Description

Indonesia Air Conditioning Industry

Indonesia is located in the tropics and has a hot climate throughout the year, which is suitable for air conditioner use scenarios. At the same time, Indonesia’s strong economic growth, increased disposable income and higher consumption levels will lead to rapid growth in demand for air conditioners. At present, the penetration rate of air conditioners in Indonesia is not high, and there is great potential for future development.

In 2021, Daikin established its newest office in Batam, Indonesia. With the launch of this office, Daikin now has 13 official representative offices scattered across various cities in Indonesia. Similarly, Sharp announced its plans to build a new air conditioner production site at the Karawang International Industrial City (KIIC) in Karawang Province.

From the demand side, according to CRI’s analysis, the CAGR of air conditioner demand in Indonesia from 2017-2021 is -2.0%, and in recent years, there has been a small decline in air conditioner demand in the Indonesian market due to the impact of Covid-19. After the demand for air conditioners in Indonesia grew by 1.11% in 2019, the Indonesian air conditioner market began to shrink due to the epidemic, and the demand for air conditioners in Indonesia fell to 2.159 million units in 2021, an increase of 11.92% year-on-year, the demand market gradually rebounded.

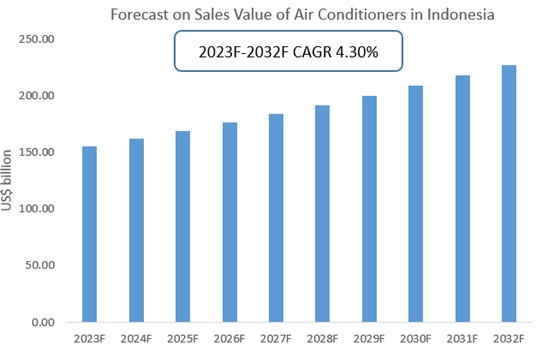

According to CRI, the market size of air conditioning industry will reach US$ 227.11 million in 2032 and the CAGR in 2023 to 2032 is 4.30%.

Due to increasing demand from the residential sector, rising per capita income, and surge in sales through online platforms, Yuan Ze Consulting forecasts that the Indonesian air conditioning market is expected to reach USD 184 million by 2027 and grow at a CAGR of 4.30% during the forecast period.

Topics covered:

- Indonesia Air Conditioning Industry Overview

- The economic and policy environment of the air conditioning industry in Indonesia

- What is the impact of COVID-19 on the air conditioning industry in Indonesia?

- Indonesia Air Conditioning Industry Market Size 2023-2032

- Analysis of major Indonesian air conditioning industry manufacturers

- Key Drivers and Market Opportunities in Indonesia’s Air Conditioning Industry

- What are the key drivers, challenges and opportunities for the air conditioning industry in Indonesia during the forecast period of 2023-2032?

- Which are the key players in Indonesia Air Conditioning Industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Air Conditioning Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia Air Conditioning Industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the air conditioning industry in Indonesia?

Related Reports:

- Vietnam Air Conditioning Industry Research Report 2023-2032

- Research Report on Southeast Asia Air Conditioning Industry 2023-2032

Table of Contents

1 Overview of Indonesia

1.1 Geographical situation

1.2 Demographic structure of Indonesia

1.3 Economic situation in Indonesia

1.4 Minimum Wage in Indonesia 2013-2022

1.5 Impact of COVID-19 on the air conditioning industry in Indonesia

2 Indonesia Air Conditioning Industry Overview

2.1 History of air conditioning development in Indonesia

2.2 FDI in Indonesia’s air conditioning industry

2.3 Policy Environment of Indonesia’s Air Conditioning Industry

3 Indonesia air conditioning industry supply and demand situation

3.1 Indonesia air conditioning industry supply situation

3.2 Indonesia air conditioning industry demand situation

4 Indonesia air conditioning industry import and export status

4.1.1 Indonesia air conditioner import volume and import value

4.1.2 Major import sources of air conditioners from Indonesia

4.2 Indonesia air conditioning industry export status

4.2.1 Indonesia Air Conditioner Export Volume and Export Value

4.2.2 Major export destinations of Indonesian air conditioners

5 Cost analysis of the air conditioning industry in Indonesia

6 Indonesia Air Conditioning Industry Market Competition

6.1 Barriers to entry in Indonesia’s air conditioning industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Indonesia’s Air Conditioning Industry

6.2.1 Bargaining power of air conditioning suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Indonesia’s Air Conditioning Industry

6.2.4 Potential entrants in the air conditioning industry

6.2.5 Alternatives to air conditioners

7 Analysis of major air conditioner manufacturing companies in Indonesia

7.1 PT. Daikin Air Conditioning Indonesia

7.1.1 Company Profile of PT. Daikin Air Conditioning Indonesia

7.1.2 PT. Daikin Air Conditioning Indonesia Air Conditioner Production and Sales

7.2 PT. LG Electronics Indonesia

7.2.1 PT. LG Electronics Indonesia Corporate Profile

7.2.2 PT. LG Electronics Indonesia Air Conditioner Production and Sales

7.3 PT. Panasonic Gobel Indonesia

7.3.1 Corporate Profile of PT. Panasonic Gobel Indonesia

7.3.2 PT. Panasonic Gobel Indonesia Air Conditioner Production and Sales

7.4 PT Gree Electric Appliances Indonesia

7.4.1 PT Gree Electric Appliances Indonesia Corporate Profile

7.4.2 PT Gree Electric Appliances Indonesia Air Conditioner Production and Sales

7.5 PT Mitsubishi Electric Indonesia

7.5.1 Corporate Profile of PT Mitsubishi Electric Indonesia

7.5.2 PT Mitsubishi Electric Indonesia Air Conditioner Production and Sales

7.6 PT Samsung Electronics Indonesia

7.6.1 PT Samsung Electronics Indonesia Corporate Profile

7.6.2 PT Samsung Electronics Indonesia Air Conditioner Production and Sales

7.7 PT. Sharp Electronics Indonesia

7.7.1 Company Profile of PT. Sharp Electronics Indonesia

7.7.2 PT. Sharp Electronics Indonesia Air Conditioner Production and Sales

7.8 PT. Berca Carrier Indonesia

7.8.1 PT. Berca Carrier Indonesia Corporate Profile

7.8.2 PT. Berca Carrier Indonesia Air Conditioner Production and Sales

7.9 PT Johnson Controls Hitachi Air Conditioning Indonesia

7.9.1 PT Johnson Controls Hitachi Air Conditioning Indonesia Corporate Profile

7.9.2 PT Johnson Controls Hitachi Air Conditioning Indonesia Air Conditioner Production and Sales

7.10 PT. Trane Indonesia

7.10.1 PT. Trane Indonesia Corporate Profile

7.10.2 PT. Trane Indonesia’s Air Conditioner Production and Sales

8 Indonesia Air Conditioning Industry Outlook 2023-2032

8.1 Indonesia Air Conditioning Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Indonesia’s Air Conditioning Industry

8.1.2 Threats and Challenges to Indonesia’s Air Conditioning Industry

8.2 Indonesia Air Conditioning Industry Supply Forecast

8.3 Indonesia Air Conditioning Market Demand Forecast

8.4 Indonesia Air Conditioning Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.