Description

Southeast Asia Theme Park Industry Overview

Tourism is one of the economic pillars of the Southeast Asian region and is one of the main drivers of its economic growth. The prosperity of the tourism industry also promotes the development of the theme park industry in Southeast Asia. And as Southeast Asia’s economy grows and residents’ living standards improve, the consumer demand for theme parks expands, and the theme park industry develops strongly in Southeast Asia.

For example, Vinpearl Amusement Park by VinGroup Group is one of the most famous theme parks in Vietnam, with cross-sea cable cars, alpine rides, a large fairy tale castle, a water park and a giant Ferris wheel attracting countless visitors. Voted “Best Theme Park in Asia” in 2021, Ba Na Hills Sun World Park has welcomed visitors from more than 160 countries around the world. Vietnam’s cheap theme park tickets and exciting experiences have further boosted its theme park industry.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the ke

y drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

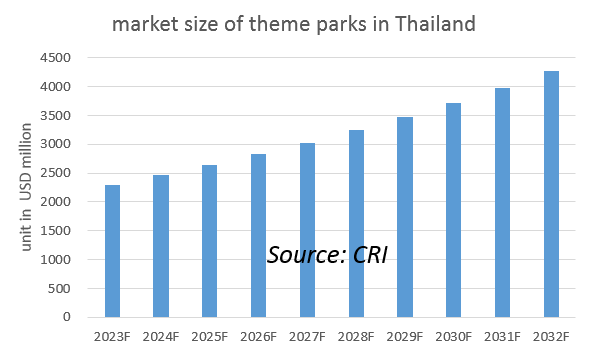

CRI expects the Southeast Asian theme park industry to maintain growth from 2023-2032.

Topics covered:

- Southeast Asia Theme Park Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Theme Park Industry?

- Which Companies are the Major Players in Southeast Asia Theme Park Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Theme Park Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Theme Park Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Theme Park Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Theme Park Industry Market?

- Which Segment of Southeast Asia Theme Park Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Theme Park Industry?

Table of Contents

1 Singapore Theme Park Industry Analysis

1.1 Singapore Theme Park Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Theme Park Industry Operation 2018-2022

1.2.1 Revenue

1.2.2 Market Demand

1.3 Analysis of Major Theme Parks in Singapore

2 Analysis of Thailand’s Theme Park Industry

2.1 Development Environment of Thailand’s Theme Park Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Minimum Wage in Thailand

2.2 Thailand Theme Park Industry Operation 2018-2022

2.2.1 Revenue

2.2.2 Market Demand

2.3 Analysis of Major Theme Parks in Thailand

3 Analysis of the Theme Park Industry in the Philippines

3.1 Development Environment of Theme Park Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Theme Park Industry Operation 2018-2022

3.2.1 Revenue

3.2.2 Market Demand

3.3 Analysis of Major Theme Parks in the Philippines

4 Malaysia Theme Park Industry Analysis

4.1 Development Environment of Malaysia Theme Park Industry

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Theme Park Industry Operation 2018-2022

4.2.1 Revenue

4.2.2 Market Demand

4.3 Analysis of Major Theme Parks in Malaysia

5 Indonesia Theme Park Industry Analysis

5.1 Development Environment of Indonesia’s Theme Park Industry

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Theme Park Industry Operation 2018-2022

5.2.1 Revenue

5.2.2 Market Demand

5.3 Analysis of Major Theme Parks in Indonesia

6 Analysis of Vietnam’s Theme Park Industry

6.1 Development Environment of Vietnam’s Theme Park Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Theme Park Industry Operation 2018-2022

6.2.1 Revenue

6.2.2 Market Demand

6.3 Analysis of Major Theme Parks in Vietnam

7 Analysis of Myanmar Theme Park Industry

7.1 Development Environment of Myanmar Theme Park Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Theme Park Industry Operation 2018-2022

7.2.1 Revenue

7.2.2 Market Demand

7.3 Analysis of Major Theme Parks in Myanmar

8 Brunei Theme Park Industry Analysis

8.1 Development Environment of Brunei Theme Park Industry

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Theme Park Industry Operation 2018-2022

8.2.1 Revenue

8.2.2 Market Demand

8.3 Analysis of Major Theme Parks in Brunei

9 Laos Theme Park Industry Analysis

9.1 Development Environment of Laos Theme Park Industry

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Theme Park Industry Operation 2018-2022

9.2.1 Revenue

9.2.2 Market Demand

9.3 Analysis of Major Theme Parks in Laos

10 Cambodia Theme Park Industry Analysis

10.1 Development Environment of Cambodia Theme Park Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Theme Park Industry Operation 2018-2022

10.2.1 Revenue

10.2.2 Market Demand

10.3 Analysis of Major Theme Parks in Cambodia

11 Southeast Asia Theme Park Industry Outlook 2023-2032

11.1 Southeast Asia Theme Park Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Disadvantageous Factors

11.2 Southeast Asia Theme Park Industry Revenue Forecast 2023-2032

11.3 Market Demand Analysis of Southeast Asia Theme Park Industry 2023-2032

11.4 Impact of COVID-19 Epidemic on Theme Park Industry

Reviews

There are no reviews yet.