Description

Global Indoor Farming Technology Market Industry Overview

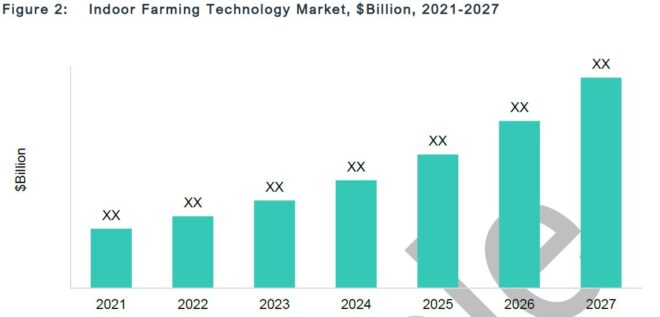

The global indoor farming technology market was valued at $5.84 billion in 2022 and is expected to reach $17.12 billion in 2027, following a CAGR of 23.99% during 2022-2027. The growth in the global indoor farming technology market is expected to be driven by increase in demand for food products produced sustainably with higher yields as compared to traditional farming technologies.

Market Lifecycle Stage

The indoor farming technology market is in a growing phase owing to different advanced technologies in the market. As increase in implementation of indoor farming methos such as aquaponics, aeroponics, and hydroponics also utilizes artificial lighting, such as LED lights, for adequate light levels and nutrients are further anticipated to fuel the growth of the market during the forecast period.

Impact

• Indoor farming can be defined as the practice of growing produce stacked on top of each other in an enclosed and controlled environment. By using vertically mounted grow racks, the area required to grow plants is significantly reduced compared to traditional growing methods. This type of cultivation is often associated with city and urban farming due to its ability to thrive in limited spaces. It helps in reducing the usage of water, labour costs, occupational hazards, and chemical or pesticides.

• The robust development in the indoor farming technology market is increasingly changing the customers’ perception of its utilization. Due to factors such as inappropriate supervision systems, automated farming tools, and strong support from government bodies, a large number of players are entering the indoor farming technology market.

Impact of COVID-19

Due to COVID-19, the production of fruits and vegetables, microgreens, ornamentals, and others under indoor farming was hindered up to a level that led to low revenue generation. This has further hampered the growth of the indoor farming technology market in 2020. However, the improved COVID-19 situation is expected to grow in the studied market during the forecast period. COVID-19 has also increased the demand for rapid pharmaceutical development, and vertical indoor farming can provide high-quality monoclonal antibodies, bioinks, vaccines, and other proteins efficiently and quickly. For instance, in March 2020, a start-up, iBio, announced that it was developing SARS-CoV-2 vaccine candidates by utilizing vertical indoor farming. This is further increasing the market size even further.

Market Segmentation:

Segmentation 1: by Growing System

• Hydroponics

• Aeroponics

• Aquaponics

• Soil-Based

• Hybrid

The global indoor farming technology market in the growing system segment is expected to be dominated by hydroponic growing system. The growth in the hydroponic segment is expected to be driven by a rise in demand for organic fruits and vegetables from the end consumers.

Segmentation 2: by Facility Type

• Greenhouses

• Indoor Vertical Farms

The greenhouse farming segment is anticipated to dominate the indoor farming technology market with a significant share during the period 2022 to 2027. The increasing number of greenhouses in several countries and the feasibility of growing more plants and crops in greenhouses are the major drivers for this segment’s growth.

Segmentation 3: by Crop Type

• Fruits and Vegetables

• Herbs and Microgreens

• Flowers and Ornamentals

• Medicinal Crops

Among all the four crop types, the fruit and vegetables segment is expected to dominate the indoor farming technology market with a significant share of $8,179.3 million by 2027. The growth in the fruit and vegetables segment is expected to be driven by the increasing popularity of the consumption of fresh, pesticide-free fruits for healthy living; many growers have initiated the cultivation of fruits, such as lemons, oranges, figs, grapefruits, cherries, and strawberries.

Segmentation 4: by Product Type

• Hardware System

• Software

The hardware segment is estimated to capture highest market share during the period 2022 to 2027. The hardware systems such as sensors, controllers, lighting systems, irrigation systems, and others are increasingly used in the various indoor farming operations. In addition, the increasing adoption of intelligent hardware components integrated with sensors and computer vision is expected to drive the growth of the indoor farming technology market worldwide.

Segmentation 5: by Region

• North America – U.S., Canada, and Mexico

• Europe – Germany, France, Netherlands, Belgium, Greece, Ukraine, Turkey, and Switzerland

• China

• U.K.

• Asia-Pacific – India, Japan, Australia and New Zealand, Singapore, and Rest-of-Asia-Pacific

• Rest-of-the-World – Brazil, South Africa, U.A.E., Saudi Arabia and Countries in Rest-of-the-World

The North America region is expected to dominate the indoor farming technology market, which can beattributed to the high technological advancement and the presence of leading indoor farming technology solution providers in the region. The growth in the market is further driven by the increasing research and development activities and large-scale adoption of digital technologies in countries such as the U.S., Canada, and Mexico.

Recent Developments in Global Indoor Farming Technology Market

• In September 2022, iFarm, based in Switzerland, partnered with Yasai AG and LOGIQS B.V. and announced long-term cooperation. Yasai AG announced the signing of a strategic agreement with the equipment and tech suppliers with the launch of the first vertical farm project based in Zurich. The company involved are LOGIQS B.V. and iFarm as the technology partners responsible for constructing a pilot facility, with about 673 sq. m of growing area and a design capacity of around 20 tons of fresh herbs per year.

• In April 2022, Lumileds Holding B.V. has launched LUXEON SunPlus HPE, a high-power, deep red (660nm) LED in the U.S. market. This product is designed specifically for the horticulture lighting industry.

• In September 2021, IUNU acquired Artemis, a U.S.-based company that provides software solutions for indoor farming activities. Nowadays, Artemis works as a subsidiary of IUNU.

• In May 2021, Freight Farms launched Greenery S, which is the latest model of Freight’s vertical container farm system. This is known as the tenth generation of the Greenery, which again includes “a fresh suite of features.” In addition, in January 2020, Everlight Electronics Co., Ltd. announced new horticultural LEDs in spectrums tailored to enhance the red pigment of strawberries.

Demand – Drivers and Limitations

Following are the demand drivers for the Indoor Farming Technology Market:

• Land Degradation and Decrease in Arable Land

• Need for Climate-Smart Agriculture

• Increased Government Support and Initiatives

The market is expected to face some following challenges:

• High Initial Investment and Operational Costs

• Suitable for the Production of Selective Crops

• Limited Awareness Among Farmers

How can this report add value to end users?

Product/Innovation Strategy: The product segment helps the reader understand the different types of hardware systems and software available in the indoor farming applications. Moreover, the study provides the reader a detailed understanding of the different product types by applications (growing systems, crop types and facility types). Hardware systems such as lighting system, climate control system, irrigation system, and container farms are most widely used hardware systems indoor farming practices. Therefore, the indoor farming technology market is a moderate investment and high revenue generating technology in the coming years owing to the rise in investment towards climate smart agriculture practices across the globe.

Growth/Marketing Strategy: The global indoor farming technology market has seen major development by key players operating in the market, such as product launch, partnership, joint venture, collaboration, and merger & acquisitions. The favoured strategy for the companies has been product launch to strengthen their positions in the indoor farming technology market.

For instance, in February 2022, Netafim USA, a subsidiary of Netafim, launched a new AlphaDisc filter for precision irrigation solutions in the U.S. This product launched helps the company increase its market presence in the U.S. market.

Competitive Strategy: Key players in the global indoor farming technology market analysed and profiled in the study involve integrated hardware systems and software manufacturers that are engaged in providing advanced indoor farming solutions to farmers and other agriculture service companies. Moreover, a detailed competitive benchmarking of the players operating in the global indoor farming technology market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, joint ventures, acquisitions, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analysing the company’s coverage, product portfolio, its market penetration.

The top segment players who are leading include key public, private, and start-ups which are indoor farming technologies manufacturers in the market and the ones which are engaged in providing advanced lighting solutions across the globe.

Key Companies Profiled

Company Type 1: Public Companies

• Everlight Electronics Co., Ltd

• Signify Holding

• OSRAM GmbH

Company Type 2: Private Companies

• AmHydro

• Argus Control Systems Limited

• California LightWorks

• Current Lighting Solutions, LLC

• Freight Farms, Inc.

• IUNU

• Link4 Corporation

• LOGIQS B.V.

• LumiGrow

• Lumileds Holding B.V.

• Netafim

• Priva

Company Type 3: Start-Up Companies

• Growlink, Inc

• Agsmartic Technologies Pvt. Ltd.

• CarbonBook

• Sentera

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Market Definition

1.1.2 Trends: Current and Future

1.1.2.1 Rise in Plant Factory Production

1.1.2.2 Rise High-Value Crops Cultivation

1.1.2.3 Increased Penetration of Information and Communication Technology (ICT) in Agriculture

1.1.3 Ongoing Programs

1.1.3.1 Consortiums and Associations

1.1.3.2 Government Initiatives and Regulatory Bodies

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Land Degradation and Decrease in Arable Land

1.2.1.2 Need for Climate-Smart Agriculture

1.2.1.3 Increased Government Support and Initiatives

1.2.2 Business Challenges

1.2.2.1 High Initial Investment and Operational Costs

1.2.2.2 Suitable for the Production of Selective Crops

1.2.2.3 Limited Awareness Among Farmers

1.2.3 Market Strategies and Development

1.2.3.1 Business Strategies

1.2.3.1.1 New Product Launch

1.2.3.2 Corporate Strategies

1.2.3.2.1 Partnerships, Joint Ventures, Collaborations, and Alliances

1.2.3.2.2 Mergers and Acquisitions

1.2.3.2.3 Snapshot of Corporate Strategies Adopted in the Global Indoor Farming Technology Ecosystem

1.2.4 Business Opportunities

1.2.4.1 Pharmaceutical Plant Production Through Indoor Farming

1.2.4.2 Internet Infrastructure Upgradation and Launch of 5G Services

1.2.4.3 Scope of Expansion in Developing Countries

1.2.5 Case Study

1.2.5.1 Frieght Farms, Inc.

1.2.5.2 Signify Holding

1.2.5.3 Netafim

1.3 Start-Up Landscape

1.3.1 Key Start-Ups in the Indoor Farming Technology Market

2 Application

2.1 Indoor Farming Technology Market (by Growing System)

2.1.1 Hydroponics

2.1.2 Aeroponics

2.1.3 Aquaponics

2.1.4 Soil-Based

2.1.5 Hybrid

2.2 Demand Analysis of Indoor Farming Technology Market (by Growing System)

2.3 Indoor Farming Technology Market (by Facility Type)

2.3.1 Greenhouses

2.3.2 Indoor Vertical Farms

2.4 Demand Analysis of Indoor Farming Technology Market (by Facility Type)

2.5 Indoor Farming Technology Market (by Crop Type)

2.5.1 Fruits and Vegetables

2.5.2 Herbs and Microgreens

2.5.3 Flowers and Ornamentals

2.5.4 Medicinal Crops

2.6 Demand Analysis of Indoor Farming Technology Market (by Crop Type)

3 Products

3.1 Indoor Farming Technology Market (by Product)

3.1.1 Hardware System

3.1.1.1 Lighting System

3.1.1.2 Climate Control System

3.1.1.3 Irrigation System

3.1.1.4 Container Farms

3.1.2 Software

3.2 Demand Analysis of Indoor Farming Technology Market (by Product)

3.3 Patent Analysis

3.3.1 Patent Analysis (by Product)

3.3.2 Patent Analysis (by Growing System)

3.3.3 Patent Analysis (by Patent Office)

3.4 Supply Chain Analysis: Indoor Farming Technology Mark

4 Region

4.1 North America

4.1.1 Market

4.1.1.1 Key Manufacturers in North America

4.1.1.2 Business Drivers

4.1.1.3 Business Challenges

4.1.2 Application

4.1.2.1 North America Indoor Farming Technology Market (by Facility Type)

4.1.2.2 North America Indoor Farming Technology Market (by Growing System)

4.1.2.3 North America Indoor Farming Technology Market (by Crop Type)

4.1.3 Product

4.1.3.1 North America Indoor Farming Technology Market (by Product)

4.1.4 North America (by Country)

4.1.4.1 U.S.

4.1.4.1.1 Market

4.1.4.1.1.1 Buyer Attributes

4.1.4.1.1.2 Key Manufacturers Operating in the U.S.

4.1.4.1.1.3 Business Drivers

4.1.4.1.1.4 Business Challenges

4.1.4.1.2 Application

4.1.4.1.3 Product

4.1.4.2 Canada

4.1.4.2.1 Market

4.1.4.2.1.1 Buyer Attributes

4.1.4.2.1.2 Key Manufacturers Operating in Canada

4.1.4.2.1.3 Business Drivers

4.1.4.2.1.4 Business Challenges

4.1.4.2.2 Application

4.1.4.2.3 Product

4.1.4.3 Mexico

4.1.4.3.1 Market

4.1.4.3.1.1 Buyer Attributes

4.1.4.3.1.2 Key Manufacturers Operating in Mexico

4.1.4.3.1.3 Business Drivers

4.1.4.3.1.4 Business Challenges

4.1.4.3.2 Application

4.1.4.3.3 Product

4.2 Europe

4.2.1 Market

4.2.1.1 Key Manufacturers in Europe

4.2.1.2 Business Drivers

4.2.1.3 Business Challenges

4.2.2 Application

4.2.2.1 Europe Indoor Farming Technology Market (by Facility Type)

4.2.2.2 Europe Indoor Farming Technology Market (by Growing System)

4.2.2.3 Europe Indoor Farming Technology Market (by Crop Type)

4.2.3 Product

4.2.3.1 Europe Indoor Farming Technology Market (by Product)

4.2.4 Europe (by Country)

4.2.4.1 Germany

4.2.4.1.1 Market

4.2.4.1.1.1 Buyer Attributes

4.2.4.1.1.2 Key Manufacturers Operating in Germany

4.2.4.1.1.3 Business Drivers

4.2.4.1.1.4 Business Challenges

4.2.4.1.2 Application

4.2.4.1.3 Product

4.2.4.2 France

4.2.4.2.1 Market

4.2.4.2.1.1 Buyer Attributes

4.2.4.2.1.2 Key Manufacturers Operating in France

4.2.4.2.1.3 Business Drivers

4.2.4.2.1.4 Business Challenges

4.2.4.2.2 Application

4.2.4.2.3 Product

4.2.4.3 The Netherlands

4.2.4.3.1 Market

4.2.4.3.1.1 Buyer Attributes

4.2.4.3.1.2 Key Manufacturers Operating in the Netherlands

4.2.4.3.1.3 Business Drivers

4.2.4.3.1.4 Business Challenges

4.2.4.3.2 Application

4.2.4.3.3 Product

4.2.4.4 Rest-of-Europe

4.2.4.4.1 Market

4.2.4.4.1.1 Buyer Attributes

4.2.4.4.1.2 Key Manufacturers Operating in Rest-of-Europe

4.2.4.4.1.3 Business Drivers

4.2.4.4.1.4 Business Challenges

4.2.4.4.2 Application

4.2.4.4.3 Product

4.2.4.5 Market Data for Other Key countries in Europe

4.2.4.5.1 Belgium

4.2.4.5.1.1 Application

4.2.4.5.1.2 Product

4.2.4.5.2 Switzerland

4.2.4.5.3 Application

4.2.4.5.4 Product

4.2.4.5.5 Greece

4.2.4.5.5.1 Application

4.2.4.5.5.2 Product

4.2.4.5.6 Ukraine

4.2.4.5.6.1 Application

4.2.4.5.6.2 Product

4.2.4.5.7 Turkey

4.2.4.5.7.1 Application

4.2.4.5.7.2 Product

4.3 U.K.

4.3.1 Market

4.3.1.1 Buyer Attributes

4.3.1.2 Key Manufacturers in the U.K.

4.3.1.3 Business Drivers

4.3.1.4 Business Challenges

4.3.2 Application

4.3.2.1 U.K. Indoor Farming Technology Market (by Facility Type)

4.3.2.2 U.K. Indoor Farming Technology Market (by Growing System)

4.3.2.3 U.K. Indoor Farming Technology Market (by Crop Type)

4.3.3 Product

4.3.3.1 U.K. Indoor Farming Technology Market (by Product)

4.4 China

4.4.1 Market

4.4.1.1 Buyer Attributes

4.4.1.2 Key Manufacturers in China

4.4.1.3 Business Drivers

4.4.1.4 Business Challenges

4.4.2 Application

4.4.2.1 China Indoor Farming Technology Market (by Facility Type)

4.4.2.2 China Indoor Farming Technology Market (by Growing System)

4.4.2.3 China Indoor Farming Technology Market (by Crop Type)

4.4.3 Product

4.4.3.1 China Indoor Farming Technology Market (by Product)

4.5 Asia-Pacific

4.5.1 Market

4.5.1.1 Key Manufacturers in Asia-Pacific

4.5.1.2 Business Drivers

4.5.1.3 Business Challenges

4.5.2 Application

4.5.2.1 Asia-Pacific Indoor Farming Technology Market (by Facility Type)

4.5.2.2 Asia-Pacific Indoor Farming Technology Market (by Growing System)

4.5.2.3 Asia-Pacific Indoor Farming Technology Market (by Crop Type)

4.5.3 Product

4.5.3.1 Asia-Pacific Indoor Farming Technology Market (by Product)

4.5.4 Asia-Pacific (by Country)

4.5.4.1 Japan

4.5.4.1.1 Market

4.5.4.1.1.1 Buyer Attributes

4.5.4.1.1.2 Key Manufacturers Operating in Japan

4.5.4.1.1.3 Business Drivers

4.5.4.1.1.4 Business Challenges

4.5.4.1.2 Application

4.5.4.1.3 Product

4.5.4.2 India

4.5.4.2.1 Market

4.5.4.2.1.1 Buyer Attributes

4.5.4.2.1.2 Key Manufacturers Operating in India

4.5.4.2.1.3 Business Drivers

4.5.4.2.1.4 Business Challenges

4.5.4.2.2 Application

4.5.4.2.3 Product

4.5.4.3 Singapore

4.5.4.3.1 Market

4.5.4.3.1.1 Buyer Attributes

4.5.4.3.1.2 Key Manufacturers Operating in Singapore

4.5.4.3.1.3 Business Drivers

4.5.4.3.1.4 Business Challenges

4.5.4.3.2 Application

4.5.4.3.3 Product

4.5.4.4 Australia and New Zealand

4.5.4.4.1 Market

4.5.4.4.1.1 Buyer Attributes

4.5.4.4.1.2 Key Manufacturers Operating in Australia and New Zealand

4.5.4.4.1.3 Business Drivers

4.5.4.4.1.4 Business Challenges

4.5.4.4.2 Application

4.5.4.4.3 Product

4.5.4.5 Rest-of-Asia-Pacific

4.5.4.5.1 Market

4.5.4.5.1.1 Buyer Attributes

4.5.4.5.1.2 Key Manufacturers Operating in the Rest-of-Asia-Pacific

4.5.4.5.1.3 Business Drivers

4.5.4.5.1.4 Business Challenges

4.5.4.5.2 Application

4.5.4.5.3 Product

4.6 Rest-of-the-World

4.6.1 Market

4.6.1.1 Key Manufacturers in Rest-of-the-World

4.6.1.2 Business Drivers

4.6.1.3 Business Challenges

4.6.2 Application

4.6.2.1 Rest-of-the-World Indoor Farming Technology Market (by Facility Type)

4.6.2.2 Rest-of-the-World Indoor Farming Technology Market (by Growing System)

4.6.2.3 Rest-of-the-World Indoor Farming Technology Market (by Crop Type)

4.6.3 Product

4.6.3.1 Rest-of-the-World Indoor Farming Technology Market (by Product)

4.6.4 Rest-of-the-World (by Country)

4.6.4.1 Brazil

4.6.4.1.1 Market

4.6.4.1.1.1 Buyer Attributes

4.6.4.1.1.2 Key Manufacturers Operating in Brazil

4.6.4.1.1.3 Business Drivers

4.6.4.1.1.4 Business Challenges

4.6.4.1.2 Application

4.6.4.1.3 Product

4.6.4.2 South Africa

4.6.4.2.1 Market

4.6.4.2.1.1 Buyer Attributes

4.6.4.2.1.2 Key Manufacturers Operating in South Africa

4.6.4.2.1.3 Business Drivers

4.6.4.2.1.4 Business Challenges

4.6.4.2.2 Application

4.6.4.2.3 Product

4.6.4.3 U.A.E.

4.6.4.3.1 Market

4.6.4.3.1.1 Buyer Attributes

4.6.4.3.1.2 Key Manufacturers Operating in the U.A.E.

4.6.4.3.1.3 Business Drivers

4.6.4.3.1.4 Business Challenges

4.6.4.3.2 Application

4.6.4.3.3 Product

4.6.4.4 Saudi Arabia

4.6.4.4.1 Market

4.6.4.4.1.1 Buyer Attributes

4.6.4.4.1.2 Key Manufacturers Operating in Saudi Arabia

4.6.4.4.1.3 Business Drivers

4.6.4.4.1.4 Business Challenges

4.6.4.4.2 Application

4.6.4.4.3 Product

4.6.4.5 Other Countries of Rest-of-the-World

4.6.4.5.1 Market

4.6.4.5.1.1 Buyer Attributes

4.6.4.5.1.2 Key Manufacturers Operating in the Other Countries of the Rest-of-the-World

4.6.4.5.1.3 Business Drivers

4.6.4.5.1.4 Business Challenges

4.6.4.5.2 Application

4.6.4.5.3 Product

5 Markets – Competitive Benchmarking & Company Profiles

5.1 Competitive Benchmarking

5.2 Competitive Ranking Analysis

5.3 Company Profiles – Public Companies

5.3.1 Everlight Electronics Co., Ltd

5.3.1.1 Company Overview

5.3.1.1.1 Role of Everlight Electronics Co., Ltd. in the Indoor Farming Technology Market

5.3.1.1.2 Pricing and Product Portfolio

5.3.1.1.2.1 Target Customers

5.3.1.2 Business Strategies

5.3.1.2.1 New Product Launch

5.3.1.3 Analyst View

5.3.2 Signify Holding

5.3.2.1 Company Overview

5.3.2.1.1 Role of Signify Holding in the Indoor Farming Technology Market

5.3.2.1.2 Pricing and Product Portfolio

5.3.2.1.2.1 Target Customers

5.3.2.1.2.2 Key Clients

5.3.2.2 Analyst View

5.3.3 OSRAM GmbH

5.3.3.1 Company Overview

5.3.3.1.1 Role of OSRAM GmbH in the Indoor Farming Technology Market

5.3.3.1.2 Pricing and Product Portfolio

5.3.3.1.2.1 Target Customers

5.3.3.1.2.2 Key Clients

5.3.3.2 Analyst View

5.4 Company Profiles – Private Companies

5.4.1 AmHydro

5.4.1.1 Company Overview

5.4.1.1.1 Role of AmHydro in the Indoor Farming Technology Market

5.4.1.1.2 Pricing and Product Portfolio

5.4.1.1.2.1 Target Customers

5.4.1.2 Analyst View

5.4.2 Argus Control Systems Limited

5.4.2.1 Company Overview

5.4.2.1.1 Role of Argus Control Systems Limited in the Indoor Farming Technology Market

5.4.2.1.2 Pricing and Product Portfolio

5.4.2.1.2.1 Target Customers

5.4.2.1.2.2 Key Clients

5.4.2.2 Business Strategies

5.4.2.2.1 New Product Launch

5.4.2.3 Corporate Strategies

5.4.2.3.1 Partnership

5.4.2.4 Analyst View

5.4.3 California LightWorks

5.4.3.1 Company Overview

5.4.3.1.1 Role of California LightWorks in the Indoor Farming Technology Market

5.4.3.1.2 Pricing and Product Portfolio

5.4.3.1.2.1 Target Customers

5.4.3.1.2.2 Key Clients

5.4.3.2 Analyst View

5.4.4 Current Lighting Solutions, LLC

5.4.4.1 Company Overview

5.4.4.1.1 Role of Current Lighting Solutions, LLC in the Indoor Farming Technology Market

5.4.4.1.2 Pricing and Product Portfolio

5.4.4.1.2.1 Target Customers

5.4.4.1.2.2 Key Clients

5.4.4.2 Corporate Strategies

5.4.4.2.1 Mergers and Acquisition

5.4.4.2.2 Collaboration

5.4.4.3 Analyst View

5.4.5 Freight Farms, Inc.

5.4.5.1 Company Overview

5.4.5.1.1 Role of Freight Farms, Inc. in the Indoor Farming Technology Market

5.4.5.1.2 Pricing and Product Portfolio

5.4.5.1.2.1 Target Customers

5.4.5.2 Business Strategies

5.4.5.2.1 New Product Launch

5.4.5.3 Corporate Strategies

5.4.5.3.1 Partnership

5.4.5.4 Analyst View

5.4.6 IUNU

5.4.6.1 Company Overview

5.4.6.1.1 Role of IUNU in the Indoor Farming Technology Market

5.4.6.1.2 Pricing and Product Portfolio

5.4.6.1.2.1 Target Customers

5.4.6.2 Corporate Strategies

5.4.6.2.1 Mergers and Acquisition

5.4.6.2.2 Partnership

5.4.6.3 Analyst View

5.4.7 Link4 Corporation

5.4.7.1 Company Overview

5.4.7.1.1 Role of Link4 Corporation in the Indoor Farming Technology Market

5.4.7.1.2 Pricing and Product Portfolio

5.4.7.1.2.1 Target Customers

5.4.7.2 Analyst View

5.4.8 LOGIQS B.V.

5.4.8.1 Company Overview

5.4.8.1.1 Role of LOGIQS B.V. in the Indoor Farming Technology Market

5.4.8.1.2 Pricing and Product Portfolio

5.4.8.1.2.1 Target Customers

5.4.8.1.2.2 Key Clients

5.4.8.2 Corporate Strategies

5.4.8.2.1 Collaboration

5.4.8.3 Analyst View

5.4.9 LumiGrow

5.4.9.1 Company Overview

5.4.9.1.1 Role of LumiGrow in the Indoor Farming Technology Market

5.4.9.1.2 Pricing and Product Portfolio

5.4.9.1.2.1 Target Customers

5.4.9.2 Business Strategies

5.4.9.2.1 New Product Launch

5.4.9.3 Corporate Strategies

5.4.9.3.1 Partnership

5.4.9.4 Analyst View

5.4.10 Lumileds Holding B.V.

5.4.10.1 Company Overview

5.4.10.1.1 Role of Lumileds Holding B.V. in the Indoor Farming Technology Market

5.4.10.1.2 Pricing and Product Portfolio

5.4.10.1.2.1 Target Customers

5.4.10.2 Business Strategies

5.4.10.2.1 New Product Launch

5.4.10.3 Analyst View

5.4.11 Netafim

5.4.11.1 Company Overview

5.4.11.1.1 Role of Netafim in the Indoor Farming Technology Market

5.4.11.1.2 Pricing and Product Portfolio

5.4.11.1.2.1 Target Customers

5.4.11.2 Business Strategies

5.4.11.2.1 New Product Launch

5.4.11.3 Corporate Strategies

5.4.11.3.1 Mergers and Acquisition

5.4.11.3.2 Partnerships

5.4.11.4 Analyst View

5.4.12 Priva

5.4.12.1 Company Overview

5.4.12.1.1 Role of Priva in the Indoor Farming Technology Market

5.4.12.1.2 Pricing and Product Portfolio

5.4.12.1.2.1 Target Customers

5.4.12.1.2.2 Key Clients

5.4.12.2 Corporate Strategies

5.4.12.2.1 Partnership

5.4.12.3 Analyst View

5.5 Company Profiles – Start-Up Companies

5.5.1 Growlink, Inc

5.5.1.1 Company Overview

5.5.1.1.1 Role of Growlink, Inc in the Indoor Farming Technology Market

5.5.1.1.2 Pricing and Product Portfolio

5.5.1.2 Analyst View

5.5.2 Agsmartic Technologies Pvt. Ltd.

5.5.2.1 Company Overview

5.5.2.1.1 Role of Agsmartic Technologies Pvt. Ltd. in the Indoor Farming Technology Market

5.5.2.1.2 Pricing and Product Portfolio

5.5.2.2 Analyst View

5.5.3 CarbonBook

5.5.3.1 Company Overview

5.5.3.1.1 Role of CarbonBook in the Indoor Farming Technology Market

5.5.3.1.2 Pricing and Product Portfolio

5.5.3.2 Analyst View

5.5.4 Sentera

5.5.4.1 Company Overview

5.5.4.1.1 Role of Sentera in the Indoor Farming Technology Market

5.5.4.1.2 Pricing and Product Portfolio

5.5.4.2 Analyst View

6 Research Methodology

6.1 Data Sources

6.2 Primary Data Sources

6.3 Secondary Data Sources

6.4 Data Triangulation

6.5 Market Estimation and Forecast

6.6 Factors for Data Prediction and Modeling

List of Figures

Figure 1: Microeconomic Indicators Impacting Indoor Farming Technology Market

Figure 2: Market Drivers and Challenges in the Indoor Farming Technology Market

Figure 3: Indoor Farming Technology Market, $Billion, 2021-2027

Figure 4: Indoor Farming Technology Market (by Product), $Million, 2021-2027

Figure 5: Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Figure 6: Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Figure 7: Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Figure 8: Indoor Farming Technology Market (by Region), $Million, 2021

Figure 9: Indoor Farming Technology Market Coverage

Figure 10: Indoor Farming Technology Trends

Figure 11: Global Production of Fresh Fruits, 2014-2020, Million Metric Tonnes

Figure 12: Factors Analysed in Business Dynamics

Figure 13: Arable Land Use Per Person till 2018, Hectare

Figure 14: Share of Key Market Strategies and Developments, 2018-2022

Figure 15: New Product Launches (by Company), 2018-2022

Figure 16: Partnerships, Joint Ventures, Collaborations, and Alliances (by Company), 2018-2022

Figure 17: Mergers and Acquisitions (by Company), 2018-2022

Figure 18: Snapshot of Corporate Strategies Adopted in the Global Indoor Farming Technology Ecosystem

Figure 19: Case Study on Freight Farms

Figure 20: Case study on Signify Holding

Figure 21: Case Study on Netafim

Figure 22: Indoor Farming Technology Market (by Growing System)

Figure 23: Indoor Farming Technology Market (by Facility Type)

Figure 24: Indoor Farming Technology Market (by Crop Type)

Figure 25: Indoor Farming Technology Market (by Product)

Figure 26: Indoor Farming Technology Market (by Hardware System)

Figure 27: Types of Lighting Systems

Figure 28: Indoor Farming Technology Patent Trend, 2019-2022

Figure 29: Patent Analysis (by Product), 2019-2022

Figure 30: Patent Analysis (by Growing System), 2019-2022

Figure 31: Patent Analysis (by Patent Office), 2019-2022

Figure 32: Supply Chain Analysis of the Indoor Farming Technology Market

Figure 33: Competitive Market High and Low Matrix for Hardware Providers

Figure 34: Competitive Market High and Low Matrix for Software Providers

Figure 35: Data Triangulation

Figure 36: Top-Down and Bottom-Up Approach

List of Tables

Table 1: Key Consortiums and Associations in the Indoor Farming Technology Market

Table 2: Indoor Farming Technology Regulatory Bodies in Some Major Countries

Table 3: Cost Structure of Indoor Farms (Area 3000sq ft-6000sq ft), $, 2021

Table 4: Indoor Farming Technology (by Growing System), $Million, 2021-2027

Table 5: Total Number of Large Greenhouses Producing Vegetables Around the World

Table 6: Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 7: Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 8: Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 9: Indoor Farming Technology Market Volume (by Hardware), Thousand Units, 2021-2027

Table 10: Indoor Farming Technology Market (by Hardware), $Million, 2021-2027

Table 11: Indoor Farming Technology Market (by Region), $Million, 2021-2027

Table 12: North America Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 13: North America Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 14: North America Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 15: North America Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 16: North America Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 17: North America Indoor Farming Technology Market (by Country), $Million, 2021-2027

Table 18: U.S. Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 19: U.S. Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 20: U.S. Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 21: Canada Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 22: Canada Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 23: Canada Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 24: Mexico Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 25: Mexico Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 26: Mexico Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 27: Europe Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 28: Europe Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 29: Europe Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 30: Europe Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 31: Europe Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 32: Europe Indoor Farming Technology Market (by Country), $Million, 2021-2027

Table 33: Germany Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 34: Germany Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 35: Germany Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 36: France Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 37: France Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 38: France Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 39: The Netherlands Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 40: The Netherlands Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 41: The Netherlands Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 42: Rest-of-Europe Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 43: Rest-of-Europe Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 44: Rest-of-Europe Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 45: Belgium Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 46: Belgium Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 47: Belgium Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 48: Switzerland Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 49: Switzerland Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 50: Switzerland Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 51: Greece Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 52: Greece Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 53: Greece Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 54: Ukraine Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 55: Ukraine Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 56: Greece Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 57: Turkey Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 58: Turkey Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 59: Turkey Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 60: U.K. Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 61: U.K. Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 62: U.K. Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 63: U.K. Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 64: U.K. Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 65: China Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 66: China Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 67: China Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 68: China Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 69: China Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 70: Asia-Pacific Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 71: Asia-Pacific Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 72: Asia-Pacific Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 73: Asia-Pacific Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 74: Asia-Pacific Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 75: Asia-Pacific Indoor Farming Technology Market (by Country), $Million, 2021-2027

Table 76: Japan Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 77: Japan Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 78: Japan Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 79: India Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 80: India Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 81: India Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 82: Singapore Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 83: Singapore Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 84: Singapore Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 85: Australia and New Zealand Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 86: Australia and New Zealand Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 87: Australia and New Zealand Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 88: Rest-of-Asia-Pacific Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 89: Rest-of-Asia-Pacific Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 90: Rest-of-Asia-Pacific Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 91: Rest-of-the-World Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 92: Rest-of-the-World Indoor Farming Technology Market (by Growing System), $Million, 2021-2027

Table 93: Rest-of-the-World Indoor Farming Technology Market (by Crop Type), $Million, 2021-2027

Table 94: Rest-of-the-World Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 95: Rest-of-the-World Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 96: Rest-of-the-World Indoor Farming Technology Market (by Country), $Million, 2021-2027

Table 97: Brazil Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 98: Brazil Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 99: South Africa Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 100: South Africa Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 101: South Africa Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 102: UAE Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 103: UAE Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 104: UAE Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 105: Saudi Arabia Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 106: Saudi Arabia Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 107: Saudi Arabia Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 108: Other Countries of Rest-of-the-World Indoor Farming Technology Market (by Facility Type), $Million, 2021-2027

Table 109: Other Countries of Rest-of-the-World Indoor Farming Technology Market (by Product), $Million, 2021-2027

Table 110: Other Countries of Rest-of-the-World Indoor Farming Technology Market (by Product), Thousand Units, 2021-2027

Table 111: Benchmarking and Weightage Parameters

Table 112: Indoor Farming Technology Players and Benchmarking Score

Table 113: Everlight Electronics Co., Ltd: Pricing and Product Portfolio

Table 114: Everlight Electronics Co., Ltd.: New Product Launch

Table 115: Signify Holding: Pricing and Product Portfolio

Table 116: OSRAM GmbH: Pricing and Product Portfolio

Table 117: AmHydro: Pricing and Product Portfolio

Table 118: Argus Control Systems Limited: Pricing and Product Portfolio

Table 119: Argus Control Systems Limited: New Product Launch

Table 120: Argus Control Systems Limited: Partnership

Table 121: California LightWorks: Pricing and Product Portfolio

Table 122: Current Lighting Solutions, LLC: Pricing and Product Portfolio

Table 123: Current Lighting Solutions, LLC: Mergers and Acquisition

Table 124: Current Lighting Solutions, LLC: Collaboration

Table 125: Freight Farms, Inc.: Pricing and Product Portfolio

Table 126: Freight Farms, Inc.: New Product Launch

Table 127: Freight Farms, Inc.: Partnership

Table 128: IUNU: Pricing and Product Portfolio

Table 129: IUNU: Mergers and Acquisition

Table 130: IUNU: Partnership

Table 131: Link4 Corporation: Pricing and Product Portfolio

Table 132: LOGIQS B.V.: Pricing and Product Portfolio

Table 133: LOGIQS B.V.: Collaboration

Table 134: LumiGrow: Pricing and Product Portfolio

Table 135: LumiGrow: New Product Launch

Table 136: LumiGrow: Partnership

Table 137: Lumileds Holding B.V.: Pricing and Product Portfolio

Table 138: Lumileds Holding B.V.: New Product Launch

Table 139: Netafim: Pricing and Product Portfolio

Table 140: Netafim: New Product Launch

Table 141: Netafim: Mergers and Acquisition

Table 142: Netafim: Partnership

Table 143: Priva: Pricing and Product Portfolio

Table 144: Priva: Partnership

Table 145: Growlink, Inc: Pricing and Product Portfolio

Table 146: Agsmartic Technologies Pvt. Ltd.: Pricing and Product Portfolio

Table 147: CarbonBook: Pricing and Product Portfolio

Table 148: Sentera: Pricing and Product Portfolio

Related Report: Smart Farming Market – A Europe Region Analysis – Focus on Application, Product, and Country-Wise Analysis – Analysis and Forecast, 2022-2027