Description

China’s Nickel Ore and Concentrates Import

Applications of nickel in industry mainly include the production of alloys (e.g. stainless steel), as well as applications in cathode material precursors for ternary lithium batteries. According to CRI’s analysis, China’s new energy vehicle market has been developing rapidly in recent years, so the demand for nickel in the Chinese market is also rising rapidly. Since China’s local nickel resources are limited, China needs to import a large amount of nickel ore every year.

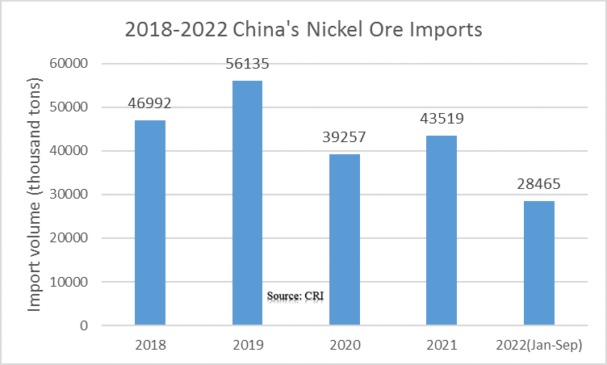

In 2021, China imported 43.519 million tons of nickel ore and concentrates (“”nickel ore””, the same below), up 10.9% year-on-year, and the import value was US$4.42 billion, up 51.0% year-on-year. According to CRI’s analysis, in the first three quarters of 2022, China imported 28.465 million tons of nickel ore, down 14.1% year-on-year, with an import value of US$3.43 billion, up 5.1% year-on-year.

The average price of China’s nickel ore imports increased continuously in 2018-2022. The average price of China’s nickel ore imports increased less in 2018-2020, remaining in the price range of US$63-75 per ton. The average price of China’s nickel ore imports in 2021 was US$101.6 per ton, an increase of 36.2% y-o-y. The near average price of China’s nickel ore imports in the first three quarters of 2022 was US$120.4 per ton, up 22.4% year-on-year.

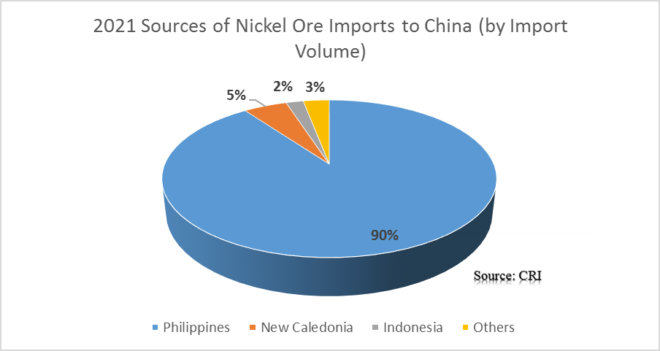

In 2021, China imported nickel ore from 21 countries or regions. According to CRI’s analysis, China’s major sources of nickel ore imports by import volume are the Philippines, New Caledonia and Indonesia. Among them, the Philippines is China’s largest source of nickel ore imports. 2021, China imports 39.01.0 million tons of nickel ore from the Philippines, accounting for 89.6% of the total import volume and US$3.0 billion, accounting for 67.9% of the total import value.

China is the world’s largest nickel consumer, but China’s local nickel ore resources are scarce and nickel ore is highly dependent on imports. With the recovery of China’s stainless-steel industry and the rapid development of new energy sector, the demand for nickel from downstream industries is expanding, and CRI expects that China will still import a large amount of nickel ore every year from 2023-2032.

Topics covered:

- China’s Nickel Ore Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China’s Nickel Ore Import?

- Which Companies are the Major Players in China’s Nickel Ore Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China’s Nickel Ore Import

- What are the Key Drivers, Challenges, and Opportunities for China’s Nickel Ore Import during 2023-2032?

- What is the Expected Revenue of China’s Nickel Ore Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China’s Nickel Ore Import Market?

- Which Segment of China’s Nickel Ore Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China’s Nickel Ore Import?

Reviews

There are no reviews yet.