Description

Malaysia Insurance Industry

Malaysia stands as the fourth largest economy in Southeast Asia, characterized by robust economic growth, which reached an impressive 8.7% in 2022. The nation’s population is approaching 32.7 million people, and it boasts a GDP per capita of $12,400. As an upper middle-income country, Malaysia’s economic landscape is heavily influenced by consumption and international trade, constituting the most crucial components of its GDP. In 2022, Malaysia’s total exports and imports reached a remarkable RM2.85 trillion, equivalent to about $627 billion, marking a substantial 27.8% year-on-year increase. This achievement marked the second consecutive year in which Malaysia surpassed the 2 trillion-ringgit threshold.

During the period from 2011 to 2021, Malaysia’s total and foreign currency insurance premiums exhibited steady growth, with a Compound Annual Growth Rate (CAGR) of 3.2%. Much of this growth can be attributed to the life and takaful segment, which achieved a robust CAGR of 4.5%, resulting in an increase in penetration from 3.1% in 2011 to 3.9% in 2021. Conversely, the general (non-life) insurance and takaful markets experienced more moderate growth, with a CAGR expansion of only 0.4% over the last decade.

The automobile insurance sector significantly dominates the insurance landscape in Malaysia, representing 46% of the general insurance market and nearly two-thirds of the general takaful market. Following closely are fire insurance and health/personal accident insurance. Meanwhile, the takaful market is primarily characterized by personal lines, with automobile and health insurance collectively accounting for about 20% of the total market. These two segments hold a substantial 75% share of the takaful market, compared to 57% in the general insurance segment.

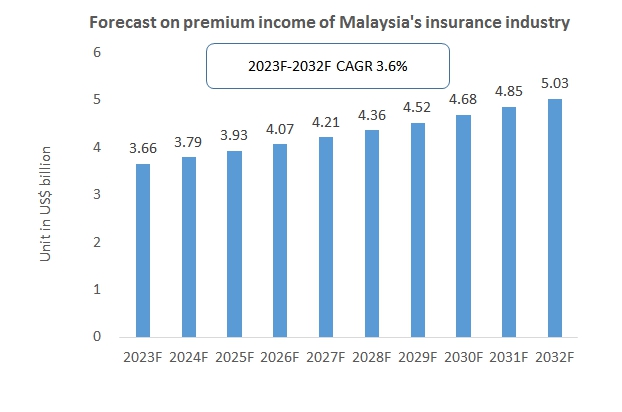

Between 2017 and 2021, Malaysia’s annual premium income exhibited a fluctuating trend, experiencing a minimal CAGR of 0.03%, according to CRI’s analysis. However, as the Malaysian economy gradually rebounds beyond 2022, the growth rate of premium income within the Malaysian insurance industry is expected to rise.

CRI anticipates the Malaysian insurance market will experience growth in the future. This growth will likely be driven by heightened public awareness of insurance, the increase in disposable income among the population, and the influence of insurtech, which is making insurance services more tailored and accessible. The projection suggests that Malaysia’s insurance premium income will reach $5.03 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 3.6% from 2023 to 2032.

Topics covered:

- Overview of the Malaysian Insurance Industry

- Economic and Policy Environment of the Malaysian Insurance Industry

- What is the impact of COVID-19 on the Malaysian insurance industry?

- Malaysia Insurance Industry Market Size, 2023-2032

- Analysis of major Malaysian insurance industry players

- Key Drivers and Market Opportunities in the Malaysian Insurance Industry

- What are the key drivers, challenges and opportunities for the insurance industry in Malaysia during the forecast period 2023-2032?

- Which are the key players in the Malaysia insurance industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia insurance industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia insurance industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the insurance industry in Malaysia?

Related reports:

- Vietnam Insurance Industry Research Report 2023-2032

- Indonesia Insurance Industry Research Report 2023-2032

- Research Report on Southeast Asia Insurance Industry 2023-2032

Table of Contents

1 Malaysia at a Glance

1.1 Geographical Situation

1.2 Malaysia’s Demographic Structure

1.3 Malaysia’s Economic Situation

1.4 Minimum Wage in Malaysia, 2013-2022

1.5 Impact of COVID-19 on the Malaysian Insurance Industry

2 Overview of the Malaysian Insurance Industry

2.1 History of Insurance Development in Malaysia

2.2 FDI in the Malaysian Insurance Industry

2.3 Policy Environment of the Malaysian Insurance Industry

3 Number of Participants in the Malaysia Insurance Market

3.1 Overview

3.2 Breakdown by Type of Insurance

4 Total Premiums Written in the Malaysia Insurance Market

4.1 Overview of Premium Income

4.2 Breakdown by Type of Insurance

4.3 Breakdown by Insurer

5 Insurance Rates in the Malaysia Insurance Market

5.1 Overview

5.2 Premium Rates for Life Insurance

5.3 Property Insurance Premium Rates

6 Insurance Claims in the Malaysia Insurance Market

6.1 Summary of Amounts Claimed

6.2 Number of Life Insurance Policies in Force

7 Competition in the Malaysian Insurance Industry Market

7.1 Barriers to Entry in the Malaysia Insurance Industry

7.1.1 Brand Barriers

7.1.2 Quality Barriers

7.1.3 Capital Barriers

7.2 Competitive Structure of the Malaysian Insurance Industry

7.2.1 Bargaining Power of Insurance Suppliers

7.2.2 Consumer Bargaining Power

7.2.3 Competition in the Malaysian Insurance Industry

7.2.4 Potential Entrants in the Insurance Industry

8 Analysis of Major Insurance Companies in Malaysia

8.1 ALLIANZ

8.1.1 ALLIANZ Company Profile

8.1.2 ALLIANZ Insurance Operations

8.2 TAKAFUL

8.2.1 TAKAFUL Company Profile

8.2.2 TAKAFUL Insurance Business Operations

8.3 MANULFE

8.3.1 MANULFE Company Profile

8.3.2 MANULFE’s Insurance Operations

8.4 MAA

8.4.1 MAA Enterprise Profile

8.4.2 MAA Insurance Business Operations

8.5 MNRB

8.5.1 MNRB Corporate Profile

8.5.2 MNRB Insurance Operations

8.6 TUNEPRO

8.6.1 TUNEPRO Company Profile

8.6.2 Status of TUNEPRO’s Insurance Operations

8.7 MPHBCAP

8.7.1 MPHBCAP Corporate Profile

8.7.2 MPHBCAP Insurance Business Operations

8.8 LPI

8.8.1 LPI Business Overview

8.8.2 LPI Insurance Business Operations

9 Malaysia Insurance Industry Outlook 2023-2032

9.1 Analysis of Factors in the Development of the Malaysian Insurance Industry

9.1.1 Driving Forces and Development Opportunities in the Malaysian Insurance Industry

9.1.2 Threats and Challenges Facing the Malaysian Insurance Industry

9.2 Forecasts of the Number of Insured Persons in the Malaysian Insurance Industry

9.3 Forecast on Premium Income of the Malaysian Insurance Industry

List of Charts

Chart Total Population of Malaysia, 2008-2022

Chart GDP per Capita in Malaysia, 2013-2022

Chart Policies Related to the Insurance Industry Issued by the Malaysian Government 2018-2022

Chart Number of Insured Persons in Malaysia, 2018-2022

Chart Breakdown of Participants by Type of Insurance in Malaysia, 2018-2022

Chart Underwritten Premiums in Malaysia 2018-2022

Chart 2022 Malaysian Underwriting Costs Breakdown by Insurance Type

Chart 2022 Malaysia Underwriting Costs Breakdown by Insurer

Chart Insurance Rates in Malaysia in 2022

Chart Life Insurance Premium Rates in Malaysia, 2022

Chart 2022 Property Insurance Premium Rates in Malaysia

Chart Insurance Claims in Malaysia 2018-2022

Chart 2023-2032 Forecast of Number of Insured Persons in Malaysia

Chart 2023-2032 Forecast of Insurance Premium Rates in Malaysia

Chart 2023-2032 Malaysia Underwriting Costs

Reviews

There are no reviews yet.