Description

Mexico Paper Industry

“Paper” typically refers to thin and smooth materials made from cellulosic substances such as wood pulp, paper grass, or waste paper. It is widely used for purposes such as writing, printing, drawing, and packaging because of its light weight, high plasticity, ease of processing, and relatively low cost. In this report, “paper” includes not only sheets of paper as traditionally understood, but also other cellulose-based materials such as cardboard, pulp products, etc.

Mexico’s paper industry is highly concentrated, with just 27 companies producing nearly all paper products. In 2019, the industry directly employed 65,000 people in 53 manufacturing plants across 21 states. In 2023, the estimated value of paper products manufactured in Mexico will reach US$27.22 billion, representing 2.14% of Mexico’s GDP. With the import value of pulp, paper and paper products expected to reach US$7.63 billion in 2023 and the export value only US$2.34 billion, this North American country has significant potential in the paper industry as domestic production cannot meet demand.

Mexico leads Latin America in the production of paper products, with three main sectors: packaging, printing/writing, and disposables. Packaging companies create a variety of solutions for industries ranging from food to electronics. Printing companies use advanced technology to produce newspapers, magazines and educational materials. Finally, the disposable paper industry provides everyday essentials such as tissues and napkins.

As mentioned, the industry is highly concentrated, with a few major brands dominating the market. Kimberly-Clark is the dominant force in disposable paper products with an estimated market share of over 60%. BIO Pappel (owner of the Scribe brand) is the largest printing and writing company, accounting for over 80% of newsprint. It is one of the largest producers of packaging paper products and has a market share of over 50% in writing paper products. Other major companies in the division include Copamex, Smurfit Kappa, Potosi, Absormex and GCP.

The current landscape of the paper industry in Mexico is shaped by a variety of factors, including economic conditions, demographic shifts, environmental priorities and technological advances. After a period of moderate expansion, the sector is now grappling with the simultaneous pressures of digital innovation and environmental awareness. While technological advancements have reduced demand for traditional paper products, the industry has shown resilience by transitioning to greener production techniques and expanding its product offerings.

Consumer preferences and sustainability concerns are driving market shifts and shaping consumer demand in significant ways. More consumers are actively seeking out companies that prioritize and integrate sustainable practices into their operations. This trend is fueling a growing demand for environmentally friendly paper products. At the same time, declining demand for traditional paper products, largely due to digitization, is being offset by a surge in packaging needs driven by the e-commerce boom. These dynamics highlight an industry in transition, adapting to meet the evolving needs of different sectors.

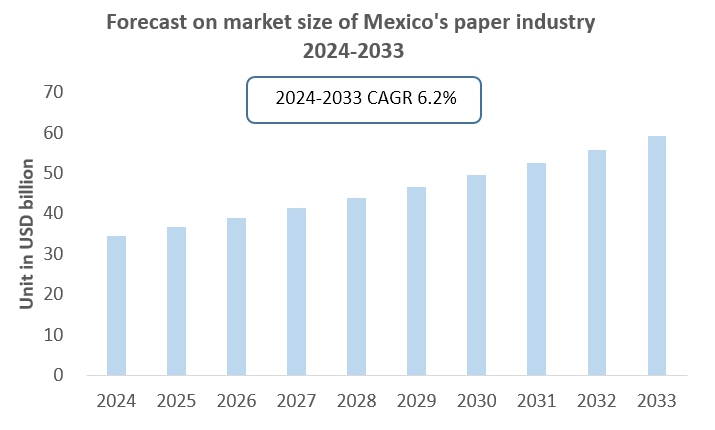

According to CRI’s forecast, Mexico’s paper industry is expected to reflect the dynamic shift toward improved sustainability and operational efficiency. Industry advances are likely to focus on reengineering processes to reduce environmental footprints and capitalize on growing green consumerism. Meanwhile, innovation will continue to play a critical role in creating market opportunities, as manufacturers will leverage technology to develop superior and sustainable products in line with emerging consumer and industrial demand trends.

These positive developments are expected to support steady growth in the Mexican paper industry over the forecast period. According to CRI, the market size of paper industry in Mexico is expected to reach US$ 59.34 billion in 2033, representing a compound annual growth rate (CAGR) of 6.2% from 2024 to 2033.

Topics covered:

- Mexico Paper Industry Overview

- The economic and policy environment of Mexico’s paper industry

- Mexico Paper Industry Market Size, 2023-2032

- Analysis of the main Mexico paper production enterprises

- Key drivers and market opportunities for Mexico’s paper industry

- What are the key drivers, challenges and opportunities for Mexico’s paper industry during the forecast period 2023-2032?

- Which companies are the key players in the Mexico paper industry market and what are their competitive advantages?

- What is the expected revenue of Mexico paper industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Mexico paper industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the paper industry in Mexico?

Table of Contents

1. Overview of Mexico

1.1 Geographical Situation

1.2 Demographic Structure of Mexico

1.3 The Economic Situation in Mexico

1.4 Minimum Wage in Mexico, 2014-2023

1.5 Impact of COVID-19 on the Paper Industry in Mexico

2. Overview of Mexico’s Paper Industry

2.1 History of Mexico’s Paper Industry Development

2.2 FDI in Mexico’s Paper Industry

2.3 Social Environment of Mexico’s Paper Industry

2.4 Policy Environment of Mexico’s Paper Industry

3. Mexico’s Paper Industry Supply and Demand Situation

3.1 Mexico’s Paper Industry Supply Situation

3.2 Mexico’s Paper Industry Demand Situation

4. Mexico’s Paper Industry Import and Export Situation

4.1 Mexico’s Paper Industry Import Situation

4.1.1 Import Volume and Import Value of Mexico’s Paper Industry

4.1.2 Main Import Sources of Mexico’s Paper

4.2 Mexico’s Paper Industry Export Situation

4.2.1 Export Volume and Import Value of Mexico’s Paper Industry

4.2.2 Main Export Destinations of Mexico’s Paper

5. Cost Analysis of the Mexico’s Paper Industry

5.1 Cost Analysis of Paper Industry in Mexico

5.1.1 Labor costs

5.1.2 Cost of raw materials

5.1.3 Other costs

5.2 Mexico Paper Industry Price Analysis

6. Market Competition of Mexico’s Paper Industry

6.1 Barriers to entry in the Mexico’s Paper Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Mexico’s Paper Industry

6.2.1 Bargaining Power of Upstream Suppliers

6.2.2 Consumer Bargaining Power

6.2.3 Competition in Mexico’s Paper Industry

6.2.4 Threat of Potential Entrants

6.2.5 Threat of Substitutes

7. Analysis of the Leading Paper Mills in Mexico, 2023

7.1 Kimberly-Clark

7.1.1 Corporate Profile of Kimberly-Clark

7.1.2 Operations of Kimberly-Clark in Mexico

7.2 Grupo Bio Pappel

7.2.1 Corporate Profile of Grupo Bio Pappel

7.2.2 Operations of Grupo Bio Pappel in Mexico

7.3 Copamex

7.3.1 Corporate Profile of Copamex

7.3.2 Operations of Copamex in Mexico

7.4 Smurfit Kappa

7.4.1 Corporate Profile of Smurfit Kappa

7.4.2 Operations of Smurfit Kappa in Mexico

7.5 Potosi

7.5.1 Corporate Profile of Potosi

7.5.2 Operations of Potosi

7.6 Absormex CMPC Tissue

7.6.1 Corporate Profile of Absormex CMPC Tissue

7.6.2 Operations of Absormex CMPC Tissue in Mexico

7.7 Papeles y Conversiones de México (PCM)

7.7.1 Corporate Profile of Papeles y Conversiones de México (PCM)

7.7.2 Operations of Papeles y Conversiones de México (PCM) in Mexico

7.8 International Paper

7.8.1 Corporate Profile of International Paper

7.8.2 Operations of International Paper in Mexico

7.9 Essity

7.9.1 Corporate Profile of Essity

7.9.2 Operations of Essity in Mexico

7.10 Papel San Francisco

7.10.1 Corporate Profile of Papel San Francisco

7.10.2 Operations of Papel San Francisco in Mexico

8. Mexico’s Paper Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Mexico’s Paper Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Mexico’s Paper Industry, 2024-2033

8.3 Demand Forecast of Mexico’s Paper Industry, 2024-2033

8.4 Import and Export Forecast of Mexico’s Paper Industry, 2024-2033

LIST OF CHARTS

Chart Location of Mexico

Chart Population of Mexico as of the end of 2018-2023

Chart 2011-2023 Mexico GDP per capita

Chart 2015-2024 Minimum Monthly Wage in Mexico

Chart Output Volume of paper and paper products in Mexico

Chart Consumption of paper and paper products in Mexico

Chart Market size of paper and paper products in Mexico

Chart Mexico’s import volume of paper and paper products, 2018-2023

Chart 2018-2023 Mexico’s paper and paper products import Value

Chart Mexico’s main import sources of paper products 2023

Chart Retail Electricity Price of Manufacturing Industry in Mexico

Chart Average price of facial paper in Mexico (USD per ton)

Chart Average price of toilet paper in Mexico (USD per ton)

Chart Average price of printing and writing paper in Mexico (USD per ton)

Chart Average price of corrugated paper in Mexico (USD per ton)

Chart Profile of Mexico Paper Corporation

Chart Forecast on Mexico’s production volume of paper and paper products 2024-2033(Unit in thousand tons)

Chart Forecast on Mexico’s consumption volume of paper and paper products 2024-2033(Unit in thousand tons)

Chart Forecast on market size of Mexico’s paper and paper products 2024-2033

Related Reports

Research Report on Southeast Asia Paper Industry 2023-2032

Vietnam Paper Industry Research Report 2023-2032

Indonesia Paper Industry Research Report 2023-2032

Research Report on Southeast Asia Corrugated Paper Packaging Industry 2023-2032

Global Medical Packaging Paper Market Outlook 2030: Industry Insights & Opportunity Evaluation, 2019-2030

Malaysia Paper Industry Research Report 2023-2032

Global Paper Dry Strength Agent Market Forecast to 2030

Bangladesh Paper Industry Research Report 2024-2033

Global Electronic Paper Display (EPD) Market Outlook 2030: Industry Insights & Opportunity Evaluation, 2019-2030

Global Thermal Paper Market Forecast to 2030

Disposable Paper Cups Market Forecast to 2030

India Paper Industry Research Report 2024-2033

Research Report on Papermaking Industry of China, 2018-2022

Asia Water & Oil Resistant Paper Packaging Market Research Forecast to 2027

Reviews

There are no reviews yet.