Description

Malaysia Steel Industry

Malaysia occupies an indispensable part of the ASEAN economy, with a total land area of 330,803 square kilometers. As of the end of 2022, Malaysia’s population is approximately 32.6 million people.

The steel industry in Malaysia can be categorically subdivided into two main segments, namely the long products and the flat products. Malaysia’s steel production capacity is approximately 16.1 million tons. According to CRI, at present, the bulk of the Malaysian steel is produced using the electric-arc-furnace (EAF) route, melting scrap iron, or scrap-substitutes like DRI and HBI to produce molten steel. The top three steel companies in Malaysia are Southern Steel Group, Prestar Resources Berhad, Malaysia Steel Works (KL) Bhd.

Scrap, the main ingredient in steel production, is mainly imported from countries such as the European Union and the United States, as domestic supplies are insufficient to meet the needs of local industry. Currently, only Perwaja Steel and Amsteel Mills produce DRI and HBI at their plants in Kemaman and Labuan respectively. Since DRI and HBI command a higher premium than scrap due to their “clean” content, a large portion is exported to countries such as Vietnam, South Korea, China and Taiwan. Malaysia’s iron & steel import in March 2022 grew by 21.6 percent to RM3.1 billion from RM2.6 billion in March 2021.

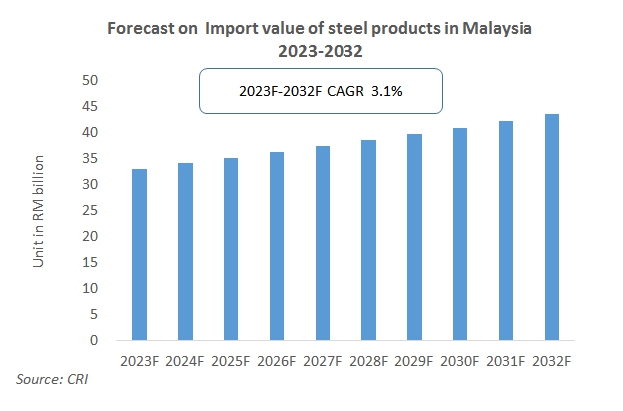

In recent years, the import volume of the Malaysian steel industry has remained with slight fluctuations. It remained at around 31 billion Malaysian ringgit in 2018 and 2019. There has been a considerable decline in 2020, falling to 24.3 billion Malaysian ringgit, most likely due to the impact of the new coronavirus There are no import channels for the impact. By 2021 and 2022, the number of imported steel products in Malaysia has increased significantly to more than 33 billion Malaysian ringgit. According to CRI, this shows that the current dependence on imported steel in the Malaysian market is gradually increasing.

Looking at the total export value of the steel industry, it is found that the export value of the steel industry is increasing year by year. It has climbed from 15503.92 million Malaysian Ringgit at the beginning to 33354.39 million Malaysian Ringgit today. This shows that Malaysia’s steel industry is in a state of continuous development and that Malaysia’s steel industry is developing rapidly.

In 2023 and 2024, considering that total steel demand will grow by 4.1%, but with the increase in steel production capacity, actual demand growth is expected to be 3.6% in 2023 and 4.8% in 2024, and exports are expected to increase further.

Faced with multiple crises such as the epidemic, geopolitical tensions and wars, financial instability and climate change, the future of the steel market industry in Malaysia and globally is not optimistic. According to CRI, as China is Malaysia’s largest import and export trading country, but China currently has chronic overcapacity, Malaysian steel manufacturers are unlikely to benefit from the expected increase in domestic steel consumption. For the Malaysian steel industry to have a sustainable future, the industry and the government must jointly address three major challenges, namely overcapacity in construction steel, green transformation and financing transformation.

Topics covered:

- Malaysia Steel Industry Overview

- The economic and policy environment of Malaysia’s steel industry

- What is the impact of COVID-19 on the Malaysia’s steel industry?

- Malaysia Steel Industry Market Size, 2023-2032

- Analysis of the main Malaysia’s steel production enterprises

- Key drivers and market opportunities for Malaysia’s steel industry

- What are the key drivers, challenges and opportunities for Malaysia’s steel industry during the forecast period 2023-2032?

- Which companies are the key players in the Malaysia steel industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia steel industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia steel industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the steel industry in Malaysia?

Table of Contents

1 Development Environment of Malaysia Steel Industry

1.1 Economic Environment

1.1.1 Malaysia’s Economy

1.1.2 Foreign Investment in Malaysia Steel Industry

1.1.3 Minimum Wage Standard in Malaysia

1.1.4 The impact of COVID-19 on Malaysia’s Steel Industry

1.2 Policy Environment

1.2.1 Policies Related to Steel Industry

1.2.2 Preferential Policies on Foreign Investment

1.2.3 Anti-dumping measures

1.3 Research Methods of the Report

1.3.1 Parameters and Assumptions

1.3.2 Data Sources

1.3.3 About CRI

2 Market Status of Malaysia Steel Industry, 2018-2022

2.1 Supply

2.1.1 Production Capacity

2.1.2 Production Volume

2.2 Demand on Malaysia Steel Market

2.2.1 Total Demand

2.2.2 Demand Structure

2.2.3 Steel Price

2.3 Competition Structure of Malaysia Steel Market

2.3.1 Upstream Suppliers

2.3.2 Downstream Customers

2.3.3 Competition in Steel Industry

2.3.4 Potential Entrants

2.3.5 Substitutes

3 Major steel products in Malaysia

3.1 Flat steel products industry

3.1.1 Supply and Production Volume

3.1.2 Demand

3.1.3 Imports and Exports

3.2 Long steel products

3.2.1 Supply and Production Volume

3.2.2 Demand

3.2.3 Imports and Exports

3.3 Steel pipes

4 Analysis on Import and Export of Steel in Malaysia, 2018-2022

4.1 Import

4.1.1 Import Overview

4.1.2 Major Import Sources

4.2 Export

4.2.1 Export Overview

4.2.2 Export Destinations

5 Major Steel Manufacturers in Malaysia, 2018-2023

5.1 Southern Steel Group

5.2 Prestar Resources Berhad

5.3 Malaysia Steel Works (KL) Bhd

5.4 k.Seng Seng Corporation Berhad

5.5 CSC Steel

5.6 Wisma Leader Steel

5.7 Kentzu Steel Sdn Bhd

6 Prospect of Malaysia Steel Market, 2023-2032

6.1 Factors Influencing Development

6.1.1 Market Opportunities and Driving Forces

6.1.2 Threats and Challenges

6.2 Forecast on Supply and Demand

6.2.1 Forecast on Production Volume

6.2.2 Forecast on Demand

6.2.3 Forecast on Import and Export

6.3 Analysis on Investment Opportunities in Malaysia Steel Industry

Reviews

There are no reviews yet.