Description

Southeast Asia Motorcycle Industry

Motorcycles are two- or three-wheeled vehicles driven by gasoline engines and steered by handgrips, which are light, flexible and fast. According to CRI’s analysis, Southeast Asia is the world’s highest per capita motorcycle ownership region, with Indonesia, Vietnam, Thailand, the Philippines and Malaysia occupying the major market share of the Southeast Asian motorcycle market.

Most of the countries in Southeast Asia are mainly mountainous, with rugged terrain and narrow roads, and many of them lack perfect public transportation and have poor road conditions, making them more suitable for motorcycles as transportation. At the same time, in addition to Singapore, the rest of the Southeast Asian countries are developing countries, with low per capita disposable income, unable to afford expensive cars, and can only choose to buy more economical motorcycles, so there is still a lot of room for development in the Southeast Asian motorcycle industry.

Southeast Asia has an abundant labor force and lower production costs, attracting global motorcycle manufacturers to shift production capacity to the Southeast Asian region. According to CRI’s analysis, Honda has successively built motorcycle production bases in Vietnam’s Vinh Phuc and Ha Nam provinces with an annual production capacity of 2.5 million units for domestic consumption and export demand. Suzuki has also established a number of motorcycle production plants in Dong Nai Province, Vietnam.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

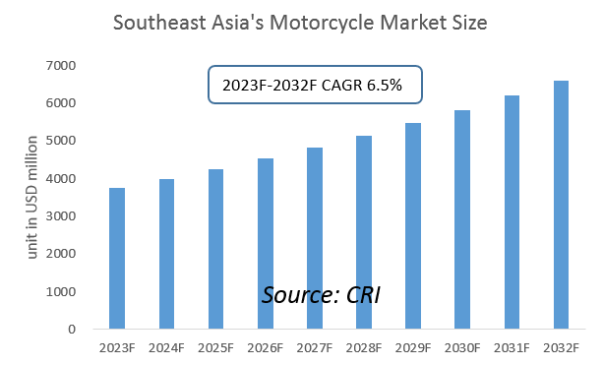

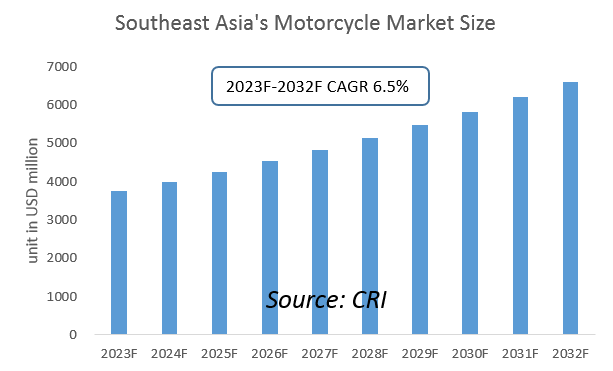

CRI expects Southeast Asia motorcycle industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Motorcycle Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Motorcycle Industry?

- Which Companies are the Major Players in Southeast Asia Motorcycle Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Motorcycle Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Motorcycle Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Motorcycle Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Motorcycle Industry Market?

- Which Segment of Southeast Asia Motorcycle Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Motorcycle Industry?

Table of Contents

1 Singapore Motorcycle Industry Analysis

1.1 Singapore’s Motorcycle Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Motorcycle Industry Operation in Singapore 2023-2032

1.2.1 Production Status

1.2.2 Sales Status

1.2.3 Import and Export Status

1.3 Analysis of Major Motorcycle Manufacturing and Trading Companies in Singapore

2 Analysis of the Motorcycle Industry in Thailand

[Thailand Fuel Motorcycle Industry Research Report 2023-2032]

2.1 Development Environment of Thailand Motorcycle Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Motorcycle Industry Operation Status 2023-2032

2.2.1 Production Status

2.2.2 Sales Situation

2.2.3 Import and Export Situation

2.3 Analysis of Major Motorcycle Manufacturers and Traders in Thailand

3 Analysis of the Motorcycle Industry in the Philippines

3.1 Development Environment of Motorcycle Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Motorcycle Industry Operation in the Philippines 2023-2032

3.2.1 Production Status

3.2.2 Sales Status

3.2.3 Import and Export Situation

3.3 Analysis of Major Motorcycle Manufacturers and Traders in the Philippines

4 Malaysia Motorcycle Industry Analysis

4.1 Malaysia Motorcycle Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Motorcycle Industry Operation Status 2023-2032

4.2.1 Production Status

4.2.2 Sales Status

4.2.3 Import and Export Status

4.3 Analysis of Major Motorcycle Manufacturers and Traders in Malaysia

5 Indonesia Motorcycle Industry Analysis

5.1 Indonesia Motorcycle Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Motorcycle Industry Operation Status 2023-2032

5.2.1 Production Status

5.2.2 Sales Status

5.2.3 Import and Export Status

5.3 Analysis of Major Motorcycle Manufacturers and Traders in Indonesia

6 Vietnam Motorcycle Industry Analysis

6.1 Development Environment of Vietnam Motorcycle Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Motorcycle Industry Operation in 2023-2032

6.2.1 Production Status

6.2.2 Sales Status

6.2.3 Import and Export Situation

6.3 Analysis of Major Motorcycle Manufacturers and Traders in Vietnam

7 Analysis of Motorcycle Industry in Myanmar

7.1 Development Environment of Myanmar Motorcycle Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Motorcycle Industry Operation in 2023-2032

7.2.1 Production Status

7.2.2 Sales Situation

7.2.3 Import and Export Situation

7.3 Analysis of Major Motorcycle Manufacturers and Traders in Myanmar

8 Brunei Motorcycle Industry Analysis

8.1 Brunei Motorcycle Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Motorcycle Industry Operation Status 2023-2032

8.2.1 Production Status

8.2.2 Sales Status

8.2.3 Import and Export Status

8.3 Brunei Major Motorcycle Manufacturers and Traders Analysis

9 Analysis of the Motorcycle Industry in Laos

9.1 Development Environment of the Motorcycle Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Motorcycle Industry Operation in Laos 2023-2032

9.2.1 Production Status

9.2.2 Sales Situation

9.2.3 Import and Export Situation

9.3 Analysis of Major Motorcycle Manufacturers and Traders in Laos

10 Analysis of the Motorcycle Industry in Cambodia

10.1 Development Environment of Motorcycle Industry in Cambodia

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Motorcycle Industry Operation Status in 2023-2032

10.2.1 Production Status

10.2.2 Sales

10.2.3 Import and Export Situation

10.3 Analysis of Major Motorcycle Manufacturing and Trading Companies in Cambodia

11 Southeast Asia Motorcycle Industry Outlook 2023-2032

11.1 Southeast Asia Motorcycle Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Motorcycle Industry Production Status Analysis 2023-2032

11.3 Southeast Asia Motorcycle Industry Sales Status Analysis 2023-2032

11.4 Southeast Asia Motorcycle Industry Import and Export Status Analysis 2023-2032

11.5 Impact of COVID -19 Epidemic on Motorcycle Industry

Related report:

Research Report on Southeast Asia Motorcycle Helmet Industry 2023-2032

Electric Motorcycles Market Research Report- Forecast till 2030

Global Electric Motorcycle Helmet Market Analysis and Forecast 2031

Reviews

There are no reviews yet.