the Mexico Automobile Industry

2 MEXICO AUTOMOBILE INDUSTRY OVERVIEW 2018-2023

2.1 History of Automobile Development in Mexico

2.2 FDI in Mexico’ automobile industry

2.3 Policy Environment of Mexico’ Automobile Industry

3 MEXICO AUTOMOBILE INDUSTRY SUPPLY AND DEMAND STATUS

3.1 Mexico Automobile Industry Supply Status

3.1.1 Automobile

3.1.2 By types

3.1.3 EV

3.2 Sales volume of Mexico’ automobile

3.2.1 Automobile

3.2.2 By types

3.2.3 EV

4 MEXICO AUTOMOBILE INDUSTRY IMPORT AND EXPORT STATUS

4.2 Import Status of Mexico’ Automobile Industry

4.1.1 Mexico Automobile Import Volume and Import Value

4.1.2 Major Import Sources of Automobiles in Mexico

4.2 Export Status of Mexico’ Automobile Industry

4.2.1 Mexico Automobile Export Volume and Export Value

4.2.2 Main Export Destinations of Mexico Automobiles

5 COST AND PRICE ANALYSIS OF THE MEXICO AUTOMOBILE INDUSTRY

5.1 Cost

5.1.1 Raw Materials

5.1.2 Labor Costs

5.1.3 Manufacturing Overhead

5.2 Price of automobile

6 MEXICO AUTOMOBILE INDUSTRY MARKET COMPETITION

6.1 Barriers to entry in Mexico’ automobile industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Mexico’ Automobile Industry

6.2.1 Bargaining Power of Automobile Suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Mexico Automobile Industry

6.2.4 Potential Entrants in the Automobile Industry

6.2.5 Alternatives to Automobiles

7 ANALYSIS OF MAJOR AUTOMOBILE Brands IN MEXICO

7.1 Nissan Motor Co., Ltd.

7.1.1 Corporate Profile of Nissan Motor Co., Ltd.

7.1.2 Corporate Automobile Sales of Nissan Motor Co., Ltd.

7.2 General Motors Company

7.2.1 Corporate Profile of General Motors Company

7.2.2 Corporate Automobile Sales of General Motors Company

7.3 Volkswagen AG

7.3.1 Corporate Profile of Volkswagen AG

7.3.2 Corporate Automobile Sales of Volkswagen AG

7.4 Toyota Motor Corporation

7.4.1 Corporate Profile of Toyota Motor Corporation

7.4.2 Corporate Automobile Sales of Toyota Motor Corporation

7.5 Kia Motors Corporation

7.5.1 Corporate Profile of Kia Motors Corporation

7.5.2 Corporate Automobile Sales of Kia Motors Corporation

7.6 Stellantis N.V. (Formerly Fiat Chrysler Automobiles N.V.)

7.6.1 Corporate Profile of Stellantis N.V.

7.6.2 Corporate Automobile Sales of Stellantis N.V.

7.7 Mazda Motor Corporation

7.7.1 Corporate Profile of Mazda Motor Corporation

7.7.2 Corporate Automobile Sales of Mazda Motor Corporation

7.8 Honda Motor Co., Ltd.

7.8.1 Corporate Profile of Honda Motor Co., Ltd.

7.8.2 Corporate Automobile Sales of Honda Motor Co., Ltd.

7.9 Ford Motor Company

7.9.1 Corporate Profile of Ford Motor Company

7.9.2 Corporate Automobile Sales of Ford Motor Company

7.10 Hyundai Motor Company

7.10.1 Corporate Profile of Hyundai Motor Company

7.10.2 Corporate Automobile Sales of Hyundai Motor Company

8 MEXICO AUTOMOBILE INDUSTRY OUTLOOK 2023-2032

8.1 Mexico Automobile Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Mexico’ Automobile Industry

8.1.2 Threats and Challenges to Mexico’ Automobile Industry

8.2 Mexico Automobile Industry Supply Forecast

8.3 Mexico Automobile Market Demand Forecast

8.4 Mexico Automobile Industry Import and Export Forecast

LIST OF CHARTS

Chart Total Population of Mexico 2008-2022

Chart GDP per capita in Mexico 2013-2022

Chart Automobile Industry Related Policies Issued by Government in Mexico 2018-2023

Chart 2018-2022 Automobile Production in Mexico

Chart 2018-2022 Domestic Consumption of Automobiles in Mexico

Chart 2018-2022 Mexico Automobile Import Volume

Chart 2018-2022 Mexico Automobile Import Value

Chart 2018-2022 Mexico Automobile Importing Countries and Import Value

Chart 2018-2022 Mexico Automobile Export Volume

Chart 2018-2022 Mexico Automobile Export Value

Chart 2018-2022 Mexico Automobile Export Countries and Export Value

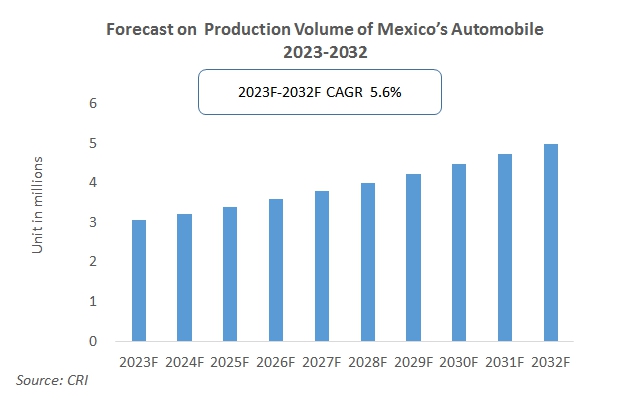

Chart 2023-2032 Mexico Automobile Production Forecast

Chart Mexico Automobile Market Size Forecast 2023-2032

Chart 2023-2032 Mexico Automobile Import Forecast

Chart 2023-2032 Mexico Automobile Export Forecast

Reviews

There are no reviews yet.