Description

China’s Gold Import

China has been the world’s largest producer and consumer of gold for many years. Because of the strong demand for gold jewelry, as well as gold bars and coins for investment purposes, China still needs to import a considerable amount of gold every year.

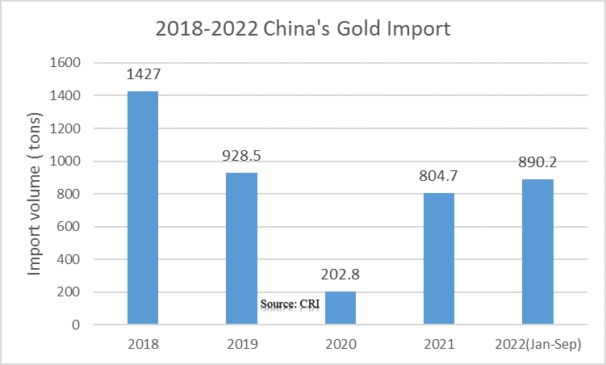

In 2021, China imported 804.7 tons of gold (refers to unwrought gold for non-monetary use, the same below), up 296.8% year-on-year, and the import value was US$46.3 billion, up 324.8% year-on-year. According to CRI’s analysis, in the first three quarters of 2022, China imported 890.8 tons of gold, up 71.6% year-on-year, with an import value of US$51.31 billion, up 71.7% year-on-year.

CRI analysis shows that the average price of China’s gold imports generally shows a gradual increase in 2018-2022. In 2018-2019, the average price of China’s gold imports remains in the price range of US$40-45 per gram. In 2020, the average price of China’s gold imports rises to US$53.8 per gram, up 21.7% year-on-year. In the first three quarters of 2021-2022, the average price of China’s gold imports stabilizes at a price range of US$57.6 per gram.

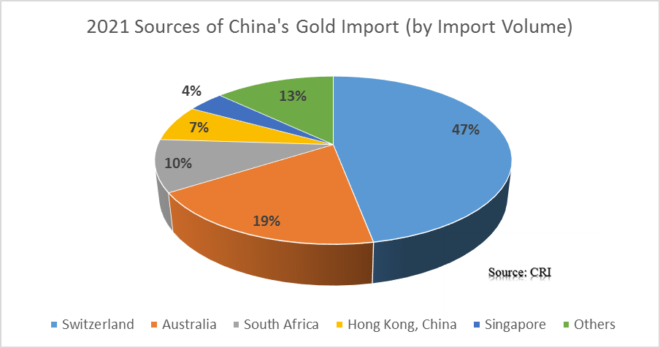

In 2021, China imported gold from a total of 25 countries and regions. According to CRI’s analysis, China’s main sources of gold imports by volume are Switzerland, Australia, South Africa, Hong Kong, China and Singapore. Among them, Switzerland is China’s largest source of gold imports. 374.3 tons of gold will be imported from Switzerland in 2021, accounting for 46.5% of the total import volume and US$21.50 billion, accounting for 46.4% of the total import value.

As Chinese residents prefer to buy gold jewelry, while some of them collect gold bars and coins as a means of preserving value. However, there is limited room for growth in China’s domestic gold production, so CRI expects that China will still import a large amount of gold every year from 2023-2032.

Topics covered:

- China’s Gold Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China’s Gold Import?

- Which Companies are the Major Players in China’s Gold Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China’s Gold Import

- What are the Key Drivers, Challenges, and Opportunities for China’s Gold Import during 2023-2032?

- What is the Expected Revenue of China’s Gold Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China’s Gold Import Market?

- Which Segment of China’s Gold Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China’s Gold Import?

Reviews

There are no reviews yet.