Description

Singapore Corrugated Packaging Industry

The Republic of Singapore, often referred to simply as Singapore, is a tropical city-state situated at the southern tip of the Malay Peninsula, at the entrance to the Strait of Malacca. It covers a land area of 728.6 square kilometers. As of the end of 2023, Singapore boasts a total population of approximately 5.92 million, including 4.15 million citizens and permanent residents. The ethnic composition is predominantly Chinese, constituting about 76% of the population, with Malays, Indians, and other groups making up the remainder.

Singapore stands as the sole developed nation in Southeast Asia, with a remarkable per capita GDP exceeding US$ 80,000 in 2023. Within the packaging sector, corrugated paper packaging plays a critical role in Singapore’s logistics and transportation industries, representing a significant subcategory. In 2023, the market size for corrugated paper packaging in Singapore reached around US$ 230 million. According to CRI, the demand for this packaging is largely driven by the manufacturing and logistics sectors. Notably, Singapore’s manufacturing industry, which is dominated by high-end sectors such as electronics, petrochemicals, biomedicine, and aerospace, contributes approximately 25% to the gross national product and is crucial to the nation’s economy.

Singapore’s manufacturing sector, heavily reliant on foreign trade, depends significantly on markets in the US, Japan, Europe, and ASEAN. In 2023, due to a sluggish global economy and diminishing demand, Singapore saw a slowdown in exports of semiconductor devices, electronic products, and pharmaceuticals. The total export value for the year decreased by 10.1% year-over-year to US$ 638.4 billion. However, after 13 consecutive months of contraction, Singapore’s non-oil exports began to grow again in December 2023, indicating a stabilizing and improving recovery trend.

Singapore is recognized as the most digital economy in Southeast Asia, supported by robust logistics infrastructure and high consumer spending levels. According to CRI, this environment provides an excellent foundation for the growth of the e-commerce market, which in turn boosts the corrugated paper products industry. Over 3.3 million Singaporeans shop on e-commerce platforms, with total annual spending around US$ 6.16 billion, equating to approximately US$ 1,869 per capita. The e-commerce market size was approximately US$ 5.84 billion in 2023, with expectations for rapid future growth.

In response to environmental concerns, the Singapore government introduced the “Zero Waste Master Blueprint” in 2019 and the “Singapore Green Development Blueprint 2030” in 2021, aiming to reduce per capita landfill waste by 20% by 2026 and an additional 30% by 2030. This heightened environmental awareness has also spurred the growth of the corrugated packaging industry, which benefits from being reusable and predominantly made from recycled paper.

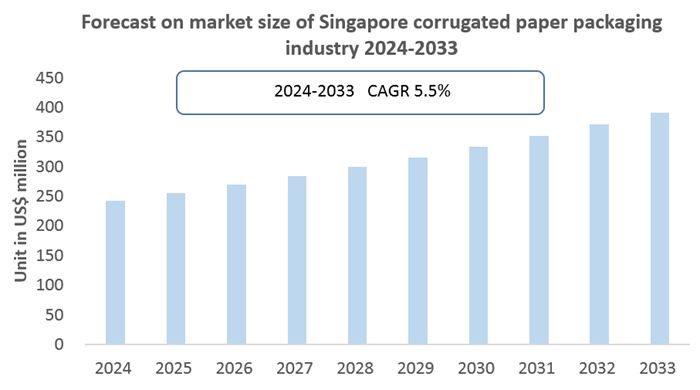

Despite the gradual recovery trend in the manufacturing sector at the end of 2023, geopolitical risks continue to pose a threat, adding uncertainty to the industry’s outlook. However, the rise of online shopping, coupled with a governmental and consumer focus on environmental sustainability, suggests that the corrugated packaging industry in Singapore is poised for relatively rapid and stable growth. According to CRI, the corrugated packaging market in Singapore is expected to reach US$ 390 million by 2033, growing at a compound annual growth rate of 5.5% from 2024 to 2033.

Topics covered:

- Overview of the corrugated packaging industry in Singapore

- The economic environment and policy environment of corrugated packaging in Singapore

- Singapore corrugated packaging market size from 2019 to 2023

- Analysis of major corrugated packaging manufacturers in Singapore

- The main driving forces and market opportunities of Singapore’s corrugated packaging industry

- What are the key drivers, challenges and opportunities for the corrugated packaging industry in Singapore during the forecast period 2024-2033?

- What is the expected revenue of the Singapore corrugated packaging market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Singapore corrugated packaging market is expected to dominate the market in 2033?

- Singapore corrugated packaging market forecast from 2024 to 2033

- What are the major headwinds facing the corrugated packaging industry in Singapore?

Table of Contents

1. Overview of Singapore

1.1 Geographical conditions

1.2 Demographic structure of Singapore

1.3 Singapore’s economy

1.4 Singapore’s minimum wage standards from 2014 to 2024

1.5 Impact of COVID-19 on Singapore’s corrugated packaging industry

2. Development environment of corrugated packaging industry in Singapore

2.1 Economic environment

2.1.1 Status of Singapore Packaging Industry

2.1.2 Analysis of corrugated packaging usage in the Singapore market

2.2 Core technology of corrugated packaging

2.3 Policy environment of Singapore’s corrugated packaging industry

2.3.1 Main government policies for the corrugated packaging industry in Singapore

2.3.2 Foreign investment policies in Singapore’s corrugated packaging industry

2.4 Analysis of operating costs of Singapore’s corrugated packaging industry

2.4.1 Human resource costs

2.4.2 Electricity price

2.4.3 Factory rent

2.4.4 Raw materials

2.5 Investment status of foreign enterprises in Singapore’s corrugated packaging industry

3. Supply and demand status of corrugated packaging industry in Singapore

3.1 Supply status of Singapore’s corrugated packaging industry

3.1.1 Capacity Overview

3.1.2 Analysis of corrugated packaging production in Singapore

3.2 Demand status of corrugated packaging industry in Singapore

3.2.1 Analysis of corrugated packaging consumption volume and consumption amount in Singapore

3.2.2 Singapore corrugated packaging demand analysis, by industry

3.2.2.1 Manufacturing industry

3.2.2.2 Logistics industry

3.3 Price Trend of Corrugated Packaging Products in Singapore from 2021 to 2024

4. Import and export status of Singapore’s corrugated packaging industry from 2019 to 2023

4.1 Import status of Singapore’s corrugated packaging industry

4.1.1 Singapore’s corrugated packaging import volume and import value

4.1.2 Main import sources of corrugated paper packaging in Singapore

4.2 Export status of Singapore’s corrugated packaging industry

4.2.1 Singapore’s corrugated packaging export volume and export value

4.2.2 Main export destinations of corrugated packaging in Singapore

5. Market competition analysis of Singapore’s corrugated packaging industry

5.1 Barriers to entry in Singapore’s corrugated packaging industry

5.1.1 Brand barriers

5.1.2 Quality barriers

5.1.3 Capital barriers

5.2 Competitive Structure of Singapore’s Corrugated Packaging Industry

5.2.1 Bargaining power of corrugated packaging suppliers

5.2.2 Consumer bargaining power

5.2.3 Competition in Singapore’s corrugated packaging industry

5.2.4 Potential entrants to the corrugated packaging industry

5.2.5 Alternatives to corrugated packaging

6 Analysis of major corrugated packaging brands in Singapore

6.1 Far East Packaging Group

6.1.1 Company Profile of Far East Packaging Group

6.1.2 Far East Packaging Group ’s operating conditions

6.2 Interpak Industries Pte Ltd

6.2 .1 Company Profile of Interpak Industries Pte Ltd

6.2 .2 Operating status of Interpak Industries Pte Ltd

6.3 Trio Packaging Industrial Pte Ltd

6.3.1 Company Profile of Trio Packaging Industrial Pte Ltd

6.3.2 Operating status of Trio Packaging Industrial Pte Ltd

6.4 Cheng Heng Paper Products Co (Pte) Ltd

6.4.1 Company Profile of Cheng Heng Paper Products Co (Pte) Ltd

6.4.2 Operating status of Cheng Heng Paper Products Co (Pte) Ltd

6.5 Singapore Cartons Pte Ltd

6.5.1 Company Profile of Singapore Cartons Pte Ltd

6.5.2 Operating status of Singapore Cartons Pte Ltd

6.6 Tat Seng Packaging Group Ltd

6.6.1 Company introduction of Tat Seng Packaging Group Ltd

6.6.2 Operating status of Tat Seng Packaging Group Ltd

7 Outlook of Singapore’s corrugated packaging industry from 2024 to 2033

7.1 Analysis of development factors of Singapore’s corrugated packaging industry

7.1.1 Driving forces and development opportunities of Singapore’s corrugated packaging industry

7.1.2 Threats and challenges faced by the corrugated packaging industry in Singapore

7.2 Supply Forecast of Singapore’s Corrugated Packaging Industry

7.3 Singapore corrugated packaging market demand forecast

7.4 Singapore’s Corrugated Packaging Import and Export Forecast

Table of selected charts

Chart Singapore’s total population from 2013 to 2023

Chart Singapore’s GDP per capita from 2013 to 2023

Chart Relevant policies for the corrugated packaging industry issued by the Singapore government from 2018 to 2024

Chart Singapore’s total corrugated packaging production 2019-2023

Chart Singapore’s nitrogen, phosphorus and potassium fertilizer production 2019-2023

Chart Domestic consumption of corrugated paper packaging in Singapore from 2019 to 2023

Chart Singapore’s corrugated packaging import volume 2019-2023

Chart Singapore’s corrugated packaging import value 2019-2023

Chart Singapore’s corrugated packaging importing countries and import amounts 2019-2023

Chart Singapore’s corrugated packaging export volume 2019-2023

Chart Singapore’s corrugated packaging export value 2019-2023

Chart Singapore’s main export destinations for corrugated packaging 2019-2023

Chart Singapore corrugated packaging production forecast 2019-2023

Chart Singapore domestic corrugated packaging market size forecast 2019-2023

Chart Singapore’s corrugated packaging import forecast 2019-2023

Chart Singapore’s corrugated packaging export forecast 2019-2023

Reviews

There are no reviews yet.