Description

Southeast Asia Vocational and Technical Education Industry

With the economic development of Southeast Asia, various fields are thriving and technology is constantly updated, but there is a shortage of talents in some industries, and a large number of people with relevant skills are needed to enter the industry. With a large population and a young demographic structure in Southeast Asia, the population of Generation Z is about 160 million, accounting for about 24% of the total population, and the future development of vocational and technical education has a bright future.

In 2017, the Southeast Asian Ministers of Education Organization (SEAMEO) held an international conference at its headquarters in Thailand to include TVET as a priority project, focusing on the training of vocational and technical personnel in tourism, manufacturing, agriculture and construction. According to CRI’s analysis, the Southeast Asian vocational and technical education sector has a wide range of development levels in different countries.

Taking Singapore as an example, Singapore’s vocational education system has become more mature, and based on international experience, it has established a modern vocational education system that is adapted to modern economic development, oriented to the needs of business and industry, progressive and interconnected with various types of education, and set up craft education colleges, polytechnics and various training institutions to provide students with skills and knowledge learning in an occupational cluster.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

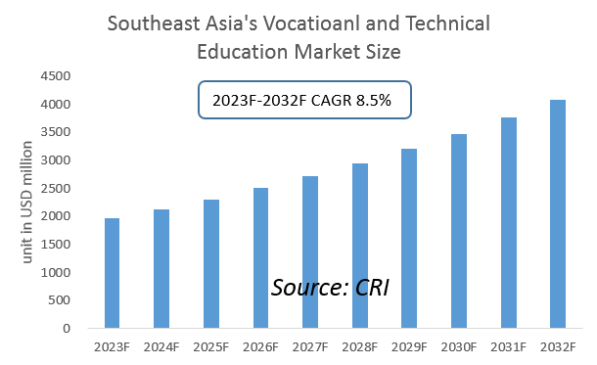

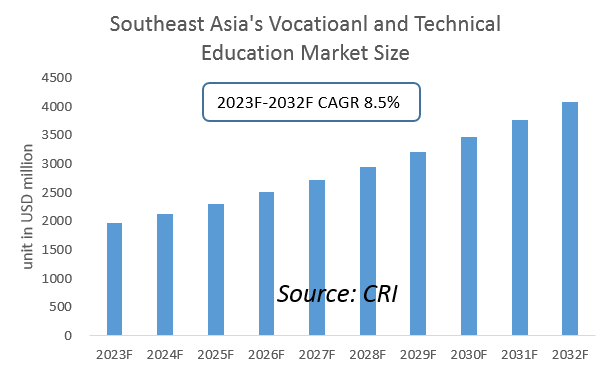

Southeast Asian economies still have strong growth potential, and most sectors are still in their infancy or developmental stages, with demand for skilled personnel gradually increasing. CRI expects the Southeast Asia vocational and technical education industry to continue to grow from 2023-2032.

Topics covered:

-

- What is the status of the vocational and technical education industry in Southeast Asia from 2018-2022 and how has COVID-19 impacted it?

The vocational and technical education industry in Southeast Asia has been growing rapidly in recent years, with a focus on improving workforce skills and addressing the mismatch between labor supply and demand. The outbreak of COVID-19 has had a significant impact on the industry, with the temporary closure of schools and training centers leading to a disruption in learning and training activities. However, the pandemic has also highlighted the importance of digital technologies in the education sector, and many institutions have adopted online learning platforms to continue delivering training programs remotely.

-

- Who are the major players in the Southeast Asia vocational and technical education industry and what are their competitive benchmarks?

There are several major players in the Southeast Asia vocational and technical education industry, including companies such as Udemy, Coursera, Skillshare, and Lynda.com. These companies offer a range of online training courses and programs, and they compete on factors such as course quality, pricing, and the availability of expert instructors.

-

- What are the key drivers and market opportunities for the vocational and technical education industry in Southeast Asia?

The key drivers of growth in the Southeast Asia vocational and technical education industry include the increasing demand for skilled workers in various industries, the growing awareness of the importance of vocational and technical education, and the adoption of digital technologies in the education sector. The market opportunities include the growing demand for online learning platforms and the increasing focus on industry-specific training programs.

-

- What are the key drivers, challenges, and opportunities facing the Southeast Asia vocational and technical education industry from 2023-2032?

The key drivers of growth in the Southeast Asia vocational and technical education industry from 2023-2032 are expected to include the increasing demand for skilled workers in emerging industries, the growing adoption of digital technologies in vocational and technical education, and the increasing focus on lifelong learning. The major challenges facing the industry include the shortage of qualified trainers and instructors, the lack of infrastructure and funding for vocational and technical education programs, and the difficulty in developing standardized training curricula across different countries and industries. The major opportunities include the growing demand for online learning platforms, the increasing need for industry-specific training programs, and the potential for partnerships between industry and education institutions.

-

- What is the expected revenue of the Southeast Asia vocational and technical education industry from 2023-2032?

It is difficult to predict the expected revenue of the Southeast Asia vocational and technical education industry from 2023-2032, as it will depend on various factors such as economic growth, government policies, and technological advancements.

-

- What strategies are the key players in the industry using to increase their market share?

The key players in the industry are using strategies such as expanding their course offerings, improving the quality of their training programs, and partnering with industry associations and employers to develop industry-specific training programs.

-

- What are the competitive advantages of the major players in the Southeast Asia vocational and technical education industry?

The competitive advantages of the major players in the Southeast Asia vocational and technical education industry include their strong brand recognition, their ability to attract top instructors and experts, and their investment in developing innovative training technologies.

-

- Which segment of the Southeast Asia vocational and technical education industry is expected to dominate the market in 2032?

It is difficult to predict which segment of the Southeast Asia vocational and technical education industry will dominate the market in 2032, as the market is still evolving and there are many different segments and sub-segments within the industry.

-

- What are the major challenges facing the Southeast Asia vocational and technical education industry?

The major challenges facing the Southeast Asia vocational and technical education industry include the shortage of qualified trainers and instructors, the lack of infrastructure and funding

Table of Contents

1 Analysis of the Vocational and Technical Education Industry in Singapore

1.1 Development Environment of Vocational and Technical Education Industry in Singapore

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Vocational and Technical Education Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.3 Analysis of Major Vocational and Technical Education Schools in Singapore

2 Analysis of the Vocational and Technical Education Industry in Thailand

2.1 Development Environment of the Vocational and Technical Education Industry in Thailand

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand’s Vocational and Technical Education Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.3 Analysis of Major Vocational and Technical Education Schools in Thailand

3 Analysis of the Vocational and Technical Education Industry in the Philippines

3.1 Development Environment of the Vocational and Technical Education Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Vocational and Technical Education Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.3 Analysis of Major Vocational and Technical Education Schools in the Philippines

4 Analysis of Malaysia’s Vocational and Technical Education Industry

4.1 Malaysia Vocational and Technical Education Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysian Vocational and Technical Education Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.3 Analysis of Major Vocational and Technical Education Schools in Malaysia

5 Indonesia Vocational and Technical Education Industry Analysis

5.1 Development Environment of Vocational and Technical Education Industry in Indonesia

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Vocational and Technical Education Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.3 Analysis of Major Vocational and Technical Education Schools in Indonesia

6 Analysis of Vocational and Technical Education Industry in Vietnam

6.1 Development Environment of Vocational and Technical Education Industry in Vietnam

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam’s Vocational and Technical Education Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.3 Analysis of Major Vocational and Technical Education Schools in Vietnam

7 Analysis of Myanmar’s Vocational and Technical Education Industry

7.1 Development Environment of Myanmar’s Vocational and Technical Education Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Vocational and Technical Education Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.3 Analysis of Major Vocational and Technical Education Schools in Myanmar

8 Brunei Vocational and Technical Education Industry Analysis

8.1 Brunei Vocational and Technical Education Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Vocational and Technical Education Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.3 Analysis of Major Vocational and Technical Education Schools in Brunei

9 Analysis of the Vocational and Technical Education Industry in Laos

9.1 Development Environment of the Vocational and Technical Education Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Lao Vocational and Technical Education Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.3 Analysis of Major Vocational and Technical Education Schools in Laos

10 Analysis of the Vocational and Technical Education Industry in Cambodia

10.1 Development Environment of Vocational and Technical Education Industry in Cambodia

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Vocational and Technical Education Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.3 Analysis of Major Vocational and Technical Education Schools in Cambodia

11 Southeast Asia Vocational and Technical Education Industry Outlook 2023-2032

11.1 Analysis of Factors Influencing the Development of Vocational and Technical Education Industry in Southeast Asia

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Supply Analysis of Southeast Asian Vocational and Technical Education Industry 2023-2032

11.3 Southeast Asia Vocational and Technical Education Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Vocational and Technical Education Industry

Reviews

There are no reviews yet.