Description

Market Report Coverage – Wiring Harnesses and Connectors for Electric Vehicles Market

Market Segmentation

• Vehicle Type: Passenger, Commercial

• Propulsion Type: Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), Plug-In Hybrid Electric Vehicle (PHEV)

• Application: Body Harness, High Voltage Battery Harness, Dashboard/Cabin Harness, HVAC Harness, Others

• Product Type: High Voltage, Low Voltage

• Material Type: Copper, Aluminum, Optical Fiber

• Component Type: Wires, Connectors, Others

Regional Segmentation

• North America: U.S., Canada, and Mexico

• Europe: Germany, France, Italy, Spain, and Rest-of-Europe

• U.K.

• China

• Asia-Pacific and Japan: Japan, South Korea, India, and Rest-of-Asia-Pacific and Japan

• Rest-of-the-World (RoW)

Market Growth Drivers

• Growing Adoption of Electric Vehicles

• Deployment of Wide-Scale Charging Infrastructure for Electric Vehicles

• Need for High Voltage Wiring Harnesses for Electric Vehicle Applications

• Growing Need for Automotive Safety Systems

Market Challenges

• Corrosion Susceptibility of Wiring Harnesses and Connectors

• Increase in Copper Prices

Market Opportunities

• Introduction of Autonomy Levels in Electric Vehicles

• Weight Reduction of Wiring Harnesses and Connectors

Key Companies Profiled

Sumitomo Electric Industries, Ltd., Leoni AG, Aptiv PLC, Fujikura Ltd., Kromberg & Schubert GmbH, Coroplast Group, SINBON Electronics Co., Ltd., Korea Electric Terminal Co., Ltd., EG Electronics, LS Cable & System Ltd., TE Connectivity, ACOME, Gebauer & Griller, Continental AG, Lear Corporation

How This Report Can Add Value

Product/Innovation Strategy: The product segment helps the readers in understanding the different types of wiring harnesses used in electric vehicles. Also, the study provides the readers with a detailed understanding of the wiring harnesses and connectors for electric vehicles market by application and product.

Growth/Marketing Strategy: In order to improve the capabilities of their product offerings, players in the wiring harnesses and connectors for electric vehicles market are developing unique products.

The readers will be able to comprehend the revenue-generating tactics used by players in the wiring harnesses and connectors for electric vehicles market by looking at the growth/marketing strategies. Other market participants’ tactics, such as go-to-market plans, will also assist readers in making strategic judgments.

Key Questions Answered in the Report:

• For a new company looking to enter the wiring harnesses and connectors for EVs market, which areas could it focus upon to stay ahead of the competition?

• How do the existing market players function to improve their market positioning?

• Which are the promising companies that have obtained financial support to develop their products and markets?

• How does the supply chain function in the global wiring harnesses and connectors for electric vehicles market?

• Which companies have been actively involved in innovation through patent applications, and which products have witnessed maximum patent applications during the period 2019-2021?

• Which product segment is expected to witness the maximum demand growth in the global wiring harnesses and connectors for electric vehicles market during 2021-2031?

• Which are the players that are catering to the demand for different wiring harnesses and connectors?

• How should the strategies adopted by market players vary for different product segments based on the size of companies involved in each segment?

• What are the key offerings of the prominent companies in the market for wiring harnesses and connectors for electric vehicles?

• What are the demand patterns of wiring harnesses and connectors across the application areas in different regions and countries during the period 2021-2031?

Global Wiring Harnesses and Connectors for Electric Vehicles Market

Wiring harnesses are fundamentally a collection of wires, connectors, relays, fuses, and switches, for transferring electrical signals in a vehicle. They help keep the loose wire securely in the proper place for the safety and well-being of the vehicle. They operate in low and high-voltage conditions.

The wiring harnesses and connectors are gaining traction owing to the growing adoption of electric vehicles, where high voltage wires are increasingly being used for the battery circuit of the vehicle to power the vehicle.

Global Wiring Harnesses and Connectors for Electric Vehicles Industry Overview

The global wiring harnesses and connectors for electric vehicle market is expected to reach $22.87 billion by 2031, with a CAGR of 23.37% during the forecast period 2021-2031. According to recent studies, the rapid advancement in the field of electric vehicles is favoring the increased demand for wiring harnesses and connectors.

Electric vehicles use almost double the amount of wires when compared to a traditional ICE vehicle. Therefore, the weight of wiring in electric vehicles increases. As a consequence, OEMs are readily resorting to aluminum wiring harnesses in order to reduce the weight of wiring harnesses, and in turn, increase the range of their vehicles.

Moreover, the demand for high voltage wires has been ramped up due to the high voltage battery ecosystems in electric vehicles. All of the above-mentioned developments in the wiring harness market have also impacted the market in a positive way, by virtue of which the market is expected to exhibit significant growth over the forecast period (2021-2031).

Market Segmentation

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Propulsion Type

Wiring harnesses and connectors for HEVs generated the most value in 2020 owing to a large number of HEV production in Asia-Pacific and Japan.

Countries such as Japan rely on HEVs for their share in the electric vehicle industry and are one of the largest producers of HEVs through leading companies such as Mitsubishi, Nissan Motor Company, and Honda. However, the market will shift toward BEVs over the forecast period as BEVs use a larger number of wires than HEV.

Also, BEV deploys larger and thicker high voltage wires when compared with HEVs owing to the bigger battery.

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Vehicle Type

Passenger electric vehicles segment is expected to dominate the market throughout the forecast period. It can be directly attributed to the larger number of passenger vehicles when compared to commercial vehicles currently.

However, it is to be noted that commercial vehicles use more wiring harnesses and connectors owing to their larger sizes and complex functions. It will also grow at a faster rate over time as commercial electric vehicles are readily being introduced in the EV domain.

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Application

Body harness occupied the largest share in the market in 2020. The wiring harness used in this system performs various important in electric vehicles, and therefore, has the most value and volume in the market currently. Nevertheless, high voltage battery harness shows a significant increase during the forecast period due to the growing adoption of electric vehicles.

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Product Type

The low voltage wiring harness segment dominates the market, albeit it will be surpassed by high voltage wires for electric vehicles by the end of the forecast period. Low voltage harnesses make up almost 70% of the total wiring harnesses present in an electric vehicle. It is needed for all the auxiliary functions in EVs, such as infotainment systems, doors, seats, HVAC, and engines.

However, the need for high voltage wires is increasing as the adoption of electric vehicles is ramping up.

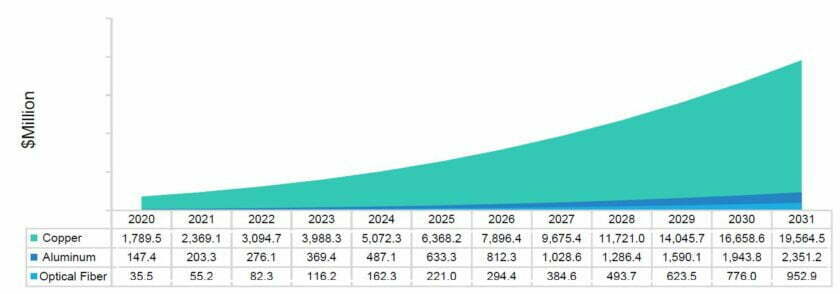

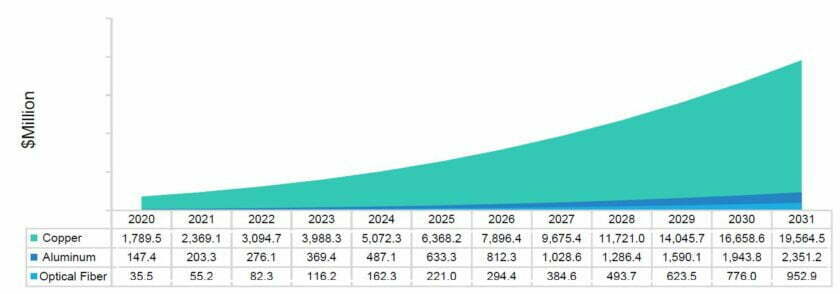

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Material Type

Electric vehicles use double the amount of copper which is usually required by ICE vehicles. Moreover, all the wires in vehicles are constructed using copper owing to its excellent conductivity and mechanical strength; however, aluminum is emerging as the favorite material for electric vehicle OEMs in order for them to reduce the weight of their vehicles. However, copper will be dominating the market throughout the forecast period.

Wiring Harnesses and Connectors Market for Electric Vehicles Market(by Material Type) , Value, 2020-2031

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Component Type

Wires form the main component of wiring harnesses. Therefore, it will dominate the market throughout the forecast period. Wires are generally made up of copper with one or multiple layers of insulation around them for protection and for prevention of energy loss.

Also, in luxury electric vehicles, a large number of wires are involved for complex electrical functions. Moreover, larger cars tend to use larger and heavier wires in conjunction with connectors to carry out operations.

Global Wiring Harnesses and Connectors for Electric Vehicles Market by Region

China is expected to be the largest market for wiring harnesses and connectors for electric vehicles in 2031, in addition to being the 2nd largest market for wiring harness and connectors for electric vehicles after Asia-Pacific and Japan. The electric vehicle market in China was the largest in terms of volume in 2020 and is expected to increase exponentially.

Therefore, the use of wiring harnesses in China is also increasing. Also, there is a large number of electric vehicles in the commercial fleet of China that have been deployed for cab services. Moreover, China is readily electrifying its existing ICE fleet into electric vehicles, which would deploy additional usage of high voltage wiring harnesses and connectors.

Key Market Players and Competition Synopsis

Sumitomo Electric Industries, Ltd., Leoni AG, Aptiv PLC, Fujikura Ltd., Kromberg & Schubert GmbH, Coroplast Group, SINBON Electronics Co., Ltd., Korea Electric Terminal Co., Ltd., EG Electronics, LS Cable & System Ltd., TE Connectivity, ACOME, Gebauer & Griller, Continental AG, Lear Corporation

The companies profiled in the report have been selected post-in-depth interviews with experts and understanding details of companies such as their product portfolios, annual revenues, market penetration, research and development initiatives, and domestic and international presence in the wiring harnesses and connectors for electric vehicles market.

Electric Vehicle Testing, Inspection, and Certification – A Global and Regional Analysis: Focus on Product, Application, and Country Assessment

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Trends: Industry Dynamics Defining the Future Trends Wiring Harnesses and Connectors for EVs Market

1.1.1.1 Impact of Electric Vehicles on the Automation of the Industry

1.1.1.2 Wireless Communication in Conjunction with Wiring Harness

1.1.1.3 Better Design Adoption in the Manufacture of Wiring Harnesses and Connectors

1.1.1.4 Parametrization and Remote Monitoring for Wiring Harness Systems

1.1.2 Supply Chain Analysis

1.1.3 Ecosystem/Ongoing Programs

1.1.3.1 Consortiums, Associations, and Regulatory Bodies

1.1.3.2 Government Initiatives

1.1.3.3 Programs by Research Institutions and Universities

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Growing Adoption of Electric Vehicles

1.2.1.2 Deployment of Wide-Scale Charging Infrastructure for Electric Vehicles

1.2.1.3 Need for High Voltage Wiring Harnesses for Electric Vehicle Applications

1.2.1.4 Growing Need for Automotive Safety Systems

1.2.2 Business Restraints

1.2.2.1 Corrosion Susceptibility of Wiring Harnesses and Connectors

1.2.2.2 Increase in Copper Prices

1.2.3 Business Strategies

1.2.3.1 Product Developments

1.2.3.2 Market Developments

1.2.4 Corporate Strategies

1.2.4.1 Mergers and Acquisitions

1.2.4.2 Partnerships, Joint Ventures, Collaborations, and Alliances

1.2.5 Business Opportunities

1.2.5.1 Introduction of Autonomy Levels in Electric Vehicles

1.2.5.2 Weight Reduction of Wiring Harnesses and Connectors

2 Application

2.1 Wiring Harnesses and Connectors for Electric Vehicles Market- Applications and Specifications

2.1.1 Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type)

2.1.1.1 Passenger

2.1.1.2 Commercial

2.1.2 Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type)

2.1.2.1 Battery Electric Vehicle (BEV)

2.1.2.2 Hybrid Electric Vehicle (HEV)

2.1.2.3 Plug-In Hybrid Electric Vehicle (PHEV)

2.1.3 Wiring Harnesses and Connectors for Electric Vehicles Market (by Application)

2.1.3.1 Body Harness

2.1.3.2 High Voltage Battery Harness

2.1.3.3 Dashboard/Cabin Harness

2.1.3.4 HVAC Harness

2.1.3.5 Others

2.2 Demand Analysis of Wiring Harnesses and Connectors for Electric Vehicles Market (by Application)

2.2.1 Global Demand Analysis (by Vehicle Type), Million Units and $Million

2.2.2 Global Demand Analysis (by Propulsion Type), Million Units and $Million

2.2.3 Global Demand Analysis (by Application), Million Units and $Million

3 Products

3.1 Wiring Harnesses and Connectors for Electric Vehicles Market- Products and Specifications

3.1.1 Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type)

3.1.1.1 High Voltage

3.1.1.2 Low Voltage

3.1.2 Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type)

3.1.2.1 Copper

3.1.2.2 Aluminum

3.1.2.3 Optical Fiber

3.1.3 Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type)

3.1.3.1 Wires

3.1.3.2 Connectors

3.1.3.3 Others

3.2 Demand Analysis of Wiring Harnesses and Connectors for Electric Vehicles Market (by Product)

3.2.1 Global Demand Analysis (by Product Type), Million Units and $Million

3.2.2 Global Demand Analysis (by Material Type), Million Units and $Million

3.2.3 Global Demand Analysis (by Component Type), Million Units and $Million

4 Region

4.1 North America

4.1.1 Market

4.1.1.1 Buyer Attributes

4.1.1.2 Key Manufacturers and Suppliers in North America

4.1.1.3 Competitive Benchmarking

4.1.1.4 Business Challenges

4.1.1.5 Business Drivers

4.1.2 Application

4.1.2.1 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.1.2.2 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.1.2.3 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.1.3 Products

4.1.3.1 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.1.3.2 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.1.3.3 North America Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.1.4 North America: Country-Level Analysis

4.1.4.1 U.S.

4.1.4.1.1 Market

4.1.4.1.1.1 Buyer Attributes

4.1.4.1.1.2 Key Manufacturers and Suppliers in the U.S.

4.1.4.1.1.3 Key Electric Vehicle Regulations and Policies in the U.S.

4.1.4.1.1.4 Business Challenges

4.1.4.1.1.5 Business Drivers

4.1.4.1.2 Application

4.1.4.1.2.1 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.1.4.1.2.2 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.1.4.1.2.3 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.1.4.1.3 Products

4.1.4.1.3.1 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.1.4.1.3.2 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.1.4.1.3.3 U.S. Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.1.4.2 Canada

4.1.4.2.1 Market

4.1.4.2.1.1 Buyer Attributes

4.1.4.2.1.2 Key Manufacturers and Suppliers in Canada

4.1.4.2.1.3 Key Electric Vehicle Regulations and Policies in Canada

4.1.4.2.1.4 Business Challenges

4.1.4.2.1.5 Business Drivers

4.1.4.2.2 Application

4.1.4.2.2.1 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.1.4.2.2.2 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.1.4.2.2.3 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.1.4.2.3 Products

4.1.4.2.3.1 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.1.4.2.3.2 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.1.4.2.3.3 Canada Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.1.4.3 Mexico

4.1.4.3.1 Market

4.1.4.3.1.1 Buyer Attributes

4.1.4.3.1.2 Key Manufacturers and Suppliers in Mexico

4.1.4.3.1.3 Key Electric Vehicle Regulations and Policies in Mexico

4.1.4.3.1.4 Business Challenges

4.1.4.3.1.5 Business Drivers

4.1.4.3.2 Application

4.1.4.3.2.1 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.1.4.3.2.2 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.1.4.3.2.3 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.1.4.3.3 Products

4.1.4.3.3.1 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.1.4.3.3.2 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.1.4.3.3.3 Mexico Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2 Europe

4.2.1 Market

4.2.1.1 Buyer Attributes

4.2.1.2 Key Manufacturers and Suppliers in Europe

4.2.1.3 Competitive Benchmarking

4.2.1.4 Business Challenges

4.2.1.5 Business Drivers

4.2.2 Application

4.2.2.1 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.2.2 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.2.3 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.3 Products

4.2.3.1 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.3.2 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.3.3 Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2.4 Europe: Country-Level Analysis

4.2.4.1 Germany

4.2.4.1.1 Market

4.2.4.1.1.1 Buyer Attributes

4.2.4.1.1.2 Key Manufacturers and Suppliers in Germany

4.2.4.1.1.3 Key Electric Vehicle Regulations and Policies in Germany

4.2.4.1.1.4 Business Challenges

4.2.4.1.1.5 Business Drivers

4.2.4.1.2 Application

4.2.4.1.2.1 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.4.1.2.2 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.4.1.2.3 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.4.1.3 Products

4.2.4.1.3.1 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.4.1.3.2 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.4.1.3.3 Germany Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2.4.2 France

4.2.4.2.1 Market

4.2.4.2.1.1 Buyer Attributes

4.2.4.2.1.2 Key Manufacturers and Suppliers in France

4.2.4.2.1.3 Key Electric Vehicle Regulations and Policies in France

4.2.4.2.1.4 Business Challenges

4.2.4.2.1.5 Business Drivers

4.2.4.2.2 Application

4.2.4.2.2.1 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.4.2.2.2 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.4.2.2.3 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.4.2.3 Products

4.2.4.2.3.1 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.4.2.3.2 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.4.2.3.3 France Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2.4.3 Italy

4.2.4.3.1 Market

4.2.4.3.1.1 Buyer Attributes

4.2.4.3.1.2 Key Manufacturers and Suppliers in Italy

4.2.4.3.1.3 Key Electric Vehicle Regulations and Policies in Italy

4.2.4.3.1.4 Business Challenges

4.2.4.3.1.5 Business Drivers

4.2.4.3.2 Application

4.2.4.3.2.1 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.4.3.2.2 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.4.3.2.3 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.4.3.3 Products

4.2.4.3.3.1 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.4.3.3.2 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.4.3.3.3 Italy Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2.4.4 Spain

4.2.4.4.1 Market

4.2.4.4.1.1 Buyer Attributes

4.2.4.4.1.2 Key Manufacturers and Suppliers in Spain

4.2.4.4.1.3 Key EV Regulations and Policies in Spain

4.2.4.4.1.4 Business Challenges

4.2.4.4.1.5 Business Drivers

4.2.4.4.2 Application

4.2.4.4.2.1 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.4.4.2.2 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.4.4.2.3 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.4.4.3 Products

4.2.4.4.3.1 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.4.4.3.2 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.4.4.3.3 Spain Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.2.4.5 Rest-of-Europe

4.2.4.5.1 Market

4.2.4.5.1.1 Buyer Attributes

4.2.4.5.1.2 Key Manufacturers and Suppliers in Rest-of-Europe

4.2.4.5.1.3 Key Electric Vehicle Regulations and Policies in Nordic Countries

4.2.4.5.1.4 Business Challenges

4.2.4.5.1.5 Business Drivers

4.2.4.5.2 Application

4.2.4.5.2.1 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.2.4.5.2.2 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.2.4.5.2.3 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.2.4.5.3 Products

4.2.4.5.3.1 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.2.4.5.3.2 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.2.4.5.3.3 Rest-of-Europe Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.3 U.K.

4.3.1 Market

4.3.1.1 Buyer Attributes

4.3.1.2 Key Manufacturers and Suppliers in the U.K.

4.3.1.3 Competitive Benchmarking

4.3.1.3.1 Key Electric Vehicle Regulations and Policies in the U.K.

4.3.1.4 Business Challenges

4.3.1.5 Business Drivers

4.3.2 Application

4.3.2.1 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.3.2.2 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.3.2.3 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.3.3 Products

4.3.3.1 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.3.3.2 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.3.3.3 U.K. Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.4 China

4.4.1 Market

4.4.1.1 Buyer Attributes

4.4.1.2 Key Manufacturers and Suppliers in China

4.4.1.3 Competitive Benchmarking

4.4.1.3.1 Key Electric Vehicle Regulations and Policies in China

4.4.1.4 Business Challenges

4.4.1.5 Business Drivers

4.4.2 Application

4.4.2.1 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.4.2.2 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.4.2.3 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.4.3 Products

4.4.3.1 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.4.3.2 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.4.3.3 China Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.5 Asia-Pacific and Japan

4.5.1 Market

4.5.1.1 Buyer Attributes

4.5.1.2 Key Manufacturers and Suppliers in the Asia-Pacific and Japan

4.5.1.3 Competitive Benchmarking

4.5.1.4 Business Challenges

4.5.1.5 Business Drivers

4.5.2 Application

4.5.2.1 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.5.2.2 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.5.2.3 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.5.3 Products

4.5.3.1 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.5.3.2 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.5.3.3 Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.5.4 Asia-Pacific and Japan: Country-Level Analysis

4.5.4.1 South Korea

4.5.4.1.1 Market

4.5.4.1.1.1 Buyer Attributes

4.5.4.1.1.2 Key Manufacturers and Suppliers in South Korea

4.5.4.1.1.3 Key Electric Vehicle Regulations and Policies in South Korea

4.5.4.1.1.4 Business Challenges

4.5.4.1.1.5 Business Drivers

4.5.4.1.2 Application

4.5.4.1.2.1 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.5.4.1.2.2 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.5.4.1.2.3 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.5.4.1.3 Products

4.5.4.1.3.1 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.5.4.1.3.2 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.5.4.1.3.3 South Korea Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.5.5 Japan

4.5.5.1 Market

4.5.5.1.1 Buyer Attributes

4.5.5.1.1.1 Key Manufacturers and Suppliers in Japan

4.5.5.1.1.2 Key Electric Vehicle Regulations and Policies in Japan

4.5.5.1.1.3 Business Challenges

4.5.5.1.1.4 Business Drivers

4.5.5.1.2 Application

4.5.5.1.2.1 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.5.5.1.2.2 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.5.5.1.2.3 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.5.5.1.3 Products

4.5.5.1.3.1 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.5.5.1.3.2 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.5.5.1.3.3 Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.5.6 India

4.5.6.1 Market

4.5.6.1.1.1 Buyer Attributes

4.5.6.1.1.2 Key Manufacturers and Suppliers in India

4.5.6.1.1.3 Key Electric Vehicle Regulations and Policies in India

4.5.6.1.1.4 Business Challenges

4.5.6.1.1.5 Business Drivers

4.5.6.1.2 Application

4.5.6.1.2.1 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.5.6.1.2.2 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.5.6.1.2.3 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.5.6.1.3 Products

4.5.6.1.3.1 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.5.6.1.3.2 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.5.6.1.3.3 India Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.5.7 Rest-of-Asia-Pacific and Japan

4.5.7.1 Market

4.5.7.1.1 Key Manufacturers and Suppliers in Rest -of-Asia-Pacific and Japan

4.5.7.1.1.1 Business Challenges

4.5.7.1.1.2 Business Drivers

4.5.7.1.2 Application

4.5.7.1.2.1 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.5.7.1.2.2 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.5.7.1.2.3 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.5.7.1.3 Products

4.5.7.1.3.1 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.5.7.1.3.2 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.5.7.1.3.3 Rest-of-Asia-Pacific and Japan Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

4.6 Rest-of-the-World (RoW)

4.6.1 Market

4.6.1.1 Buyer Attributes

4.6.1.2 Key Manufacturers and Suppliers in Rest-of-the-World (RoW)

4.6.1.3 Competitive Benchmarking

4.6.1.4 Business Challenges

4.6.1.5 Business Drivers

4.6.2 Application

4.6.2.1 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Volume and Value Data

4.6.2.2 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Volume and Value Data

4.6.2.3 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Value and Volume Data

4.6.3 Products

4.6.3.1 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Volume and Volume Data

4.6.3.2 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Volume and Value Data

4.6.3.3 Rest-of-the-World (RoW) Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Volume and Value Data

5 Markets - Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.2 Company Profiles

5.2.1 Sumitomo Electric Industries, Ltd.

5.2.1.1 Company Overview

5.2.1.1.1 Product Portfolio

5.2.1.1.2 R&D Analysis

5.2.1.2 Business Strategies

5.2.1.2.1 Product Development

5.2.1.2.2 Market Development

5.2.1.3 Competitive Position

5.2.1.3.1 Strength of the Company in the Market

5.2.1.3.2 Weakness of the Company in the Market

5.2.1.4 Patent Analysis

5.2.2 Leoni AG

5.2.2.1 Company Overview

5.2.2.1.1 Product Portfolio

5.2.2.1.2 R&D Analysis

5.2.2.2 Business Strategies

5.2.2.2.1 Product Development

5.2.2.2.2 Market Development

5.2.2.3 Corporate Strategies

5.2.2.3.1 Partnerships and Collaborations

5.2.2.3.2 Mergers and Acquisitions

5.2.2.4 Competitive Position

5.2.2.4.1 Strength of the Company in the Market

5.2.2.4.2 Weakness of the Company in the Market

5.2.2.5 Patent Analysis

5.2.3 Aptiv PLC

5.2.3.1 Company Overview

5.2.3.1.1 Product Portfolio

5.2.3.1.2 R&D Analysis

5.2.3.2 Corporate Strategies

5.2.3.2.1 Mergers and Acquisitions

5.2.3.3 Competitive Position

5.2.3.3.1 Strength of the Company in the Market

5.2.3.3.2 Weakness of the Company in the Market

5.2.3.4 Patent Analysis

5.2.4 Fujikura Ltd.

5.2.4.1 Company Overview

5.2.4.1.1 Product Portfolio

5.2.4.1.2 R&D Analysis

5.2.4.2 Corporate Strategies

5.2.4.2.1 Partnerships and Collaborations

5.2.4.3 Competitive Position

5.2.4.3.1 Strength of the Company in the Market

5.2.4.3.2 Weakness of the Company in the Market

5.2.4.4 Patent Analysis

5.2.5 Kromberg & Schubert GmbH

5.2.5.1 Company Overview

5.2.5.1.1 Product Portfolio

5.2.5.2 Business Strategies

5.2.5.2.1 Product Development

5.2.5.2.2 Market Development

5.2.5.3 Competitive Position

5.2.5.3.1 Strength of the Company in the Market

5.2.5.3.2 Weakness of the company in the market

5.2.5.4 Patent Analysis

5.2.6 Coroplast Group

5.2.6.1 Company Overview

5.2.6.1.1 Product Portfolio

5.2.6.2 Business Strategies

5.2.6.2.1 Market Development

5.2.6.3 Competitive Position

5.2.6.3.1 Strength of the Company in the Market

5.2.6.3.2 Weakness of the Company in the Market

5.2.6.4 Patent Analysis

5.2.7 SINBON Electronics Co., Ltd.

5.2.7.1 Company Overview

5.2.7.1.1 Product Portfolio

5.2.7.1.2 R&D Analysis

5.2.7.2 Business Strategies

5.2.7.2.1 Market Development

5.2.7.3 Competitive Position

5.2.7.3.1 Strength of the Company in the Market

5.2.7.3.2 Weakness of the Company in the Market

5.2.8 Korea Electric Terminal Co., Ltd.

5.2.8.1 Company Overview

5.2.8.1.1 Product Portfolio

5.2.8.1.2 R&D Analysis

5.2.8.2 Business Strategies

5.2.8.2.1 Product Development

5.2.8.2.2 Market Development

5.2.8.3 Competitive Position

5.2.8.3.1 Strength of the Company in the Market

5.2.8.3.2 Weakness of the Company in the Market

5.2.8.4 Patent Analysis

5.2.9 EG Electronics

5.2.9.1 Company Overview

5.2.9.1.1 Product Portfolio

5.2.9.2 Business Strategies

5.2.9.2.1 Product Development

5.2.9.3 Corporate Strategies

5.2.9.3.1 Partnerships and Collaborations

5.2.9.4 Competitive Position

5.2.9.4.1 Strength of the Company in the Market

5.2.9.4.2 Weakness of the Company in the Market

5.2.10 LS Cable & System Ltd.

5.2.10.1 Company Overview

5.2.10.1.1 Product Portfolio

5.2.10.1.2 R&D Analysis

5.2.10.2 Business Strategies

5.2.10.2.1 Product Development

5.2.10.2.2 Market Development

5.2.10.3 Corporate Strategies

5.2.10.3.1 Partnerships and Collaborations

5.2.10.4 Competitive Position

5.2.10.4.1 Strength of the Company in the Market

5.2.10.4.2 Weakness of the Company in the Market

5.2.10.5 Patent Analysis

5.2.11 TE Connectivity

5.2.11.1 Company Overview

5.2.11.1.1 Product Portfolio

5.2.11.1.2 R&D Analysis

5.2.11.2 Business Strategies

5.2.11.2.1 Product Development

5.2.11.3 Corporate Strategies

5.2.11.3.1 Mergers and Acquisitions

5.2.11.4 Competitive Position

5.2.11.4.1 Strength of the Company in the Market

5.2.11.4.2 Weakness of the Company in the Market

5.2.11.5 Patent Analysis

5.2.12 ACOME

5.2.12.1 Company Overview

5.2.12.1.1 Product Portfolio

5.2.12.2 Business Strategies

5.2.12.2.1 Product Development

5.2.12.2.2 Market Development

5.2.12.3 Corporate Strategies

5.2.12.3.1 Partnerships and Collaborations

5.2.12.3.2 Mergers and Acquisitions

5.2.12.4 Competitive Position

5.2.12.4.1 Strength of the Company in the Market

5.2.12.4.2 Weakness of the Company in the Market

5.2.12.5 Patent Analysis

5.2.13 Gebauer & Griller

5.2.13.1 Company Overview

5.2.13.1.1 Product Portfolio

5.2.13.1.2 R&D Analysis

5.2.13.2 Business Strategies

5.2.13.2.1 Market Development

5.2.13.3 Competitive Position

5.2.13.3.1 Strength of the Company in the Market

5.2.13.3.2 Weakness of the Company in the Market

5.2.13.4 Patent Analysis

5.2.14 Continental AG

5.2.14.1 Company Overview

5.2.14.1.1 Product Portfolio

5.2.14.1.2 R&D Analysis

5.2.14.2 Business Strategies

5.2.14.2.1 Market Development

5.2.14.3 Competitive Position

5.2.14.3.1 Strength of the Company in the Market

5.2.14.3.2 Weakness of the Company in the Market

5.2.14.4 Patent Analysis

5.2.15 Lear Corporation

5.2.15.1 Company Overview

5.2.15.1.1 Product Portfolio

5.2.15.1.2 R&D Analysis

5.2.15.2 Corporate Strategies

5.2.15.2.1 Partnerships and Collaborations

5.2.15.3 Competitive Position

5.2.15.3.1 Strength of the Company in the Market

5.2.15.3.2 Weakness of the Company in the Market

5.2.15.4 Patent Analysis

6 Research Methodology

6.1 Data Sources

6.1.1 Primary Data Sources

6.2 Data Triangulation

6.3 Market Estimation and Forecast

6.3.1 Factors for Data Prediction and Modeling

List of Figures

Figure 1: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Vehicle Type), Value, 2020-2031

Figure 2: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Propulsion Type), Value, 2020-2031

Figure 3: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Application), Value, 2020, 2021, 2031

Figure 4: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Product Type), Value, 2020 and 2031

Figure 5: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Material Type), Value, 2020-2031

Figure 6: Wiring Harnesses and Connectors Market for Electric Vehicles Market (by Material Type), Value, 2020-2031

Figure 7: Global Wiring Harnesses and Connectors for Electric Vehicle Market(by Region), Value, 2020

Figure 8: Global Wiring Harnesses and Connectors for Electric Vehicles Market: Coverage

Figure 9: Wiring Harnesses and Connectors for Electric Vehicles Supply Chain

Figure 10: Stakeholders in Wiring Harnesses and Connectors for Electric Vehicles Market

Figure 11: Consortiums, Associations, and Regulatory Bodies for Electric Vehicles

Figure 12: Business Dynamics for the Wiring Harnesses and Connectors For Electric Vehicles Market

Figure 13: BEV and PHEV Sales, 2010-2019

Figure 14: Key Business Strategies

Figure 15: Product Developments (by Company), 2019-2021

Figure 16: Market Developments (by Company), 2019-2021

Figure 17: Key Corporate Strategies (by Company), 2019-2021

Figure 18: Mergers and Acquisitions (by Company), 2019-2021

Figure 19: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2019-2021

Figure 20: Wiring Harnesses and Connectors for Electric Vehicles Market for Passenger Vehicle, Kilotons and $Millions, 2020-2031

Figure 21: Wiring Harnesses and Connectors for Electric Vehicles Market for Commercial Vehicle, Kilotons and $Millions, 2020-2031

Figure 22: Wiring Harnesses and Connectors for Electric Vehicles Market for BEV, Kilotons and $Millions, 2020-2031

Figure 23: Wiring Harnesses and Connectors for Electric Vehicles Market for PHEV, Kilotons and $Millions, 2020-2031

Figure 24: Wiring Harnesses and Connectors for Electric Vehicles Market for HEV, Kilotons and $Millions, 2020-2031

Figure 25: Body Harness for Electric Vehicles Market for Passenger Vehicle, Kilotons and $Millions, 2020-2031

Figure 26: High Voltage Battery Harness for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 27: Dashboard/Cabin Harness for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 28: HVAC Harness for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 29: Other Harnesses for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 30: Components of a Wiring Harness

Figure 31: High Voltage Wiring Harnesses and Connectors for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 32: Low Voltage Wiring Harnesses and Connectors for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 33: Copper Wiring Harnesses and Connectors for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 34: Aluminum Wiring Harnesses and Connectors for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 35: Optical Fiber Wiring Harnesses and Connectors for Electric Vehicles Market, Kilotons and $Millions, 2020-2031

Figure 36: Wiring Harnesses and Connectors for Electric Vehicles Market for Wire, Kilotons and $Millions, 2020-2031

Figure 37: Wiring Harnesses and Connectors for Electric Vehicles Market for Connectors, Kilotons and $Millions, 2020-2031

Figure 38: Wiring Harnesses and Connectors for Electric Vehicles Market for Other Components, Kilotons and $Millions, 2020-2031

Figure 50: Data Triangulation

Figure 51: Top-Down and Bottom-Up Approach

Figure 52: Assumptions and Limitations

List of Tables

Table 1: Wiring Harnesses and Connectors for Electric Vehicles Market Overview

Table 2: Government Initiatives for Electric Vehicles

Table 3: Programs by Research Institutions and Universities

Table 4: Impact of Business Drivers

Table 5: Impact of Business Restraints

Table 6: Impact of Business Opportunities

Table 7: Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), Kilotons, 2020-2031

Table 8: Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), $Millions, 2020-2031

Table 9: Wiring Harnesses and Connectors for Electric Vehicles Market (by Propulsion Type), Kilotons, 2020-2031

Table 10: Wiring Harnesses and Connectors for Electric Vehicles Market (by Vehicle Type), $Millions, 2020-2031

Table 11: Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), Kilotons, 2020-2031

Table 12: Wiring Harnesses and Connectors for Electric Vehicles Market (by Application), $Millions, 2020-2031

Table 13: Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), Kilotons, 2020-2031

Table 14: Wiring Harnesses and Connectors for Electric Vehicles Market (by Product Type), $Millions, 2020-2031

Table 15: Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), Kilotons, 2020-2031

Table 16: Wiring Harnesses and Connectors for Electric Vehicles Market (by Material Type), $Millions, 2020-2031

Table 17: Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), Kilotons, 2020-2031

Table 18: Wiring Harnesses and Connectors for Electric Vehicles Market (by Component Type), $Millions, 2020-2031

Table 19: Wiring Harnesses and Connectors for Electric Vehicles Market (by

Executive Summary

The automotive industry is experiencing rising adoption of electric vehicles due to changing consumer preferences, rising concerns with regard to driver safety, environmental concerns, and acute government regulations and policies.

Major original equipment manufacturers (OEMs) are constantly working on development for making electric vehicles more safe, affordable, and efficient. Over time, the automotive industry is evolving, and technical advancements are being made for electric vehicle accessories such as battery systems, cooling systems, wiring harness systems, and other infrastructure.

Wiring harnesses remain to be one of the most crucial components of any vehicle as they comprise one of the heaviest and most expensive parts of the vehicle. In addition to this, these are usually customized based on a car’s model and its requirements; the cable system is tailor-made to optimize the vehicular model as much as possible.

The wiring system is usually divided into high voltage electric wire harnesses and low voltage electric wire harnesses.

The high voltage harness is used for the battery connections as they require additional expensive high-voltage lines for AC-DC charging, high-voltage batteries, and traction, as well as special wiring for the main battery and the battery management system.

The low voltage harnesses are usually used in the sensory framework of the car and doors. These low voltage harnesses also make up the dashboard and infotainment system of the vehicle.

There is a big difference between the wiring harnesses served in normal internal combustion engine (ICE) vehicles and electric vehicles.

The EVs require more amount of wiring as the number of PCBs and circuits greatly increases. The sensors are also more in number and thus, require more wiring. There is less need for high voltage cabling in traditional ICE vehicles that is almost unmatched by its need in EVs.

The high voltage cabling is absolutely essential owing to the battery system of EVs. This difference can result in several kgs of weight increase in EVs than ICE cars. The harnesses weigh about only XXkg in traditional cars versus almost mounting up almost a staggering XX kgs of weight in the EVs.

There are a number of advancements being made in the field of wiring harnesses in vehicles, their framework, placement, and the type of material being used in the wires. With increasing sensor complexity, the wiring Is getting more central, with the battery as a powerhouse at the core of the vehicle. Significant changes to electronic systems will continue to fuel demand for innovative solutions as more automobiles become electric.

Printed circuit boards (PCBs) are also becoming more crucial in the production and operation of electrically driven vehicles. PCBs are a critical component of autonomous car technology. When using a vehicle's autonomous capabilities, several external sensors are required to assure safety, which increases the amount of cabling and pressure on the harness setup.

Traditionally the wiring harness involves copper wires in ICE vehicles, which are heavy, and since the weight has everything to do with the performance and range of an EV, the wiring harness in an electric vehicle uses a combination of copper and aluminum wires to deliver maximum performance while adding as less weight to the overall vehicle as possible. The harness also needs to adhere to some safety and resilience standards, such as it must withstand various shocks and ultraviolet radiation.

The charging harness must meet the moving harness's anti-rolling criteria. The car's high-voltage harness should be able to tolerate a variety of liquids that may come into contact with it. The car's high-voltage harness is normally a single core for the convenience of installation, while the charging harness is typically a multi-core integrated wiring harness, including high-voltage main and ground lines, low-voltage signal lines, and even communication double-effect lines (CAN).

Considering the effect of COVID-19 on the North America market, several businesses, such as Volkswagen, Honda, Ford, Daimler, Mercedes, and Nissan, around the globe concentrated on manufacturing accessories to bolster the global health care systems. Therefore, there was a shortage of funds for companies to invest in their R&Ds.

This led to the decline in the sales of electric vehicles in general. Consequently, the supply chain of wiring harnesses and connectors manufacturers got disrupted, and it inadvertently affected their growth.

However, as the COVID-19 is normalizing and the electric car sales are picking pace, wiring harness manufacturers will also witness a surge in demand in the coming years.