Description

Malaysia Light Truck Industry

Malaysia stands as the third-largest commercial vehicle (CV) market in the Asia Pacific region, following Indonesia and Thailand, and is currently undergoing a rapid growth phase. Pickup trucks dominate the market, accounting for the largest share in terms of sales and production. Prior to the establishment of the national automotive company Proton, Japanese companies held over 70% of Malaysia’s domestic market, encompassing both passenger cars and commercial vehicles. While most imported parts are utilized for Completely Knocked Down (CKD) production, some are produced locally through joint ventures or alliances with foreign companies.

The trade dynamics of commercial vehicles in Malaysia mirror those of passenger cars. The country has been grappling with a trade deficit in the import and export of commercial vehicles. However, compared to passenger vehicles, the volume of commercial vehicle imports in Malaysia is significantly smaller due to the limited size of the domestic market and negligible commercial vehicle exports. The primary export destinations for Malaysian commercial vehicles include Indonesia, Thailand, and Papua New Guinea. Exports to Indonesia and Thailand have exhibited fluctuations from year to year, while exports to Papua New Guinea have shown a consistent upward trend.

Since 2015, there has been a noticeable shift in consumer preference in Malaysia from C-segment vehicles to pickup trucks. This shift can be attributed to the diverse features offered by pickup trucks, an increase in the number of entrepreneurs in this segment, and the availability of affordable pickup truck models. Numerous Original Equipment Manufacturers (OEMs) have capitalized on this trend by offering multiple variants and retrofitted models. The reliability and high resale value of pickup trucks have further fueled the growing demand in Malaysia.

From 2018 to 2022, as analyzed by CRI, the sales of light commercial vehicles in Malaysia displayed a fluctuating pattern, initially decreasing and then increasing, with a Compound Annual Growth Rate (CAGR) of 17.45% from 2019 to 2022. The Covid-19 pandemic led to a 5.09% decline in annual light commercial vehicle sales in Malaysia in 2020, with a total of 37,000 units sold. Subsequently, with the gradual easing of restrictions and the recovery of the economy and supply chain, Malaysia’s light commercial vehicle market began to rebound in 2021 and 2022. During these years, annual sales of light commercial vehicles increased by 20.14% and 42.08%, respectively, with sales figures reaching 44,000 units and 63,000 units.

Boasting an impressive 89% Internet penetration rate, Malaysia ranks among the top Southeast Asian nations for Internet usage. The country’s e-commerce market is experiencing rapid growth, surpassing mature markets in the region. In 2022 alone, the Malaysian e-commerce market is expected to grow by 20%. This growth aligns with a rising consumer preference for online shopping and the availability of customized payment options. Projections indicate that by 2027, Malaysia’s e-commerce market will reach $16.98 billion, growing at a CAGR of 13.6%. The robust expansion of the e-commerce sector has spurred increased demand for logistics and courier services in Malaysia, contributing to the growing need for light trucks.

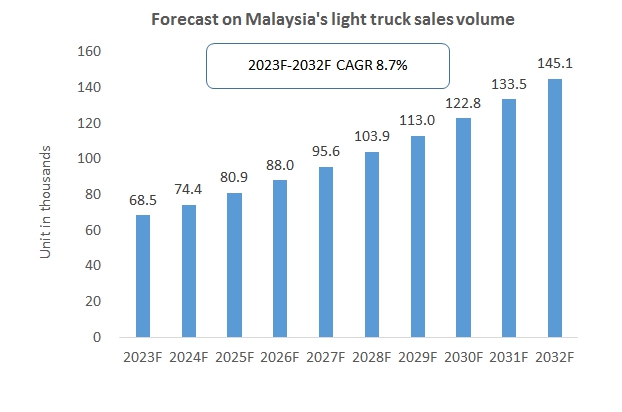

CRI anticipates that Malaysia’s annual light truck sales will reach 145,000 units by 2032, experiencing a compound annual growth rate (CAGR) of 8.7% during the 2023-2032 period.

Topics covered:

- Overview of the Light Truck Industry in Malaysia

- Economic and Policy Environment of Light Truck Industry in Malaysia

- What is the impact of COVID-19 on the light truck industry in Malaysia?

- Malaysia Light Truck Industry Market Size, 2023-2032

- Analysis of Major Malaysian Light Truck Industry Players

- Key Drivers and Market Opportunities for Light Truck Industry in Malaysia

- What are the key drivers, challenges and opportunities for the Light Truck industry in Malaysia during the forecast period 2023-2032?

- Which are the key players in the Malaysia Light Truck Industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia Light Truck Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia light truck industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors faced by the Light Trucks industry in Malaysia?

Other related reports:

- Indonesia Light Truck Industry Research Report 2023-2032

- Thailand Light Truck Industry Research Report 2023-2032

- Philippines Light Truck Industry Research Report 2023-2032

- Vietnam Light Truck Industry Research Report 2023-2032

Table of Contents

1 Malaysia at a Glance

1.1 Geographical Situation

1.2 Malaysia’s Demographic Structure

1.3 Malaysia’s Economic Situation

1.4 Minimum Wage in Malaysia, 2013-2022

1.5 Impact of COVID-19 on the Light Truck Industry in Malaysia

2 Overview of Malaysia Light Truck Industry

2.1 Industrial Policy and Foreign Investment Policy

2.2 Malaysia Light Truck Industry Operation 2018-2022

2.2.1 Status of Light Truck Production in Malaysia

2.2.2 Sales of Light Trucks in Malaysia

2.2.3 Import and Export of Light Trucks in Malaysia

2.2.4 Development of Electric Light Trucks in Malaysia

2.3 Malaysia Light Truck Policy Environment

2.3.1 Driver’s License Requirements

2.3.2 Licensing Fees

3 Import and Export Analysis of Light Trucks in Malaysia

3.1 Import Analysis

3.1.1 Import Overview

3.1.2 Main Import Sources

3.2 Export Analysis

3.2.1 Export Overview

3.2.2 Main Export Destinations

4 Market Competition in the Malaysian Light Truck Industry

4.1 Barriers to Entry in Malaysia’s Light Truck Industry

4.1.1 Brand Barriers

4.1.2 Quality Barriers

4.1.3 Capital Barriers

4.2 Competitive Structure of the Light Truck Industry in Malaysia

4.2.1 Bargaining Power of Light Truck Suppliers

4.2.2 Consumer Bargaining Power

4.2.3 Competition in the Light Truck Industry in Malaysia

4.2.4 Potential Entrants in the Light Truck Industry

4.2.5 Alternatives to Light Trucks

5 Malaysia Major Light Truck Manufacturers Analysis

5.1 Daihatsu

5.1.1 Daihatsu Corporate Profile

5.1.2 Daihatsu’s Operations

5.2 Proton

5.2.1 Proton Corporate Profile

5.2.2 Proton Operations

5.3 Perodua

5.3.1 Perodua Corporate Profile

5.3.2 Perodua Operations

5.4 Hino

5.4.1 Hino Business Overview

5.4.2 Hino Operations

5.5 Mitsubishi

5.5.1 Mitsubishi Corporate Profile

5.5.2 Mitsubishi Operations

5.6 Toyota

5.6.1 Overview of Toyota Enterprises

5.6.2 Toyota Operations

5.7 Isuzu

5.7.1 Isuzu Corporate Profile

5.7.2 Isuzu’s Operations

5.8 Ford

5.8.1 Overview of Ford Enterprises

5.8.2 Ford Operations

6 Malaysia Light Truck Industry Outlook, 2023-2032

6.1 Analysis of Factors for the Development of the Light Truck Industry in Malaysia

6.1.1 Drivers and Growth Opportunities for the Light Truck Industry in Malaysia

6.1.2 Threats and Challenges Facing the Light Truck Industry in Malaysia

6.2 Supply Forecast for Light Truck Industry in Malaysia

6.3 Light Truck Market Demand Forecast in Malaysia

6.4 Import and Export Forecasts for the Light Truck Industry in Malaysia

6.5 Revenue Forecast for Light Truck Industry in Malaysia

List of Charts

Chart Total Population of Malaysia, 2008-2022

Chart Malaysia’s GDP per Capita, 2013-2022

Chart Policies Related to Light Truck Industry Issued by Malaysian Government 2018-2022

Chart Light Truck Production in Malaysia 2018-2022

Chart Light Truck Sales in Malaysia 2018-2022

Chart Number of Road Freight Transportation in Malaysia 2018-2022

Chart Total Road Cargo Unloading in Malaysia, 2018-2022

Chart Number of Electric Light Trucks in Malaysia in 2022

Chart 2022 Malaysia Electric Light Truck Inputs by Region

Chart Import Volume and Import Value of Light Trucks in Malaysia 2018-2022

Chart 2018-2022 Malaysia Light Trucks Export Volume and Export Value

Chart 2023-2032 Light Truck Production Forecast in Malaysia

Chart Light Trucks Market Size Forecast in Malaysia, 2023-2032

Chart Light Truck Sales Forecast in Malaysia, 2023-2032

Chart Import and Export Forecast of Light Trucks in Malaysia, 2023-2032

Reviews

There are no reviews yet.