Description

Southeast Asia Corrugated Paper Packaging Industry

Paper is one of the most environmentally friendly materials, biodegradable, easy to recycle, and can be applied to renewable energy sources. Corrugated paper is a common material used in paper packaging boxes. Packaging containers made from corrugated paper are lighter in weight than packaging containers made from other materials and have a certain degree of hardness and are easy to cut to size, which protects the packaged product from damage.

According to CRI’s analysis, corrugated paper packaging is mainly used in food, beverage, personal care, healthcare, e-commerce, logistics and transportation, and industrial applications.

With the rapid development of several industries in Southeast Asia, the demand for corrugated packaging is rising. According to CRI’s analysis, the e-commerce sector, for example, has seen a gradual increase in e-commerce penetration in various countries, with e-commerce GMV reaching US$131 billion in 2022 and the number of online shoppers exceeding 220 million. Corrugated paper packaging is a major tool for e-commerce delivery, and the boom in e-commerce in Southeast Asia has contributed to the flourishing of its corrugated box industry.

Southeast Asia’s corrugated paper packaging industry varies in its degree of development from country to country. According to CRI’s analysis, Vietnam’s corrugated packaging market has developed relatively quickly in recent years. Lower production costs have attracted global corrugated packaging manufacturers to build production bases in Vietnam.

For example, Japan’s OJI PAPER CO., LTD invested 5 billion yen to build its seventh carton factory in Vietnam in 2021. Vina Kraft Paper also announced in 2021 that it will build a new corrugated raw paper plant in Hanoi, which is expected to have an annual production capacity of 370,000 tons when it goes into operation, providing raw materials for Vietnam’s soaring domestic demand for corrugated paper packaging consumption.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly.

Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

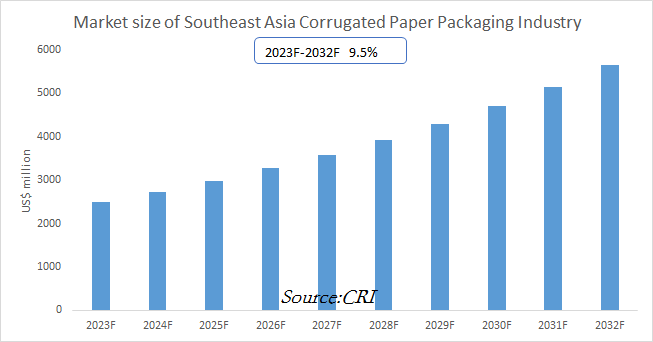

CRI expects the Southeast Asian corrugated paper packaging industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Corrugated Paper Packaging Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Corrugated Paper Packaging Industry?

- Which Companies are the Major Players in Southeast Asia Corrugated Paper Packaging Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Corrugated Paper Packaging Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Corrugated Paper Packaging Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Corrugated Paper Packaging Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Corrugated Paper Packaging Industry Market?

- Which Segment of Southeast Asia Corrugated Paper Packaging Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Corrugated Paper Packaging Industry?

Corrugated Packaging Industry Research Report by Country

- Indonesia Corrugated Packaging Industry Research Report 2024-2033

- Malaysia Corrugated Packaging Industry Research Report 2024-2033

- Singapore Corrugated Packaging Industry Research Report 2024-2033

- Thailand Corrugated Packaging Industry Research Report 2024-2033

- Vietnam Corrugated Packaging Industry Research Report 2024-2033

We also published Paper Industry research by country, see the links:

Mexico Paper Industry Research Report 2024-2033

India Paper Industry Research Report 2024-2033

Bangladesh Paper Industry Research Report 2024-2033

Malaysia Paper Industry Research Report 2023-2032

Indonesia Paper Industry Research Report 2023-2032

Vietnam Paper Industry Research Report 2023-2032

Table of Contents

1 Analysis of Singapore’s Corrugated Paper Packaging Industry

1.1 Singapore’s Corrugated Paper Packaging Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Corrugated Paper Packaging Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.3 Analysis of Major Corrugated Paper Packaging Manufacturing and Trading Companies in Singapore

2 Analysis of the Corrugated Paper Packaging Industry in Thailand

2.1 Development Environment of Thailand’s Corrugated Paper Packaging Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand’s Minimum Wage

2.2 Thailand Corrugated Paper Packaging Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.3 Analysis of Major Corrugated Paper Packaging Manufacturers and Traders in Thailand

3 Analysis of the Corrugated Paper Packaging Industry in the Philippines

3.1 Development Environment of the Corrugated Paper Packaging Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Corrugated Paper Packaging Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.3 Analysis of Major Corrugated Paper Packaging Manufacturing and Trading Companies in the Philippines

4 Analysis of the Malaysian Corrugated Paper Packaging Industry

4.1 Malaysia’s Corrugated Paper Packaging Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Corrugated Paper Packaging Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.3 Analysis of Major Corrugated Paper Packaging Manufacturing and Trading Companies in Malaysia

5 Analysis of Indonesia’s Corrugated Paper Packaging Industry

5.1 Development Environment of Indonesia’s Corrugated Paper Packaging Industry

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Corrugated Paper Packaging Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.3 Analysis of Major Corrugated Paper Packaging Manufacturers and Traders in Indonesia

6 Analysis of Vietnam’s Corrugated Paper Packaging Industry

6.1 Development Environment of Vietnam’s Corrugated Paper Packaging Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam’s Corrugated Paper Packaging Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.3 Analysis of Major Corrugated Paper Packaging Manufacturing and Trading Companies in Vietnam

7 Analysis of Myanmar’s Corrugated Paper Packaging Industry

7.1 Development Environment of Myanmar’s Corrugated Paper Packaging Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Corrugated Paper Packaging Industry Operation 2023-2032

7.2.1 Supply

7.2.2 Demand

7.3 Analysis of Major Corrugated Paper Packaging Manufacturers and Traders in Myanmar

8 Brunei Corrugated Paper Packaging Industry Analysis

8.1 Development Environment of Brunei’s Corrugated Paper Packaging Industry

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Corrugated Paper Packaging Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.3 Analysis of Major Corrugated Paper Packaging Manufacturers and Traders in Brunei

9 Laos Corrugated Paper Packaging Industry Analysis

9.1 Development Environment of the Corrugated Paper Packaging Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Corrugated Paper Packaging Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.3 Analysis of Major Corrugated Paper Packaging Manufacturers and Traders in Laos

10 Cambodia Corrugated Paper Packaging Industry Analysis

10.1 Development Environment of the Corrugated Paper Packaging Industry in Cambodia

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Corrugated Paper Packaging Industry Operation 2023-2032

10.2.1 Supply

10.2.2 Demand

10.3 Analysis of Major Corrugated Paper Packaging Manufacturing and Trading Companies in Cambodia

11 Southeast Asia Corrugated Paper Packaging Industry Outlook 2023-2032

11.1 Analysis of Factors Affecting the Development of Southeast Asia’s Corrugated Paper Packaging Industry

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Corrugated Paper Packaging Industry Supply Analysis 2023-2032

11.3 Southeast Asia Corrugated Paper Packaging Industry Demand Analysis 2023-2032

11.4 Impact of the COVID-19 Epidemic on the Corrugated Paper Packaging Industry

Reviews

There are no reviews yet.