Description

Malaysia Paper Industry

The pulp and paper industry, despite facing numerous challenges over the past two decades, remains one of the world’s largest industrial sectors, playing a crucial role in the global economy and socio-economic development. Contrary to initial predictions that the digital age would disrupt the industry, its continued growth has proven such beliefs wrong. The demand for products from this industry remains high worldwide, driven by its environmental attributes and other unique benefits. However, companies must continue to innovate to meet evolving needs.

The Malaysian paper industry has emerged as a notable player in this global landscape, attracting prominent companies that employ advanced production processes and high-tech automated machinery, supported by a well-developed and advanced supply chain. In recent years, the performance of the Malaysian paper industry has remained stable, thanks in part to the establishment of overseas operations in Malaysia by Chinese pulp and paper companies. Leveraging Industry 4.0 technology, these companies have adopted environmentally friendly production methods while enhancing their monitoring and maintenance capabilities. By aligning Malaysian facilities with these advanced technologies and processes, the Malaysian paper industry can further develop and modernize its production techniques.

Within Malaysia, the paper industry comprises three main subsectors: pulp manufacturing, paper and paper products, and printing and publishing. The industry is particularly dominated by packaging papers, including kraft paper, corrugated paper, and boxboard. Leading producers in this sector include GS Paper & Packaging, Muda Paper Mills, and Pascorp Paper Industries. Notably, the industry is increasingly turning to biomass as a feedstock for paper production, with companies like Eco Palm Paper pioneering the use of Empty Fruit Bundles (EFB) for paper production.

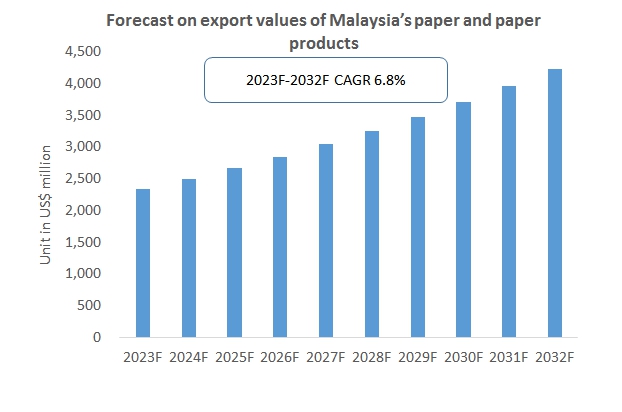

From 2018 to 2022, the export value of paper and paper products in Malaysia exhibited a fluctuating yet generally upward trend, with a Compound Annual Growth Rate (CAGR) of 19.05% during this period. Although the industry experienced a slight decline in export value in 2020 due to the Covid-19 pandemic, subsequent years saw varying degrees of growth. In 2022, the export value of Malaysia’s paper and paper products reached US$2.19 billion, reflecting a year-on-year increase of 16.82%.

The future of the paper industry in Malaysia appears promising, as the country continues to attract investment interest from top global companies seeking to expand their operations in Malaysia by establishing factories. With the participation of these investors, Malaysia’s paper production capacity is expected to experience exponential growth. The nation is poised to become a significant exporter of paper packaging products in Southeast Asia.

CRI’s predictions indicate that the Malaysian paper industry will continue its growth trajectory, with exports on the rise throughout the 2023-2032 period. CRI anticipates that Malaysia’s export value of paper and paper products will reach US$4.23 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 6.8% from 2023 to 2032.

Topics covered:

- Malaysia Paper Industry Overview

- The Economic and Policy Environment of Malaysia’s Paper Industry

- What is the impact of COVID-19 on the Malaysian paper industry?

- Malaysia Paper Industry Market Size, 2023-2032

- Analysis of major Malaysian paper industry players

- Key Drivers and Market Opportunities for the Paper Industry in Malaysia

- What are the key drivers, challenges and opportunities for the paper industry in Malaysia during the forecast period 2023-2032?

- Which are the key players in the Malaysia Paper Industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia paper industry market during the forecast period of 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia paper industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the paper industry in Malaysia?

Related Reports:

- Research Report on Southeast Asia Paper Industry 2023-2032

- Indonesia Paper Industry Research Report 2023-2032

- Vietnam Paper Industry Research Report 2023-2032

- Research Report on Southeast Asia Corrugated Paper Packaging Industry 2023-2032

- Global Paper Dry Strength Agent Market Forecast to 2030

- Global Thermal Paper Market Forecast to 2030

- Disposable Paper Cups Market Forecast to 2030

Table of Contents

1 Malaysia at a Glance

1.1 Geographical Situation

1.2 Malaysia’s Demographic Structure

1.3 Malaysia’s Economic Situation

1.4 Minimum Wage in Malaysia, 2013-2022

1.5 Impact of COVID-19 on the Paper Industry in Malaysia

2 Overview of the Paper Industry in Malaysia

2.1 History of the Paper Industry in Malaysia

2.2 FDI in Paper Industry in Malaysia

2.3 Policy Environment of the Paper Industry in Malaysia

3 Supply and Demand Situation of Paper Industry in Malaysia

3.1 Supply Situation of Paper Industry in Malaysia

3.2 Demand for Paper in Malaysia

3.3 Malaysia Paper Industry Segment Analysis

3.3.1 Packaging Paper

3.3.2 Household Paper

3.3.3 Printing and Writing Paper

4 Import and Export Status of the Paper Industry in Malaysia

4.1 Import Status of the Malaysian Paper Industry

4.1.1 Import Volume and Value of Malaysia Paper Industry

4.1.2 Major Import Sources of Malaysia’s Paper Industry

4.2 Export Status of the Malaysian Paper Industry

4.2.1 Malaysia Paper Industry Export Volume and Value

4.2.2 Major Export Destinations of Malaysia’s Paper Industry

5 Price and Cost Analysis of the Paper Industry in Malaysia

5.1 Cost Analysis of Paper Industry in Malaysia

5.1.1 Manpower Costs

5.1.2 Cost of Raw Materials

5.1.3 Other Costs

5.2 Malaysia Paper Industry Price Analysis

6 Competition in the Malaysian Paper Industry Market

6.1 Barriers to Entry in Malaysia’s Paper Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of the Paper Industry in Malaysia

6.2.1 Bargaining Power of Paper Industry Suppliers

6.2.2 Consumer Bargaining Power

6.2.3 Competition in the Malaysian Paper Industry

6.2.4 Potential Entrants in the Paper Industry

6.2.5 Substitutes in the Paper Industry

7 Analysis of Major Paper Manufacturing and Trading Companies in Malaysia

7.1 Indah Paper Industries Sdn Bhd

7.1.1 Indah Paper Industries Sdn Bhd Corporate Profile

7.1.2 Indah Paper Industries Sdn Bhd Operations

7.2 Yelowcare

7.2.1 Yelowcare Corporate Profile

7.2.2 Yelowcare Operations

7.3 Klueber

7.3.1 Klueber Corporate Profile

7.3.2 Klueber’s Operational Status

7.4 PLATINUMSPAPER

7.4.1 PLATINUMSPAPER Corporate Profile

7.4.2 PLATINUMSPAPER’s Operation Status

7.5 AVKVALVES

7.5.1 AVKVALVES Company Profile

7.5.2 AVKVALVES Operational Status

7.6 CHEMANALYST

7.6.1 CHEMANALYST Corporate Profile

7.6.2 CHEMANALYST Operations

7.7 YOKOGAWA

7.7.1 YOKOGAWA Corporate Profile

7.7.2 YOKOGAWA Operation Status

7.8 KROHNE

7.8.1 KROHNE Corporate Profile

7.8.2 KROHNE Operations

7.9 AVARGA

7.9.1 AVARGA Corporate Profile

7.9.2 AVARGA Operations

7.10 Asia Honour Paper Industries (M) Sdn Bhd

7.10.1 Asia Honour Paper Industries (M) Sdn Bhd Corporate Profile

7.10.2 Asia Honour Paper Industries (M) Sdn Bhd Operations

8 Malaysia Paper Industry Outlook 2023-2032

8.1 Analysis of Factors for the Development of the Paper Industry in Malaysia

8.1.1 Drivers and Development Opportunities for Malaysia’s Paper Industry

8.1.2 Threats and Challenges Facing the Paper Industry in Malaysia

8.2 Malaysia Paper Industry Supply Forecast

8.3 Market Demand Forecast for Malaysia Paper Industry

8.4 Malaysian Paper Industry Export Forecast

List of Charts

Chart Total Population of Malaysia, 2008-2022

Chart GDP per Capita in Malaysia, 2013-2022

Chart Policies Related to Paper Industry Issued by the Malaysian Government, 2018-2022

Chart Production of Paper Industry in Malaysia 2018-2022

Chart Domestic Consumption of Paper Industry in Malaysia 2018-2022

Chart Import of Paper Industry in Malaysia 2018-2022

Chart Import Value of Paper Industry in Malaysia 2018-2022

Chart Import Countries and Import Value of Paper Industry in Malaysia 2018-2022

Chart Exports of Paper Industry in Malaysia 2018-2022

Chart Export Value of Paper Industry in Malaysia, 2018-2022

Chart Export Countries and Export Value of Paper Industry in Malaysia, 2018-2022

Chart 2018-2022 Household Paper Production in Malaysia

Chart Domestic Consumption of Household Paper in Malaysia 2018-2022

Chart Import of Household Paper in Malaysia 2018-2022

Chart Import Value of Household Paper in Malaysia, 2018-2022

Chart Import Countries and Import Value of Household Paper in Malaysia 2018-2022

Chart 2018-2022 Malaysia Household Paper Exports

Chart Export Value of Household Paper from Malaysia, 2018-2022

Chart Malaysia Household Paper Exporting Countries and Export Value 2018-2022

Chart Industrial Paper Production in Malaysia 2018-2022

Chart Domestic Consumption of Industrial Paper in Malaysia 2018-2022

Chart Import of Industrial Paper in Malaysia 2018-2022

Chart Import Value of Industrial Paper in Malaysia 2018-2022

Chart Import Countries and Import Value of Industrial Paper in Malaysia 2018-2022

Chart Malaysia Industrial Paper Exports 2018-2022

Chart Export Value of Industrial Paper from Malaysia, 2018-2022

Chart Export Countries and Export Value of Industrial Paper from Malaysia, 2018-2022

Chart Printing and Writing Paper Production in Malaysia 2018-2022

Chart Domestic Consumption of Printing and Writing Paper in Malaysia 2018-2022

Chart Import of Paper for Printing and Writing in Malaysia 2018-2022

Chart Import Value of Paper for Printing and Writing in Malaysia, 2018-2022

Chart Import Countries and Import Value of Paper for Printing and Writing in Malaysia 2018-2022

Chart Malaysia Printing and Writing Paper Exports 2018-2022

Chart Export Value of Printing and Writing Paper from Malaysia, 2018-2022

Chart Malaysia Printing and Writing Paper Exporting Countries and Export Value 2018-2022

Chart 2023-2032 Malaysia Paper Industry Production Forecasts

Chart 2023-2032 Market Size Forecast of Malaysia Paper Industry

Chart Import Forecast for Malaysia Paper Industry, 2023-2032

Chart 2023-2032 Malaysia Paper Industry Export Forecasts

Reviews

There are no reviews yet.