Description

Indonesia Steel Industry

Indonesia stands as the foremost economy in Southeast Asia and holds the position of the largest steel producer in the region. As of 2022, Indonesia ranks 16th globally in terms of steel production.

In 2021, Indonesia steel industry showcased remarkable resilience and growth, defying the challenges posed by the ongoing global impact of the Covid-19 pandemic. In the third quarter of the year, the sector expanded by an impressive 9.82%, as reported by the Indonesian government’s statistics office (BPS), attributing this positive trajectory to the export of steel products.

During November 2021, the export value of steel products reached an impressive $19.6 billion, generating a significant profit of $6.1 billion. According to CRI, the pivotal role of government regulations in steering the development of Indonesia’s steel sector was emphasized by Budi Susanto, Metal sector Director of the General Directorate of Metals, Machinery, Transport Equipment, and Electronics Industry (ILMATE), representing the Ministry of Industry (Kemenperina).

Susanto highlighted the effectiveness of the government’s control efforts, introducing the concept of “smart supply and demand” and orchestrating a strategic shift from the upstream to downstream in the iron and steel industry. The surge was further fueled by the growing demand for steel, bolstered by the automotive industry’s PPnBM policy, which escalated to 27% in the third quarter of 2021.

According to the Indonesian Iron & Steel Industry Association (IISIA), the steel sector witnessed substantial investments of nearly USD 12 billion in 2021, with projections indicating a further increase to USD 15.2 billion or IDR 215 trillion in 2022. According to CRI this growth is intricately tied to the rising domestic steel demand and a surge in exports, particularly in the downstream steel sector.

However, challenges persist in the upstream business, notably in carbon steel, which is yet to meet Indonesia’s domestic demand. Steel imports, as reported by the Government Bureau of Statistics Indonesia (BPS), experienced a 23% increase from 3.9 million tons in 2020 to 4.8 million tons in 2021. While some argue that using 2020 statistics may be futile given the severe impact of the Covid-19 outbreak, a comparison with 2019 statistics reveals a noteworthy 31% decrease in steel imports.

The rise in steel imports is further attributed to unfair trade practices such as dumping and tariff manipulations, with Cold Rolled Coil (CRC) products experiencing a substantial 70% increase in 2021. Meanwhile, other items, including Hot Rolled Coil (HRC), witnessed a 16% increase, and Coated Sheet steel products saw an 18% rise.

Despite various government initiatives to limit imports, including import substitution programs, the P3DN program promoting domestic product use, mandatory SNI for quality assurance, and incentives for increasing investments in the metals sector, Indonesia continues to import carbon steel from international steel-exporting countries. According to CRI, steel imports are anticipated to become Indonesia’s second-largest non-oil and gas import commodity.

Looking ahead, steel manufacturers in Indonesia anticipate the need for tightened import licenses, particularly for steel goods that can be produced domestically. Concurrently, according to BPS-Statistics Indonesia, steel products emerged as the third-largest export commodity in Indonesia from 2020 to 2022, surpassing various other significant export products and showcasing the industry’s growing prominence in contributing to Indonesia’s economic growth. According to CRI, this data underscores the steel sector’s resilience and increasing significance on the global stage, emphasizing its pivotal role in Indonesia’s economic development.

Topics covered:

- Indonesia Steel Industry Overview

- The economic and policy environment of Indonesia steel industry

- What is the impact of COVID-19 on the Indonesia steel industry?

- Indonesia Steel Industry Market Size, 2023-2032

- Analysis of the main Indonesia steel production enterprises

- Key drivers and market opportunities for Indonesia’s steel industry

- What are the key drivers, challenges and opportunities for Indonesia’s steel industry during the forecast period 2023-2032?

- Which companies are the key players in the Indonesia steel industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia steel industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia steel industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the steel industry in Indonesia?

Table of Contents

1 Development Environment of Indonesia Steel Industry

1.1 Economic Environment

1.1.1 Indonesia’s Economy

1.1.2 Foreign Investment in Indonesia Steel Industry

1.1.3 Minimum Wage Standard in Indonesia

1.1.4 The impact of COVID-19 on Indonesia’s Steel Industry

1.2 Policy Environment

1.2.1 Policies Related to Steel Industry

1.2.2 Preferential Policies on Foreign Investment

1.2.3 Anti-dumping measures

1.3 Research Methods of the Report

1.3.1 Parameters and Assumptions

1.3.2 Data Sources

1.3.3 About CRI

2 Market Status of Indonesia Steel Industry, 2018-2022

2.1 Supply

2.1.1 Production Capacity

2.1.2 Production Volume

2.2 Demand on Indonesia Steel Market

2.2.1 Total Demand

2.2.2 Demand Structure

2.2.3 Steel Price

2.3 Competition Structure of Indonesia Steel Market

2.3.1 Upstream Suppliers

2.3.2 Downstream Customers

2.3.3 Competition in Steel Industry

2.3.4 Potential Entrants

2.3.5 Substitutes

3 Major steel products in Indonesia

3.1 Flat steel products industry

3.1.1 Supply and Production Volume

3.1.2 Demand

3.1.3 Imports and Exports

3.2 Long steel products

3.2.1 Supply and Production Volume

3.2.2 Demand

3.2.3 Imports and Exports

3.3 Steel pipes

4 Analysis on Import and Export of Steel in Indonesia, 2018-2022

4.1 Import

4.1.1 Import Overview

4.1.2 Major Import Sources

4.2 Export

4.2.1 Export Overview

4.2.2 Export Destinations

5 Major Steel Manufacturers in Indonesia, 2018-2023

5.1 PT Gunung Raja Paksi Tbk

5.2 PT Krakatau Steel (Persero) Tbk

5.3 PT Steel Pipe Industry of Indonesia Tbk

5.4 PT Gunawan Dianjaya Steel Tbk

5.5 PT Betonjaya Manunggal Tbk

5.6 PT Saranacentral Bajatama Tbk

6 Prospect of Indonesia Steel Market, 2023-2032

6.1 Factors Influencing Development

6.1.1 Market Opportunities and Driving Forces

6.1.2 Threats and Challenges

6.2 Forecast on Supply and Demand

6.2.1 Forecast on Production Volume

6.2.2 Forecast on Demand

6.2.3 Forecast on Import and Export

6.3 Analysis on Investment Opportunities in Indonesia Steel Industry

LIST OF CHARTS

Chart Location of Indonesia in Southeast Asia

Chart Indonesia GDP per capita 2011-2022

Chart Minimum Daily Wage in Indonesia 2011-2023

Chart Indonesia’s steel import volume as a percentage of steel consumption

Chart Output Volume of Crude Steel in Indonesia, 2018-2022

Chart Output Volume of Finished Steel in Indonesia, 2018-2022

Chart Demand Volume of Finished Steel in Indonesia, 2018-2022

Chart Demand Structure of Steel in Indonesia in 2022

Chart Price Index of Indonesia Import Steel

Chart Output Volume of Flat Steel in Indonesia, 2018-2022

Chart Demand Volume of Flat Steel in Indonesia, 2018-2022

Chart Import Volume of Flat Steel in Indonesia, 2018-2022

Chart Export Volume of Flat Steel in Indonesia, 2018-2022

Chart Output Volume of Long Steel in Indonesia, 2018-2022

Chart Demand Volume of Long Steel in Indonesia, 2018-2022

Chart Import Volume of Long Steel in Indonesia, 2018-2022

Chart Export Volume of Long Steel in Indonesia, 2018-2022

Chart Import Volume of Finished Steel in Indonesia, 2018-2022

Chart Export Volume of Finished Steel in Indonesia, 2018-2022

Chart Profile of PT Gunung Raja Paksi Tbk

Chart Profile of PT Krakatau Steel (Persero) Tbk

Chart Profile of PT Steel Pipe Industry of Indonesia Tbk

Chart Profile of PT Gunawan Dianjaya Steel Tbk

Chart Profile of PT Betonjaya Manunggal Tbk

Chart Profile of PT Saranacentral Bajatama Tbk

Chart Forecast on Output Volume of Indonesia Steel 2023-2032

Chart Forecast on Consumption of Indonesia Steel 2023-2032

Chart Forecast on Import Volume of Indonesia Steel 2023-2032

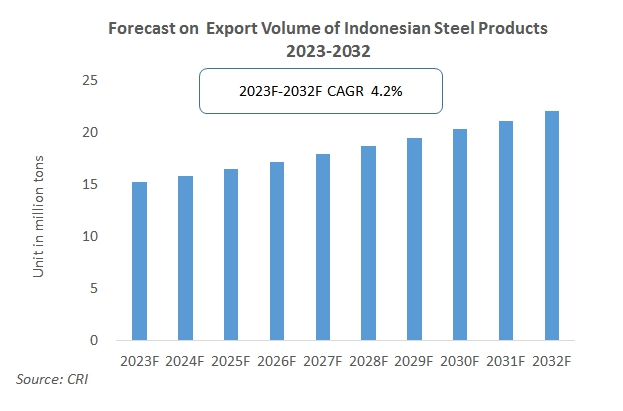

Chart Forecast on Export Volume of Indonesia Steel 2023-2032

Reviews

There are no reviews yet.