Description

Malaysia Corrugated Packaging Industry

Malaysia, situated in Southeastern Asia near the equator, had a population of approximately 33.4 million people by the end of 2023. According to CRI analysis, Malaysia’s per capita GDP exceeds US$ 10,000, classifying it as a relatively developed nation within Southeast Asia. The manufacturing sector is a major component of Malaysia’s economy, contributing more than US$ 70 billion in 2023, which accounts for over 20% of the GDP.

The packaging production industry is among the fastest-growing industries in Malaysia. Propelled by advancements in manufacturing, as well as the burgeoning e-commerce and logistics sectors, the Malaysian corrugated packaging industry has maintained a consistent growth trajectory. According to CRI analysis, Malaysia hosts over 1,000 corrugated packaging manufacturers, and in 2023, the market size for Malaysian corrugated packaging was approximately US$ 597 million.

The production and sales of corrugated packaging are closely linked to the developments within the manufacturing and logistics industries. According to CRI analysis, Malaysia’s manufacturing sector continues to lead in Southeast Asia, showing a modest growth of 0.8% in 2023. Key expanding sectors within the industry include food, beverages and tobacco; and textiles, clothing, leather, and footwear. The evolution of these sectors has significantly spurred the growth of Malaysia’s corrugated packaging industry.

Malaysia’s strategic location and economic growth have also fueled the expansion of the logistics industry, with e-commerce playing a crucial role. Despite not being as large as Indonesia’s or Thailand’s, Malaysia’s e-commerce market size is comparable to that of Vietnam and the Philippines. The COVID-19 pandemic further accelerated online shopping habits among Malaysian consumers.

In 2023, with more than 30 million active internet users, the GMV of Malaysia’s e-commerce sector reached US$ 13 billion. The boom in e-commerce has not only bolstered the express delivery industry but has also significantly enhanced the corrugated packaging industry in Malaysia.

According to CRI analysis, the Malaysian corrugated packaging market is currently highly fragmented, with numerous local companies such as Mabuchi Package (M) Sdn Bhd, Biszon Flexipack Sdn Bhd, and Far East Corrugated Carton Industrial Sdn. Bhd. playing significant roles. Additionally, international firms like International Paper Packaging Malaysia Johor Sdn Bhd, Westrock Packaging Solutions (M) Sdn. Bhd., and Amcor PLC have established their presence through foreign investment or joint ventures.

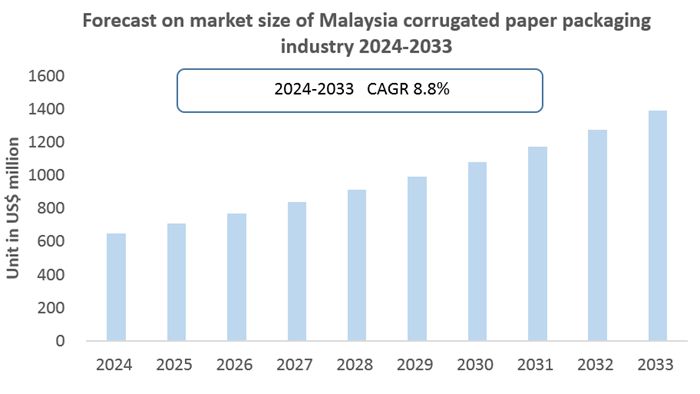

Looking ahead, CRI predicts that with ongoing population growth and economic development, the Malaysian corrugated packaging industry will continue to expand. By 2033, the market size is projected to reach US$ 1.39 billion, growing at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2033.

Topics covered:

- Overview of the corrugated packaging industry in Malaysia

- Economic environment and policy environment of corrugated packaging in Malaysia

- Malaysia’s corrugated packaging market size from 2019 to 2023

- Analysis of major Malaysian corrugated packaging manufacturers

- The main driving forces and market opportunities of Malaysia’s corrugated packaging industry

- What are the key drivers, challenges and opportunities for the Malaysian corrugated packaging industry during the forecast period 2024-2033?

- What is the expected revenue of the Malaysian corrugated packaging market during the forecast period 2024-2033?

- What strategies are adopted by the key players in the market to increase their market share in the industry?

- Which segment in the Malaysia corrugated packaging market is expected to dominate the market by 2033?

- Malaysia corrugated paper packaging market forecast 2024-2033

- What are the key headwinds facing the corrugated packaging industry in Malaysia?

Table of Contents

1. Overview of Malaysia

1.1 Geographical conditions

1.2 Demographic structure of Malaysia

1.3 Malaysia’s economy

1.4 Malaysia’s minimum wage standards from 2014 to 2024

1.5 Impact of COVID-19 on Malaysia’s corrugated packaging industry

2. Development environment of corrugated packaging industry in Malaysia

2.1 Economic environment

2.1.1 Status of Malaysian Packaging Industry

2.1.2 Analysis of corrugated packaging usage in the Malaysian market

2.2 Core technology of corrugated packaging

2.3 Policy environment of Malaysia’s corrugated packaging industry

2.3.1 Main government policies for the corrugated packaging industry in Malaysia

2.3.2 Foreign investment policies in Malaysia’s corrugated packaging industry

2.4 Analysis of operating costs of Malaysia’s corrugated packaging industry

2.4.1 Human resource costs

2.4.2 Electricity price

2.4.3 Factory rent

2.4.4 Raw materials

2.5 Investment status of foreign enterprises in Malaysia’s corrugated packaging industry

3. Supply and demand status of corrugated packaging industry in Malaysia

3.1 Supply status of Malaysia’s corrugated packaging industry

3.1.1 Capacity Overview

3.1.2 Analysis of corrugated packaging production in Malaysia

3.2 Demand status of corrugated packaging industry in Malaysia

3.2.1 Analysis of corrugated packaging consumption volume and consumption amount in Malaysia

3.2.2 Malaysia corrugated packaging demand analysis, by industry

3.2.2.1 Manufacturing industry

3.2.2.2 Logistics industry

3.3 Price Trend of Corrugated Packaging Products in Malaysia from 2021 to 2024

4. Import and export status of Malaysia’s corrugated packaging industry from 2019 to 2023

4.1 Import status of Malaysia’s corrugated packaging industry

4.1.1 Malaysia’s corrugated packaging import volume and import value

4.1.2 Main import sources of corrugated paper packaging in Malaysia

4.2 Export status of Malaysia’s corrugated packaging industry

4.2.1 Malaysia’s corrugated packaging export volume and export value

4.2.2 Main export destinations of corrugated packaging in Malaysia

5. Market competition analysis of Malaysia’s corrugated packaging industry

5.1 Barriers to entry in Malaysia’s corrugated packaging industry

5.1.1 Brand barriers

5.1.2 Quality barriers

5.1.3 Capital barriers

5.2 Competitive Structure of Malaysia’s Corrugated Packaging Industry

5.2.1 Bargaining power of corrugated packaging suppliers

5.2.2 Consumer bargaining power

5.2.3 Competition in Malaysia’s corrugated packaging industry

5.2.4 Potential entrants to the corrugated packaging industry

5.2.5 Alternatives to corrugated packaging

6 Analysis of major corrugated packaging brands in Malaysia

6.1 International Paper Packaging Malaysia Johor Sdn Bhd

6.1.1 The development history of International Paper Packaging Malaysia Johor Sdn Bhd

6.1.2 International Paper Packaging Malaysia Johor Sdn Bhd’s main products

6.1.3 International Paper Packaging Malaysia Johor Sdn Bhd’s operating model

6.2 Westrock Packaging Solutions (M) Sdn. Bhd.

6.2.1 Development History of Westrock Packaging Solutions (M) Sdn.Bhd.

6.2.2 Main products of Westrock Packaging Solutions (M) Sdn. Bhd.

6.2.3 Westrock Packaging Solutions (M) Sdn. Bhd.’s operating model

6.3 Amcor PLC

6.3.1 The development history of Amcor PLC

6.3.2 Main products of Amcor PLC

6.3.3 Amcor PLC’s operating model

6.4 Mabuchi Package (M) Sdn Bhd

6.4.1 The development history of Mabuchi Package (M) Sdn Bhd

6.4.2 Main products of Mabuchi Package (M) Sdn Bhd

6.4.3 Mabuchi Package (M) Sdn Bhd’s operating model

6.5 Biszon Flexipack Sdn Bhd

6.5.1 The development history of Biszon Flexipack Sdn Bhd

6.5.2 Biszon Flexipack Sdn Bhd’s main products

6.5.3 Biszon Flexipack Sdn Bhd’s operating model

6.6 Box-Pak (Malaysia) Bhd

6.6.1 The development history of Box-Pak (Malaysia) Bhd

6.6.2 Box-Pak (Malaysia) Bhd ’s main products

6.6.3 Box-Pak (Malaysia) Bhd’s operating model

6.7 KYM Industries (M) Sdn Bhd

6.7.1 The development history of KYM Industries (M) Sdn Bhd

6.7.2 KYM Industries (M) Sdn Bhd’s main products

6.7.3 KYM Industries (M) Sdn Bhd’s operating model

6.8 Far East Corrugated Carton Industrial Sdn. Bhd.

6.8.1 The development history of Far East Corrugated Carton Industrial Sdn. Bhd.

6.8.2 Main products of Far East Corrugated Carton Industrial Sdn. Bhd.

6.8.3 Far East Corrugated Carton Industrial Sdn. Bhd.’s operating model

6.9 FinePac Industries Sdn Bhd

6.9.1 The development history of FinePac Industries Sdn Bhd

6.9.2 Main Products of FinePac Industries Sdn Bhd

6.9.3 FinePac Industries Sdn Bhd’s operating model

6.10 Megabox Industries Sdn Bhd

6.10.1 Development History of Megabox Industries Sdn Bhd

6.10.2 Main Products of Megabox Industries Sdn Bhd

6.10.3 Megabox Industries Sdn Bhd’s operating model

7 Outlook of Malaysia’s corrugated packaging industry from 2024 to 2033

7.1 Analysis of development factors of Malaysia’s corrugated packaging industry

7.1.1 Driving forces and development opportunities of Malaysia’s corrugated packaging industry

7.1.2 Threats and challenges faced by the corrugated packaging industry in Malaysia

7.2 Supply Forecast of Malaysia’s Corrugated Packaging Industry

7.3 Malaysian corrugated packaging market demand forecast

7.4 Malaysia’s Corrugated Packaging Import and Export Forecast

Table of selected charts

Chart illustrating the total population of Malaysia from 2013 to 2023.

Chart depicting Malaysia’s GDP per capita from 2013 to 2023.

Chart outlining relevant policies for the corrugated packaging industry issued by the Malaysian government from 2018 to 2024.

Chart displaying Malaysia’s total production of corrugated packaging from 2019 to 2023.

Chart presenting Malaysia’s production of nitrogen, phosphorus, and potassium fertilizers from 2019 to 2023.

Chart illustrating domestic consumption of corrugated paper packaging in Malaysia from 2019 to 2023.

Chart depicting Malaysia’s import volume of corrugated packaging from 2019 to 2023.

Chart showing the import value of corrugated packaging in Malaysia from 2019 to 2023.

Chart detailing the importing countries and import amounts of Malaysia’s corrugated packaging from 2019 to 2023.

Chart presenting Malaysia’s export volume of corrugated packaging from 2019 to 2023.

Chart outlining Malaysia’s export value of corrugated packaging from 2019 to 2023.

Chart displaying Malaysia’s main export destinations for corrugated packaging from 2019 to 2023.

Chart forecasting Malaysia’s corrugated packaging production from 2024 to 2033.

Chart predicting the size of the Malaysian domestic corrugated packaging market from 2024 to 2033.

Chart projecting Malaysia’s corrugated packaging import forecasts from 2024 to 2033.

Chart forecasting Malaysia’s corrugated packaging exports from 2024 to 2033.

Reviews

There are no reviews yet.