Description

China’s Automotive Electric Water Pump Industry

According to CRI, China’s automobile industry has been developing rapidly since China joined the WTO. From 2009 to 2007, China’s automobile production and sales ranked the first in the world for nine consecutive years.

In 2017, China’s automobile production exceeded 29 million, and automobile sales were approximately 29 million. China’s automobile industry needs industrial upgrading with energy saving and emission reduction, weight reduction and electrification as the mainstream trends. The electric water pump is a key part of new energy vehicles. Its market size has been expanding in recent years.

It is also widely used in traditional fuel engines. As an essential part of turbocharged engines, it is widely used in medium and high-end automobiles.

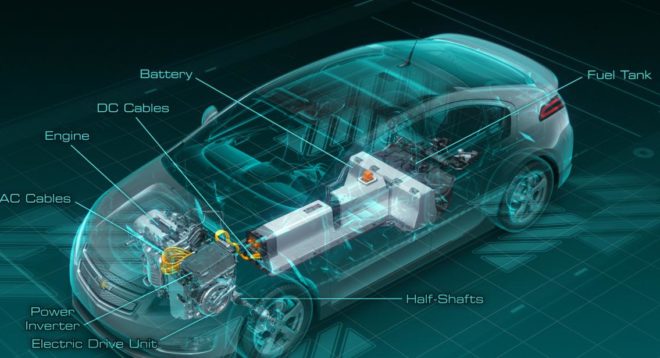

As the core part of the engine cooling system, automobile water pumps can be classified into mechanical water pumps and electric water pumps by drive mode. Electric water pumps have advantages such as compact structure, convenient installation, flexible control, reliable performance, low power consumption and high efficiency.

They will gradually replace traditional mechanical water pumps in the transformation and upgrading of the automobile industry.

As new energy vehicles develop rapidly in China, there is a surging demand for new-type parts such as automotive electric water pumps. An increasing number of enterprises are accelerating research and development of and setting up production lines for electric water pumps.

At present, the Chinese market is monopolized by several dominant enterprises and the competition in the electric water pump industry is fierce because of the high technological and capital barriers and the need for long-term cooperation with downstream automakers.

In 2017, the rise in upstream raw material prices pushed up the costs of electric water pumps, and the profit decline of downstream automobile industry crimped the profits of electric water pumps. To win the competition, manufacturers need to keep improving technologies and reducing costs.

The dramatic rise in the production volume of new energy vehicles has opened a broad market for automotive electric water pumps.

A traditional fuel vehicle needs only one mechanical water pump while a new energy vehicle needs two to five electric water pumps (about three on average) when using water cooling for precise temperature control over the electric drive, battery and electronic control system. Meanwhile, the unit price of electric water pumps is CNY 300 (60W power) compared with CNY 120 – CNY 150 of traditional ones.

According to CRI, China’s production volume of new energy vehicles ranked first in the world for three consecutive years from 2015 to 2017, and the sales volume exceeded 770,000 in 2017, which fueled the market demand for electric water pumps.

The market size of electric water pumps for new energy vehicles will exceed CNY 3 billion on assumption that each new energy vehicle needs three electric water pumps.

On the other hand, as Chinese residents’ income increases with fast economic development, the steady growth in high-income households’ luxury car consumption increases the market penetration rate of turbocharged engines and further expands the market for electric water pumps.

It is expected that in 2022, the proportions of turbocharged passenger vehicles and turbocharged commercial vehicles will reach 40% and 90% respectively in China, the overall penetration rate of electric water pumps will exceed 20%, and the market size of electric water pumps will exceed CNY 5 billion. Electric water pumps are expected to maintain a fast growth rate in China from 2018 to 2022.

Topics Covered:

– Development environment of China’s automotive electric water pump industry

– Supply and demand in China’s automotive electric water pump industry

– Competition in China’s automotive electric water pump industry

– Major automotive electric water pump manufacturers in China

– Factors influencing development of China’s automotive electric water pump industry

– Prospect of China’s automotive electric water pump industry from 2018 to 2022

Global Hydraulic Components Market Research Report- Forecast till 2026