Description

Philippines Electric Vehicle Industry

The Philippine electric vehicle (EV) market is smaller than its neighbors in the Southeast Asian region in terms of size. However, with changes in energy policy, government incentives for investment and adoption of cleaner technologies, the Philippines EV market has a bright future.

EVIDA LAW INCENTIVIZES DEVELOPMENT OF EV INDUSTRY: In April 2022, the Philippines passed the Electric Vehicle Industry Development Act (EVIDA, Republic Act 11697).The passage of the EVIDA is in line with Philippine policies that seek to ensure the country’s energy security and independence by reducing the transportation sector’s dependence on imported fuels.

The passage of the Act helps the Philippine EV industry to develop more granular guiding regulations to facilitate private sector participation in a level and non-discriminatory playing field. Under the EVDA, all electric and hybrid vehicles will be issued a special EV license plate and will be entitled to tax exemptions. Under the TRAIN Act, also known as the Tax Reform for Acceleration and Inclusion Act (TRAIN), fully battery-powered vehicles will be exempted from 100 percent of the excise tax, while hybrids powered by both fuel and batteries will be exempted from 50 percent of the excise tax.

Import tariff reduction to boost electric vehicle import growth in the Philippines: the Philippine National Economic and Development Authority (PNEDA) passed an executive order on November 24, 2022 that will reduce tariffs on several imported electric vehicles and parts in early 2023. At that time, the authority will temporarily withdraw tariffs on imported EVs for a period of five years, but will not apply to hybrid vehicles. The current 5 percent tariff on electric vehicle parts will be reduced to 1 percent within the same period.

The Philippines’ Department of Transportation (DOTr) is implementing a Public Utility Vehicle (PUV) Modernization Program, a massive transportation initiative that calls for the phasing out of jeepneys (World War II-era jeepneys converted to public transportation) that are at least 15 years old and replacing them with environmentally friendly alternatives. The replacements can be Euro 4 compliant vehicles or electric vehicles. There are nearly 180,000 jeeps in the country that need to be replaced, and the electric vehicle industry is aiming to meet 10 percent of this potential demand.

From 2020-2022, electric vehicle sales in the Philippines are growing year-on-year, with a CAGR of 63.70% from 2020-2022, according to CRI’s analysis. In 2020, only 378 electric vehicles will be sold in the Philippines, and by 2022, this number grows to 1,013, a year-on-year increase of 20.17%.

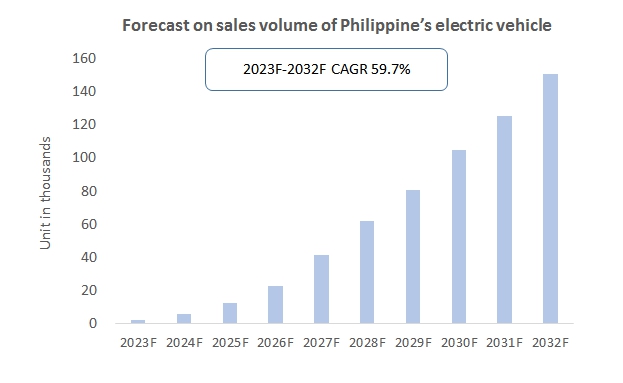

CRI expects the sales volume of Philippine’s EV to reach 150,800 units in 2032, growing at a CAGR of 59.7% from 2023-2032.

The Philippine electric vehicle market is expected to see rapid growth in the next few years, and CRI anticipates that the Philippine electric vehicle supporting facilities industry, such as charging piles and charging stations, will also see many investment opportunities.

Topics covered:

- Overview of the Electric Vehicle Industry in the Philippines

- Economic and Policy Environment of the Philippine Electric Vehicle Industry

- What is the impact of COVID-19 on the Philippine electric vehicle industry?

- Philippines Electric Vehicle Industry Market Size, 2023-2032

- Analysis of Major Philippine Electric Vehicle Industry Manufacturers

- Key Drivers and Market Opportunities in the Philippine Electric Vehicle Industry

- What are the key drivers, challenges and opportunities for the Electric Vehicles industry in the Philippines during the forecast period 2023-2032?

- Which are the key players in the Philippines Electric Vehicle Industry market and what are their competitive advantages?

- What is the expected revenue of the Electric Vehicle Industry market in Philippines during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Philippines electric vehicle industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the electric vehicle industry in the Philippines?

Table of Contents

1. Overview of the Philippines

1.1 Geographical Situation

1.2 Demographic Structure of the Philippines

1.3 Economic Situation in the Philippines

1.4 Philippine Minimum Wage 2013-2022

1.5 Impact of COVID-19 on the Philippine Electric Vehicle Industry

2. Overview of the Electric Vehicle Industry in the Philippines

2.1 History of Electric Vehicle Development in the Philippines

2.2 FDI in the Philippine Electric Vehicle Industry

2.3 Policy Environment of the Philippine Electric Vehicle Industry

3. Supply and Demand Situation of the Electric Vehicle Industry in the Philippines

3.1 Supply Situation of the Electric Vehicle Industry in the Philippines

3.2 Demand in the Philippine Electric Vehicle Industry

4. Export and Import Status of the Electric Vehicle Industry in the Philippines

4.1 Import Status of the Philippine Electric Vehicle Industry

4.1.1 Electric Vehicle Import Volume and Value in the Philippines

4.1.2 Major Import Sources of Electric Vehicles in the Philippines

4.2 Export Status of the Philippine Electric Vehicle Industry

4.2.1 Export Volume and Value of Electric Vehicles in the Philippines

4.2.2 Major Export Destinations of Electric Vehicles in the Philippines

5. Cost and Price Analysis of the Electric Vehicle Industry in the Philippines

5.1 Cost Analysis of the Philippine Electric Vehicle Industry

5.1.1 Manpower Costs

5.1.2 Cost of Raw Materials

5.1.3 Other Costs

5.2 Price Analysis of the Philippine Electric Vehicle Industry

6. Market Competition in the Philippine Electric Vehicle Industry

6.1 Barriers to Entry in the Philippine Electric Vehicle Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of the Philippine Electric Vehicle Industry

6.2.1 Bargaining Power of Electric Vehicle Suppliers

6.2.2 Consumer Bargaining Power

6.2.3 Competition in the Philippine Electric Vehicle Industry

6.2.4 Potential Entrants in the Electric Vehicle Industry

6.2.5 Alternatives to Electric Vehicles

7. Analysis of Major Electric Vehicle Companies in the Philippines

7.1 Jaguar

7.1.1 Jaguar Corporate Profile

7.1.2 Jaguar Corporate Electric Vehicle Sales

7.2 Changan

7.2.1 Changan Company Profile

7.2.2 Electric Vehicle Sales of Changan Enterprises

7.3 BYD

7.3.1 BYD Corporate Profile

7.3.2 BYD Enterprise Electric Vehicle Sales

7.4 Nissan

7.4.1 Nissan Corporate Profile

7.4.2 Nissan Corporate Electric Vehicle Sales

7.5 Tojo Motors

7.5.1 Tojo Motors Corporate Profile

7.5.2 Tojo Motors Corporate Electric Vehicle Sales

7.6 Honda

7.6.1 Overview of Honda Enterprises

7.6.2 Electric Vehicle Sales of Honda Enterprises

7.7 BMW

7.7.1 Overview of BMW Enterprises

7.7.2 BMW Corporate Electric Vehicle Sales

7.8 KYMCO

7.8.1 KYMCO Corporate Profile

7.8.2 Electric Vehicle Sales of KYMCO Enterprises

7.9 Lexus

7.9.1 Lexus Corporate Profile

7.9.2 Lexus Corporate Electric Vehicle Sales

7.10 Toyota

7.10.1 Overview of Toyota Enterprises

7.10.2 Electric Vehicle Sales of Toyota Enterprises

8. Philippines Electric Vehicle Industry Outlook, 2023-2032

8.1 Analysis of Factors for the Development of the Electric Vehicle Industry in the Philippines

8.1.1 Drivers and Growth Opportunities for the Electric Vehicle Industry in the Philippines

8.1.2 Threats and Challenges Facing the Electric Vehicle Industry in the Philippines

8.2 Supply Forecast for the Electric Vehicle Industry in the Philippines

8.3 Electric Vehicle Market Demand Forecast in the Philippines

8.4 Export and Import Forecasts for the Philippine Electric Vehicle Industry

Reviews

There are no reviews yet.